Cathie Wood and her ARK Investment Management firm are making headlines. Again.

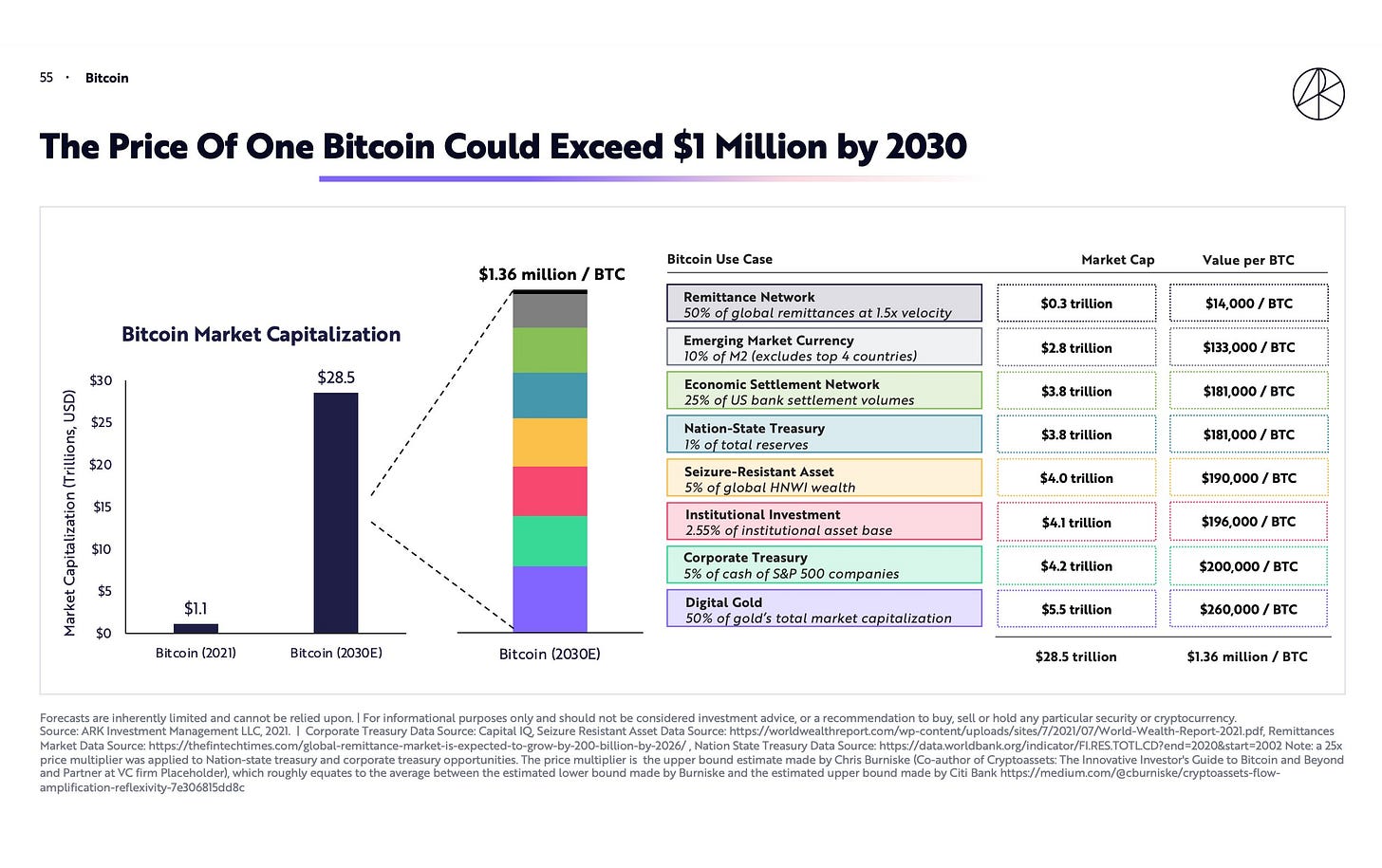

The firm last week predicted that the price of Bitcoin could exceed $1 million by the year 2030. To be sure, many others have made the same prediction, but with Bitcoin falling fifty percent off its all-time high recently, you’re not hearing much of that talk right now.

ARK’s main thesis around Bitcoin was summed up nicely by their analyst Yassine Elmandjra, who wrote this in the firm’s “Big Ideas 2022” outlook report, just released on Tuesday:

“Bitcoin’s market capitalization still represents a fraction of global assets and is likely to scale as nation-states adopt it as legal tender.”

Bitcoin is already taking major market share in the global settlements space, as its transfer volume increased by 460% in 2021. Bitcoin’s settlement volume has now surpassed that of credit card giant Visa.

In addition, ARK cited these factors as contributing to the advancement of Bitcoin:

The Taproot upgrade to the Bitcoin infrastructure

The Lightning network, speeding up Bitcoin transactions

Institutional adoption of Bitcoin growing

Nation states adopting Bitcoin usage, some as official currency

Last year, Wood, individually, called for a Bitcoin price of $500,000 by the year 2026.

A bit of ARK’s analysis, projecting Bitcoin’s potential growth in market share:

Wood, a devout Christian, named her firm after the Ark of the Covenant, described in the book of Exodus as containing the two stone tablets of the Ten Commandments. She’s come under fire recently, as her high-tech investments have plunged, along with the rest of technology stocks. Her flagship ARK Innovation Fund has dropped by thirty percent in the last month, along with other tech funds.

Long-term, though, Wood is super bullish on tech and Bitcoin.

US Could Implement a National Digital Currency

Analysts at Bank of America feel that the United States is just a few years away from adopting a national digital currency. They predict that the first US digital dollar could be issued between the years 2025 an 2030.

The public is encouraged to respond to the Federal Reserve about its position, right up until May 20th.

The Federal Reserve conducted a study evaluating the pros and cons of a US digital currency, and its findings were released just this week. Over the next few months, the Fed will consider whether or not a digital dollar “could improve the safe and effective domestic payments system,” according to Federal Reserve Chair Jerome Powell.

President Biden, meanwhile, is expected to issue a series of executive orders to multiple agencies, instructing them to develop a federal strategy on cryptocurrencies, according to Bloomberg.

My take: Government officials will conclude that a stablecoin that they are proposing would take the place of Bitcoin. This couldn’t be further from the truth. A central bank digital currency (CBDC) would be centrally-controlled, as opposed to a truly decentralized asset like Bitcoin. In addition, CBDCs can be printed to an unlimited quantity, just like fiat dollars. Bitcoin’s hard cap of 21 million coins is a completely different animal. As some like to say, “you can put lipstick on a pig…”

Facebook Rumored to be Scrapping Digital Coin Venture

Analysts at Bloomberg are reporting that the stablecoin project initiated by Facebook’s chairman Mark Zuckerberg is making no progress, due to unrelenting federal regulatory pressure. The organization backing the project, The Diem Association, is considering selling off the assets of the venture and returning capital to its investors.

A sale to California-based Silvergate Capital for $200 million is what the rumor mill is saying, just reported on this Wednesday.

Facebook, now rebranded as Meta Platforms, Inc., announced their stablecoin project in June 2019 to much fanfare. Labeled the Libra Coin, the venture attracted capital from the likes of PayPal, eBay, Visa and Mastercard. Their goal was to create a global digital currency which would allow billions of unbanked people around the world to enter the financial system.

Link to my previous story about Libra

The project and the coin were later rebranded as Diem, and new investors were brought on board in 2020. But as the US government scrutinizes stablecoin projects carefully, it was becoming more apparent that stablecoin issuers would be required to become regulated banks.

Meta reportedly owns a third of the Diem project, and other investors include Union Square Ventures, Andreessen Horowitz, and Thrive Capital.

Issue No. 41, January 28, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter