“It is a riddle wrapped in a mystery inside an enigma…” - Winston Churchill, on Russia, 1939.

Churchill, in these times, could just as well have been describing Bitcoin’s pseudonymous creator, simply known as Satoshi Nakamoto. Who Satoshi is or was is indeed a mystery, but what he, she or they created is known throughout the world. The world’s first workable, decentralized, peer-to-peer cash system and store of value.

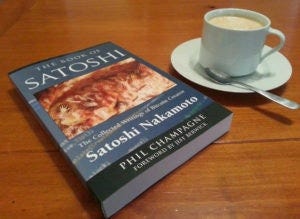

Sure, all Bitcoiners know who Satoshi Nakamoto is. I mean, we know of Satoshi’s work, but few know what he wrote and how he interacted with real, live humans. Fortunately, Satoshi’s emails and correspondence live on, and are published in the book, The Book of Satoshi, The Collected Writings of Bitcoin Creator Satoshi Nakamoto, by Phil Champagne. Fortunately for me, I received the book as a most thoughtful birthday gift.

I find Satoshi’s writings to be remarkable and timeless, and I think people will be studying them for a long time.

Following are some of Satoshi’s great writings. Getting these words straight from the mouth, or keyboard, of Bitcoin’s creator gives added meaning to the technology and to the world-changing potential that Bitcoin holds.

Satoshi’s Bitcoin announcement, posted on a cryptography mailing list, November 1, 2008:

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party. The paper is available at:

http://www.bitcoin.org/bitcoin.pdf

January 17, 2009, thirteen years ago this week, one of Satoshi’s most often-shared quotes:

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy.”

Well, he tipped us off, didn’t he?

February 18, 2009, discussing Bitcoin’s properties as a currency and as a store of value":

“It’s more typical of a precious metal. Instead of the supply changing to keep the value the same, the supply is predetermined and the value changes. As the number of users grows, the value per coin increases.”

Bitcoin’s “number go up” technology. Brilliant.

July 9, 2010, discussing vulnerability to someone “cornering the market” on Bitcoin:

“When someone tries to buy all the world’s supply of a scarce asset, the more they buy the higher the price goes. At some point, it gets too expensive for them to buy any more. It’s great for the people who owned it beforehand because they get to sell it to the corner at crazy high prices. As the price keeps going up and up, some people keep holding out for yet higher prices and refuse to sell.”

Satoshi then discusses the Hunt brothers famously bankrupting themselves trying to corner the silver market in 1979. Obviously, he thinks a “corner” on Bitcoin is impossible.

August 7, 2010, on Bitcoin’s Energy Usage:

“It’s the same as gold and gold mining. The marginal cost of gold mining tends to stay near the price of gold. Gold mining is a waste, but that waste is far less than the utility of having gold available as a medium of exchange.”

“I think the case will be the same for Bitcoin. The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin would be the net waste.”

More on Bitcoin’s Electricity Usage, from 2010:

“The heat from your computer is not wasted if you need to heat your home. If you’re using electric heat where you live, then your computer’s heat isn’t a waste.”

“Bitcoin’s generation should end up where it’s cheapest.”

“There are legitimate places where it’s free. Generation is basically free anywhere that has electric heat, since your computer’s heat is offsetting your baseboard electric heating.

On the Possibility of Mining Pools, November, 2010:

“New users wouldn’t really even need the Bitcoin software. They could download a miner, create an account….enter their deposit address into the miner and point it at anyone’s pool server. When the miner says it found something, a while later a few coins show up in their account.”

Satoshi was spot-on with that one.

On Bitcoin’s Future, from 2009:

“Even if it doesn’t take off straight away, it’s now available for use by the next guy who comes up with a plan that needs some kind of token or electronic currency. Once it gets bootstrapped, there are so many applications, if you could effortlessly pay a few cents to a website as easily as dropping coins into a vending machine.”

In an email to Gavin Andresen, April 26, 2011:

“I wish you wouldn’t keep talking about me as a mysterious shadowy figure, the press just turns that into a pirate currency angle. Maybe instead make it about the open source project and give more credit to your dev contributors: it helps motivate them.”

(Did Satoshi foresee Sen. Elizabeth Warren calling crypto people “shadowy super coders?”)

Link to one of my earlier articles about Satoshi:

Issue No. 40, January 21, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter