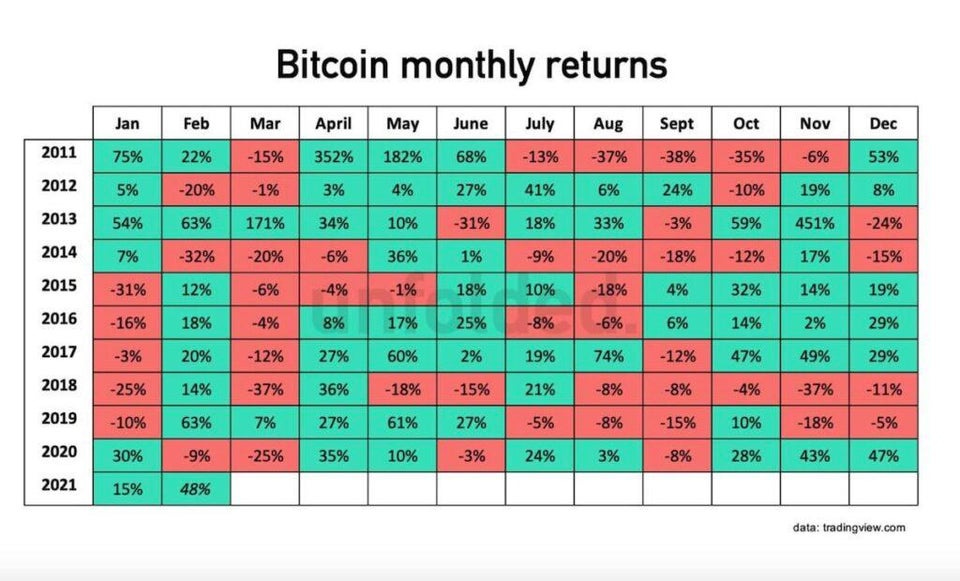

December has historically been good for Bitcoin.

During the past ten Decembers, Bitcoin’s price has gone up in six of those months and down in four. But in total, Bitcoin’s price has advanced by a net of 130% during December. Makes for nice holiday cheer. (Stocks have generally enjoyed good fortunes in December, as well. Hence the term, “Santa Claus rally.”)

It should be noted that in 2017, Bitcoin’s price soared to over $19,000 before falling to close the month at $16,477. A net gain for December, but a fall late in the month that continued in January 2018, dropping another 25%.

Whose 2021 Price Predictions Will Come True?

Back in June, I wrote a piece called “$500,000 Bitcoin? $1 Million?” I discussed the price predictions of many noted analysts and related Scott Melker’s Bitcoin adaptation of The Parable of the Ox. The parable tells of the method used to take samples of predictions, and of its remarkable accuracy.

Link to $500,000 Bitcoin? $1 Million?

Melker’s survey resulted in an average price prediction of $235,000 for Bitcoin, though time frames for the calls varied widely. My sampling of 26 top analysts’ predictions came in at $311,273.

As for short-term forecasts, or December 2021 predictions, Max Keiser called for $100,000. I myself also called for $100,000 by the end of 2021, then a pullback to $70,000 in 2022. The famous Stock-To-Flow model by “Plan B” called for a price range during this December of $107,000 to $109,000.

So, how are we doing now?

After soaring to over $69,000 this fall, Bitcoin has settled back to find good support at the $55,000-58,000 level. A run this month to $100K would mean about a 75% spurt in thirty days. Bitcoin has gone on runs like that before. In fact, in November 2013, its price rose by 451%.

Will it take off this month? Any of a number of factors could emerge as the catalyst for such a move. The SEC could approve a spot Bitcoin ETF, as Canada has done. Another big corporation could add Bitcoin to its balance sheet, as Square, Tesla and MicroStrategy have done. Some of the whales could continue buying, Michael Saylor, Elon Musk, or someone new. It’s a volatile asset, and almost anything is possible. I wouldn’t want to miss out.

December Moments in Bitcoin History:

December 4, 2013: Bloomberg reports that Fed Chairman Alan Greenspan says “Bitcoin is a bubble, without any intrinsic currency value.” That’s interesting coming from a banker, in that currency, fiat currency, by its nature has no intrinsic value. That’s what fiat means.

Oh, the “bubble” has continued for another eight years. Definition of a bubble: “a good or fortunate situation that is isolated from reality or unlikely to last.” Every day, the bubble moniker becomes less and less appropriate with Bitcoin. (The Lindy Effect, which I also wrote about.)

(In March 2014, Warren Buffett called Bitcoin a “mirage.” That, too, is not aging well.)

December 9, 2017: Bitcoin futures contracts began to be offered, and the US Chicago Board of Options Exchange (CBOE) began formally settling the futures daily. At that time, the Winklevoss twins proclaim that “Bitcoin futures trading brings crypto into the mainstream.” This year, Bitcoin futures ETFs have been approved by the SEC.

Where is the price going? When in doubt, zoom out:

It’s always good to zoom out a bit, too. Take your eyes off of the day-to-day price movements and look at what Bitcoin has done over its thirteen-year history. This puts it all in perspective:

Who would want to miss out on owning an asset like that?

Update on the “Who is Satoshi” Trial:

Last week’s issue focused on the court case taking place in Florida, pitting the family of the late Dave Kleiman against Craig Wright, the Australian software developer. Kleiman’s family alleges that Wright and Dave Kleiman teamed up to write the Bitcoin whitepaper and together mined over 1 million Bitcoins. Wright denies any involvement with Kleiman and denies that he is Satoshi. At stake is a fortune worth over $60 billion, a stack of Bitcoins that hasn’t moved since 2009. And also, maybe the truth as to who the real “Satoshi Nakamoto” is.

Just Wednesday morning, jurors in the case told the judge that they were deadlocked and could not come to a decision. Judge Beth Bloom then read Florida’s “Allen Charge” to the jury, imploring them to take all the time they needed and to continue deliberating. If they continue to insist they cannot agree on a verdict, then a mistrial may be declared.

“Unfortunately, we cannot come to a conclusion and we cannot all agree on a verdict on any of the questions,” jury note passed to Judge Beth Bloom.

Wright’s defense attorney Jorge A. Mestre optimistically said, “They’re seeing the merit in our case.”

Note - As of 10PM EST Wednesday, they still had not reached a decision.

Stay tuned.

Issue No. 32, December 3, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter