$500,000 Bitcoin? $1 Million?

Price Predictions from top Bitcoin analysts, and The Parable of the Ox.

Bitcoin and blockchain technology are stories for the ages. The decentralization and sovereignty of cryptocurrency can be world-changing. But focus is always on the Bitcoin price, and its incredible ride from less than a penny to $60,000 per coin. The “number go up” aspect, in Bitcoin vernacular.

So, where are we heading from here, in terms of Bitcoin’s price? I researched dozens of price predictions from prominent Bitcoin analysts and did a composite analysis, and formulated my own targets as well. All are discussed below. But, let’s step back a minute.

Noted Bitcoin analyst Scott Melker, aka “The Wolf of All Streets,” ran a piece in his newsletter about averaging many opinions on a subject and coming up with a consensus target. He relates the “Parable of the Ox” and how he used it to form a consensus opinion on the price. From Melker - “The parable is about a competition in the early 1900s where hundreds of people would attempt to guess the weight of an ox at a county fair. The winner got to keep the ox. Farmers, mathematicians, philosophers, and travelers took the competition seriously. At one point, statistician Francis Galton recognized that the average of all guesses was extremely close to the actual weight of the ox. Thus, he relied on the accrued predictions of others, including even the absurdly low and high guesses. What he found was that the average of everyone’s predictions almost perfectly matched the weight of the ox.”

Melker decided to compile the price predictions of nine top predictive models, and came out with an average of $235,000 for Bitcoin’s price target. Not a large sample at all. However, a study was done averaging 200 top predictions, and the result came out amazingly close at $231,931. Note that price predictions are for various target dates, from 2021 through 2030. Here are some of the notable Bitcoin price predictions that I researched:

Max Keiser $100,000 short-term, $400,000 long-term. Host of the Keiser Report. Why? Comparisons to gold as a store of value.

Adam Back $300,000 over the next several years. Bitcoin developer, early pioneer. Why? “Retaining value when there’s a lot of money printing in the world”

“Plan B” $288,000 in 2022. Creator of “Stock to Flow” model. (@100trillionusd). Why? Pure mathematics and incoming supply versus demand.

Winklevoss twins $500,000 by 2030. Famous “Bitcoin Billionaires” and Gemini exchange founders. Why? “Bitcoin is gold 2.0; it will disrupt gold’s $9T value.”

Anthony Pompliano $250,000 by 2022. Host of the “Pomp” podcast believes available supply of Bitcoin is less than perceived, and institutional demand is rising.

John Pfeffer $700,000 (no date). London money manager believes Bitcoin will replace gold and is “vastly easier to store and secure.”

Chamath Palihapitiya $1,000,000 by 2037. Golden State Warriors owner, owns billions in Bitcoin. Why? Store of value against “autocratic regimes, corrosive banking.”

My sample of 26 top analysts’ predictions yielded an average price target of $345,500. Of course, the time frames for these targets varied quite a bit. Then, throwing out the two highest and lowest numbers, I got a price target of $311,273.

If some of the above price predictions and the corresponding reasons make sense to you, then Bitcoin should also be seen as an attractive investment. Not without its volatility, of course. (Not a recommendation for anyone to buy BTC.)

So, there you have Bitcoin price predictions from noted experts and analysts from around the world, as well as reasons for their forecasts. Well, you want to know, “What’s Rick’s prediction? What is the official price prediction of The Bitcoin Files?” Despite the fact that any prediction I make will exist on the internet forever like a non-fungible token, here goes. I see the Bitcoin market playing out like this over the next few years:

Strong rally this summer and fall. Retail and institutional FOMO take hold. Pullback late this year and early next, as traders take profits. Price goes over $100,000 in late 2021. Pullback to the $70,000’s in 2022. Then, strong accumulation and steady growth into 2023. Bitcoin will closely follow the “Stock to Flow” model.

Price predictions - $100,000 during late 2021. $225,000 by mid-2023.

Why? I like two sets of facts to support my prediction. First, I believe that Bitcoin will disrupt gold as the anti-inflationary store of value, for two reasons. Bitcoin has a finite supply. With gold, there is a finite supply, above the ground and below the ground. We just don’t know what it is. Also, when gold prices go higher, more gold can be mined. The other reason that Bitcoin will disrupt gold is that it is simply easier and more practical. All you need is a phone. No gold bars to store. (Try taking them on an airplane.) I won’t even bring up the usurious commissions or “vig” you pay when buying and selling gold.

Second, I base my prediction on simple math and basic laws of supply and demand. There isn’t much more Bitcoin to be mined, and additions to the supply are slowing. (Block rewards for mining are cut in half about every four years.)

Additionally, long-term holders of Bitcoin, and larger holders (“whales”) are not selling. That’s the biggest trend this year in Bitcoin, in my opinion. More coins are going off the market into deep, cold storage. At the same time, demand is rising.

More corporations are putting Bitcoin on their balance sheets. ETFs are being approved, giving investors more access to Bitcoin. Retirement plans are starting to add crypto options. Retail investing has never been easier, with the exchanges like Coinbase. Payroll services are converting wages to Bitcoin. Well, you get it.

In sum, the effective supply of Bitcoins on the market is decreasing, while at the same time, both institutional and retail demand are rising. Simple laws of economic supply and demand. Supply goes down and demand goes up, prices have to go up. Or, as Bitcoiners say, “Number Go Up.”

(I’ll leave myself one disclaimer. If governments foolishly try to “ban” or “crack down” on cryptocurrencies, price movements and adoption may be slowed. I don’t think this will ultimately happen in any devastating manner.)

Did You Know?

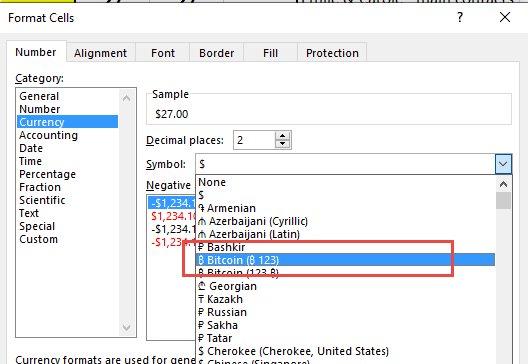

Recent versions of Microsoft Excel list the Bitcoin symbol as an option for numeric and currency fields:

This Week in Bitcoin History:

June 11, 2016 - Bitcoin’s market cap tops $10 billion for the first time. Today it stands at roughly $750 billion. Yep, 75x in just five years.

“Bitcoin may be humanity’s greatest invention.” - Jeff Booth, entrepreneur, tech leader, author of @priceoftomorrow - Why Deflation Is the Key to an Abundant Future.

Issue No. 8 June 18, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, runs marathons, yells at the Yankees and Giants, and is getting better at making homemade wine.

Follow on Twitter! The Bitcoin Files Newsletter