Unpopular Opinion: Altcoins Are a Distraction From Bitcoin

Plus, Bitcoin Hash Rate Hits All-time High

Ten thousand altcoins. It reminds me of the dot com craze of 1997–2000. I know, I know. They have “utility.” They have uses, applications. And some of them do. So did some of the dot com startups. Not many survived, however.

But people get focused on altcoins, for various reasons. They hear of the astronomical returns that the guy in the next cubicle just made. They see celebrities promoting coins with animals on them. Moreover, they just don’t understand Bitcoin, nor the altcoins that they just threw their federal stimulus check at.

I can’t count how many times this has happened to me. I ask someone, “Hey, have you heard about Bitcoin?” Invariably, I get a response like, “Oh, my friend bought some of that Dogecoin.”

Oh man.

The problem, and I do consider it a problem, is that the mainstream media uses the terms “cryptocurrency,” “Bitcoin,” and “defi” interchangeably. As a result, most people think that all crypto coins are the same. And they are truly missing the main points:

Bitcoin is truly decentralized, and Bitcoin has a hard cap of 21 million coins.

There is not an altcoin in existence that is truly decentralized. They all have founders, and most have been pre-mined. Much like a corporation, where the founders own a large percentage of the stock, and then other shares are offered to the public, or to the VCs, at a huge multiple. Nothing illegal here, but distinctly different from Bitcoin, the OG crypto. There are no Bitcoin founders cashing in their pre-mined, hyped-up coins.

As for the second point, there is not a government currency with a hard cap of coins available. Consider the US dollar. In 1900, the money supply was $7 billion. Today, the money supply is over $21 trillion. A constant increase in the money supply in society creates more demand, and in turn, higher prices. Inflation. (When a nation can’t pay back its debt, what else can it do?)

Trillions of dollars have been pumped into altcoins, mostly into Ethereum. And Ethereum will survive. It has many useful applications, and more are being developed all the time. Most of the other 10,000 will not survive. Most “investors” in these altcoins are really traders. They are not into “crypto” for the long haul and are not interested in the breakthrough technologies offered by Bitcoin and Ethereum.

They are in it for quick gains. It’s the Robinhood phenomenon.

What else does the mainstream media confuse with Bitcoin?

Stablecoins. Throwing around the terms “Bitcoin,” “crypto” and “digital currency” together is downright reckless. Here’s one of my biggest fears surrounding cryptocurrencies:

Governments will feel that CBDCs (central bank digital coins) will serve the same function as Bitcoin.

Why? Because most elected officials are not educated about Bitcoin, stablecoins, altcoins, blockchain, none of it. (Apologies to Sen. Cynthia Lummis.) There will be no cap on the quantity of CBDCs that will be minted. And privacy, forget about it.

So, the general public will be distracted from the potential of Bitcoin by coins with animals on them. And, governments will implement digital coins and think they’ve found a substitute for Bitcoin.

Bitcoin, however, will continue to function 24/7, processing millions of transactions per day. Miners will continue to secure the network for the hardest money in existence.

At some point, many altcoin traders will get wrecked. And it’s too bad. The real thing was available all along. Bitcoin. The OG.

Bitcoin Hash Rate Hits All-time High

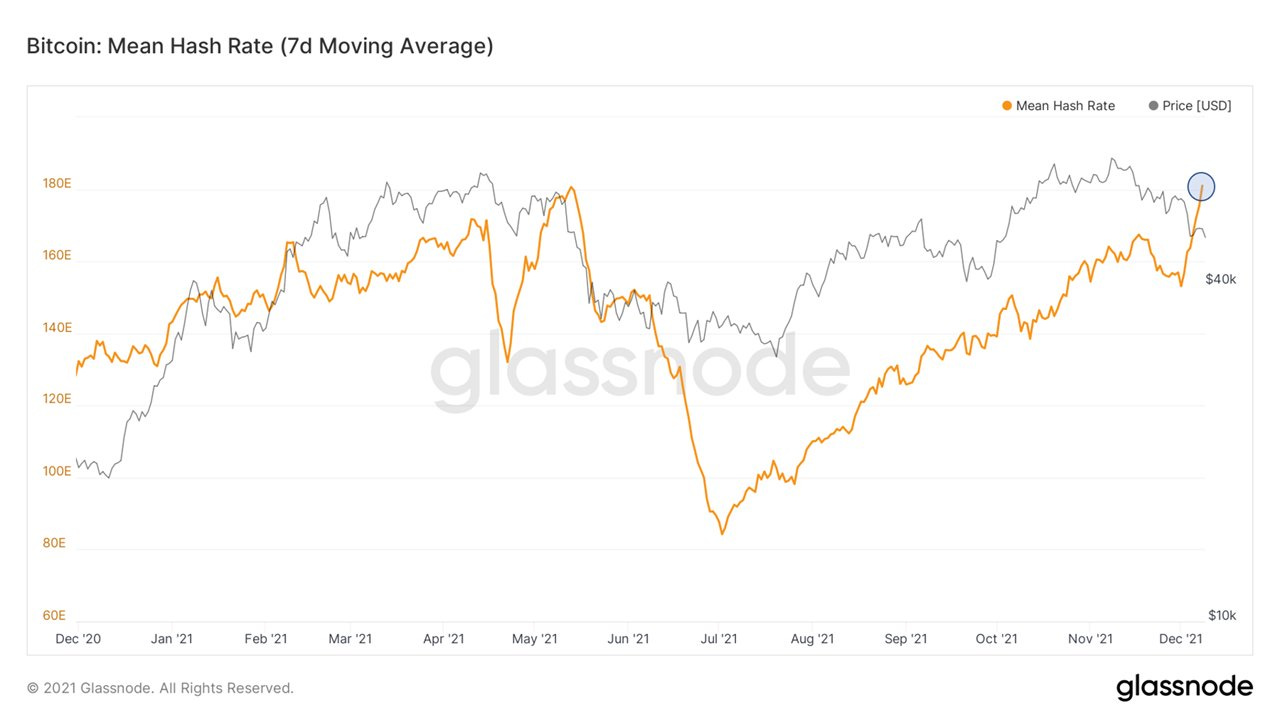

When China outlawed Bitcoin mining in July, Bitcoin’s worldwide hash rate plummeted, falling greater than fifty percent. Put another way, half of all Bitcoin mining was going on in China, and suddenly miners had to find a new home.

See Issue No. 9 from June 25, 2021.

Well, the miners did relocate, to Texas, to Kazakhstan, to Russia, to a lot of places. The miners went in search of low-cost, renewable sources of energy and found abundant solar and wind power. What’s even more important is that Bitcoin mining became more decentralized, not concentrated in one nation or even on one continent.

One major criticism of Bitcoin, from the standpoint of the US Congress, was that the mining was centered in China. And after all, who knows what the Chinese government could do to Bitcoin, and how many investors could be harmed? China has already instituted at least three “Bitcoin bans.” Well, that major source of FUD has been removed. Theoretically, anyway, lawmakers should be more receptive to Bitcoin. We’ll see.

Glassnode’s chart illustrates that the hash rate has gone pretty much straight up in the last two weeks. This is occurring just five months after the devastating drop in July.

As a result of the miners getting up and running quickly in various areas, the Bitcoin network is stronger than ever. The miners are generating more coins and securing more transactions. It’s all very bullish for Bitcoin. Will it mean a runup in Bitcoin’s price?

As the above chart also shows, hash rate and price have been kind of loosely correlated, so the possibility exists of higher prices. We’ll find out soon.

One very relevant tweet from this week:

Subscribe on Substack — Always Free!

Issue No. 35, December 17, 2021.

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter