Last Friday, local officials in Southwest China’s Sichuan Province ordered a halt to all Bitcoin mining in the region. By Sunday, an estimated 26 mining operations were shut down. Combined with similar crackdowns in China’s northern regions, this could mean that 90% of China’s Bitcoin mining capacity will be shut down, at least temporarily. In addition, the Sichuan Energy Bureau ordered local electric providers to cut off all power to mining operations by Sunday. Bitcoin mining operators in China had hoped that the Sichuan region would be an exception to the government actions, as there exists an extreme glut of hydro-powered electricity in the rainy seasons.

I know what you’re thinking. With all the electricity that is used in mining, and with Chinese operations performing 80% of the world’s Bitcoin mining, this was probably inevitable. That doesn’t seem to be the case, however. The miners had felt that by using the excess hydro power and combining with some coal power, the operation wouldn’t take an excessive toll on the region’s power grid. What’s more, the Chinese government didn’t officially state that they had a problem with Bitcoin mining’s energy consumption at all.

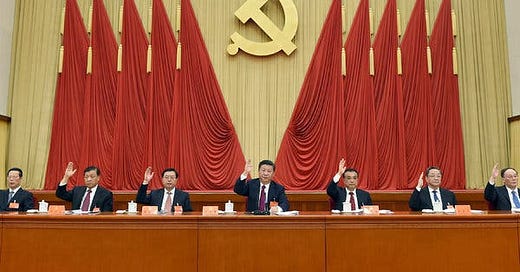

Rather, Chinese regulators have been determined to, in their words, “curb speculative trading and control financial risks” to its citizens. In addition, officials stated it was necessary to prevent the transmission of individual risks to the wider society, as well as help to stem the tide of illegal activities, such as money laundering. So, that’s the official CCP government position, to protect its citizens. I did a little research to find out what some prominent figures in the Bitcoin space thought, both about what it will mean for Bitcoin, and what other motivation the Chinese government may have had.

Bobby Lee, Founder & CEO, Ballet Bitcoin Wallet:

Lee, the author of The Promise of Bitcoin, feels that this mining ban will strengthen the Bitcoin network over time, as the vast majority of mining operations will not be centered in one nation. Lee points out that China has attempted several Bitcoin “bans” over the years. In 2013 , China officially recognized Bitcoin as a property but banned its citizens from using it for transactions. In 2017, China banned mainland residents from trading in cryptocurrencies on exchanges and made it illegal for Chinese startups to raise funds via initial coin offerings.

Lee points out that China rarely goes through the process of changing financial laws and regulations, but rather acts through executive orders. He states, “China will ban Bitcoin again and again,” and feels this ban will not be a big blow to the network in the long run.

Lucas Nuzzi, Network Project manager at Coin Metrics:

Nuzzi believes that the Chinese government has a completely different motivation for trying to ban Bitcoin in the country. He postulates that the government sees Bitcoin as a threat, due to its decentralized nature. China is soon unveiling a new, central bank digital coin that may enable government surveillance of its citizens, says Nuzzi. He also states, “Dictatorships like to unbank their citizens.”

Nuzzi sees the migration of mining away from China as “the most positive development for Bitcoin in 2021.”

Anthony “Pomp” Pompliano, podcast host and venture capitalist:

“China just made a significant geopolitical mistake.”

That’s how Pomp led off his Monday morning newsletter.

Pomp likens China’s mining ban to what the North Korean regime did with internet service. North Korea restricted internet usage to government officials and a few selected individuals, while only allowing its citizens to partake in a restricted intranet controlled by the government. The goal seemed to be to shut the citizens off from the outside world. Similarly, Chinese government officials are allowed to own and use Bitcoin, but private citizens are not. Again, economic freedom for the masses is not the goal of the CCP.

Despite these measures, Bitcoin remains completely decentralized, continues to function perfectly, and is providing access to a financial system for millions who had previously been excluded from banking. Another great take from Pomp:

“China doesn’t control Bitcoin and never has.”

My take:

Despite prompting some short-term FUD among investors and legislators, China’s move will be very good for Bitcoin in the long run. Already, days after this announcement, we are seeing Bitcoin miners move their operations to other countries, countries with cheaper renewable energy sources, countries with greater economic freedoms. This will accelerate during 2021, and free markets will sort out where these operations will locate.

We have seen this play out before across the world. Authoritarian governments like China’s will seek to quash any company/product/technology that they deem gets too big for the government to control, or that empowers their citizens a bit too much.

Here’s the biggest reason why I’m bullish on China’s move: Bitcoin critics in the US, including those in Congress, present the argument that most of the crypto mining being centered in China was not good, and that China couldn’t be trusted. There was also the misguided belief that China could somehow “control” the Bitcoin network or market. So now, with mining spreading around the world, where is that argument? The answer, of course, is that the argument is now losing most of its teeth. And that is super bullish for Bitcoin.

This Week in Bitcoin History:

June 23, 2013 - The US Drug Enforcement Administration listed 11 Bitcoins as an asset that was seized in a Justice Department action, marking the first time that a government agency claimed to have seized Bitcoin.

Tweet of the Week:

Bitcoin Prices, this week in history:

6/28/2015 $ 272. 6/26/2016 $ 659. 6/25/2017 $ 2,506. 6/24/2018 $ 6,385. 6/23/2019 $ 10,817. 6/21/2020 $ 9,144. 6/24/2021 $ 34,512.

Until next week, stay the course, learn all that you can, and HODL your Bitcoin.

Issue No. 9 June 25, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, runs marathons, yells at the Yankees and Giants, and is getting better at making homemade wine.

Follow on Twitter! The Bitcoin Files Newsletter