Fidelity Predicts $1 Billion Bitcoin

Investing giant goes all in on crypto space

$1,000,000,000. A lot of zeroes. In 2021, a billion dollars seems like a lot of money. Even in 2038, it will be a lot of money. Jurrien Timmer, Director of Global Macro at Fidelity Investments, believes that one Bitcoin could be worth $1 billion by the year 2038.

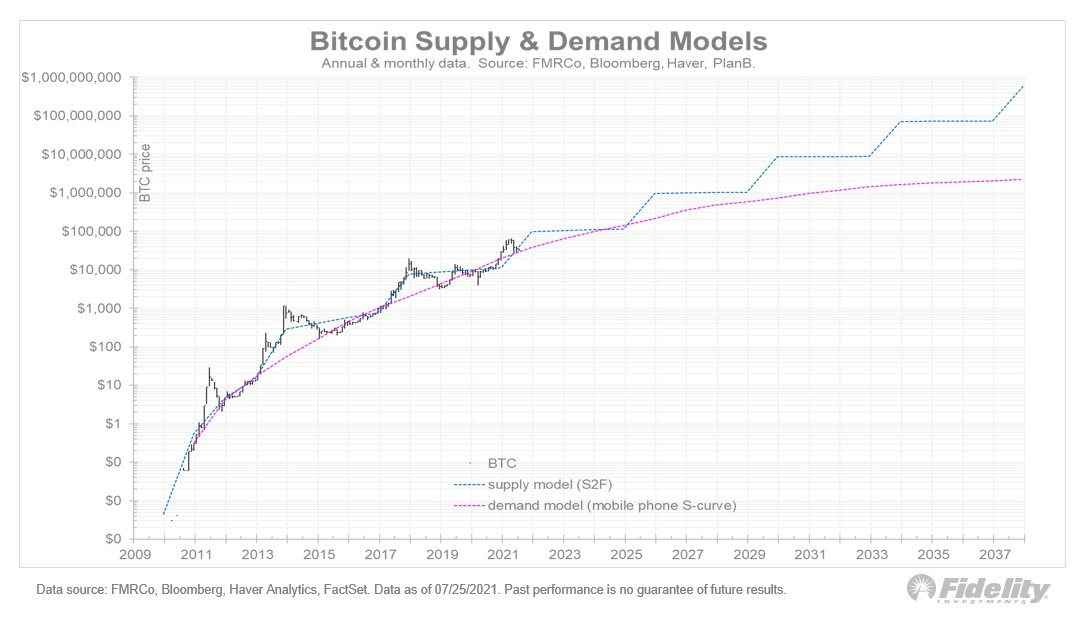

Timmer also believes that the orange coin could hit $1 million before this decade is over. That’s only eight years from now, and would represent a 20x multiple of Bitcoin’s current market price of around $48,000. I know. Anyone can make predictions like that. But Timmer lays out his case using his own valuation model and another well known model, the Stock to Flow model.

Timmer’s demand model is based upon Metcalfe’s Law. (See last week’s issue!) Metcalfe holds that as the number of users of a network grows linearly, the value of the network grows exponentially. Thus, if the number of users doubled, its value would grow at four times, or the square of two. Timmer’s demand model grows steadily to about $1 million by the year 2030.

By contrast, the Stock to Flow model, created by the pseudonymous analyst that goes simply by Plan B, is based on the supply of new coins growing at a decreasing rate each year. This occurs because of the built-in halvenings every four years. Given increases in adoption and demand, the result will be prices expanding exponentially. Indeed, the price of Bitcoin has grown at approximately 10x every four years, not by just the 50% slowdown in supply. Pretty powerful stuff.

Stock to Flow predicts even faster growth in price than does Timmer’s Demand Model, especially after the year 2030.

Timmer’s Reason’s for the Bold Prediction:

The devaluation and unraveling of the current fiat monetary system.

The exponential growth in the values of networks.

Increasing demand and adoption in the crypto space.

Fidelity is going all in on cryptocurrencies:

Fidelity is one of the largest financial services companies in the world, with $5 trillion in assets under management. They are going all in, and that’s extremely bullish for crypto. Here are some of the moves Fidelity has been making:

Fidelity is seeking SEC approval for its own Bitcoin ETF, to be named Wise Origin Bitcoin Trust.

In July, Fidelity acquired a 7.4% stake in Marathon Digital Holdings, a North American crypto mining giant, for $20 million.

Fidelity Digital Assets was formed to build Bitcoin custody solutions for large institutional clients.

Fidelity started a venture capital division called Devonshire Investors to invest in crypto startups. Some of these are Coin Metrics, Talos and ErisX.

The investment giant says that 90% of its biggest clients are interested in buying Bitcoin and other cryptocurrencies.

My take: The Stock to Flow model and the halvening cycles have indicated exponential growth at a 10x factor every four years. Four more cycles, through the year 2038, have the potential to yield 10x growth every four years, resulting in $500 million price by 2038. That depends on a lot of factors of course, but shrinking supply and increasing demand can only push the number up. Thus, the Bitcoin expression, “Number Go Up.” It’s built in to the code.

This Week in Bitcoin History:

In September of 2012, the Bitcoin Foundation was launched in their words, “to accelerate the global growth of Bitcoin through standardization, protection, and promotion of the open source protocol.” Link: https://bitcoinfoundation.org/

Catch Last Week’s Issue!

Issue No. 20, September 10, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter