Metcalfe’s Law and Bitcoin

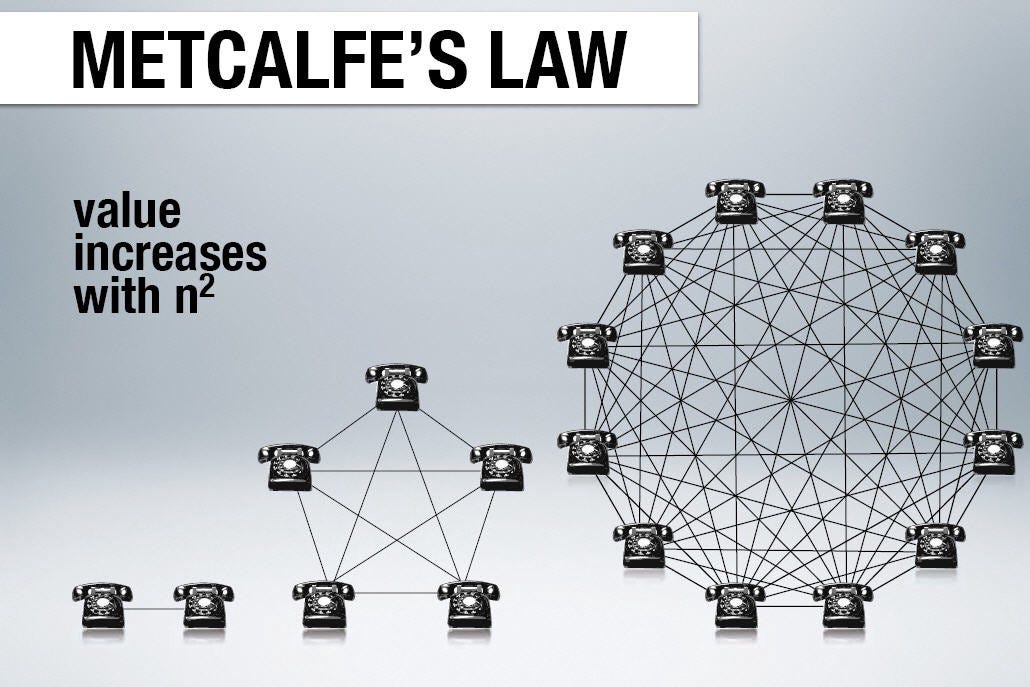

Metcalfe’s Law states that the value of a network is proportional to the square of the number of connected users in the system. Damn, talk about exponential growth! This week I explore how this relates to the growth of Bitcoin, both in users and in price.

Metcalfe’s Law, named for Robert Metcalfe, the inventor of ethernet, attempts to quantify the increase in value of a network based upon the growth in its users. (The law was named by George Gilder, publisher of Gilder Technology Report.) During the 1980’s and 1990’s when telecommunications networks and later, the internet, were taking off, this was the mantra of tech entrepreneurs. Grow the network. Digital companies gained competitive advantages through building networks, as opposed to linear businesses, which needed to buy assets and supply chains to spur growth.

Direct network effects occur when an increase in the number of users directly creates more utility for all of the users. Think Facebook. Before social media, think of the origins of the fax machine. The first fax machine, by itself, was useless. But, when a company added machines at each of its locations, then they had something valuable. Later, as their customers and suppliers added fax machines, the value of a machine grew exponentially.

The added bonus of this theory of non-linear, exponential growth of a digital enterprise is that costs would, at most, grow linearly.

Cool concepts, what about Bitcoin?

Bitcoin’s users and acceptance have grown, during its twelve-year existence, at an exponential rate, to say the least. There are at least 220 million users of cryptocurrencies in the world, as of last month. More people buying, selling, and spending Bitcoin, more merchants accepting it, more exchanges dealing in crypto, and more investors gobbling up coins make for greater value and liquidity in the system. Just like the fax machine, right?

Consider these facts: Bitcoin is growing faster than the internet at the same age. Bitcoin, in 2021, is approximately, in terms of users, where the internet was in 1997. The World Wide Web was still in its relative infancy. Bitcoin’s potential, then, is astounding, when you think what has happened to the internet since then.

Additionally: Bitcoin’s price per coin has grown by 362,000% since August, 2011. This certainly indicates exponential price growth, along with user growth. Has it grown in accordance with Metcalfe’s formula? Or, close to it? Sort of. Let’s take a look at some criticisms of Metcalfe’s Law.

Flaw in the Law?

One criticism of Metcalfe’s Law is that it measures the potential number of contacts in a network, as if each user has the potential to connect with all other users. In reality, there may be barriers, such as language, geopolitical or geographic impediments, that would restrict the functionality of many potential connections. In short, Metcalfe assumes that the value of each connection, or node, is of equal benefit. Obviously, this can’t be true. What’s more, users may not have a want or need to communicate with all other groups. Wrote Henry David Thoreau in 1854,

“We are in great haste to construct a magnetic telegraph from Maine to Texas; but Maine and Texas, it may be, have nothing important to communicate.”

Certainly, as the users of a network double, its value more than doubles, but maybe not directly in accordance with Metcalfe’s formula. In sum, it would appear that the increase in value of a network, as its number of users grows, probably lies somewhere in between linear growth and perfectly exponential growth.

Bitcoin closely follows the Stock-to-Flow model

The Stock-to-Flow model, developed by the pseudonymous Bitcoin researcher known simply as Plan B, attempts to predict the price of Bitcoin in relation to its supply and relative scarcity. The model measures the ratio of the current stock of a commodity to the flow of new production. Obviously, the rate of production flow of new Bitcoin is decreasing, so given rising demand, the price will grow at greater than a linear rate. It predicts exponential growth in price, similar to Metcalfe. Incidentally, Plan B’s S2F model predicts a Bitcoin price of $100,000 per coin later this year.

Bitcoin’s Future and the Lindy Effect

The Lindy Effect is the theorized phenomenon that the older something is, the longer it’s likely to be around in the future. Put another way, the longer the time that something has survived, the greater the odds of its continued existence in the future. The theory applies to non-perishable items, those that do not have an unavoidable expiration date. So, it wouldn’t apply to humans!

The origin of the term can be traced to a 1964 New Republic article by Albert Goldman. Goldman coined the theory the Lindy Effect, named for Lindy’s Delicatessen in New York City. Lindy’s was a regular late-night haunt for comedians, who would gather and discuss shows and entertainers. There, it was theorized that comedians had a fixed amount of material, so the longer a performer could stretch out his shows, the greater likelihood that his career would continue. Similarly, the longer time that a Broadway show kept running, the greater lifespan it could be predicted to have.

Kind of like aging, in reverse.

How can the Lindy Effect be applied to Bitcoin? Well, many people predicted the demise of Bitcoin in 2012 and 2013, but it has now survived for twelve years. Investors, institutions and governments have grown to accept cryptocurrencies and are developing ways to promote and accommodate their existence. With every year, Bitcoin grows and looks more and more like it’s here to stay. It’s not just a passing fad.

Kind of like the internet.

What’s all this mean?

Metcalfe’s Law is an empirical observation, or description, not an immutable physical law.

Greater adoption and acceptance of Bitcoin has lead to non-linear, exponential growth in the value of the network.

More users, or nodes, in the network have resulted in greater liquidity and stability in the cryptocurrency markets.

A significant portion of Bitcoin’s exponential price growth can be attributed to concepts in Metcalfe’s Law.

The fact that Bitcoin has survived twelve years indicates a great probability that it will be around for a long while.

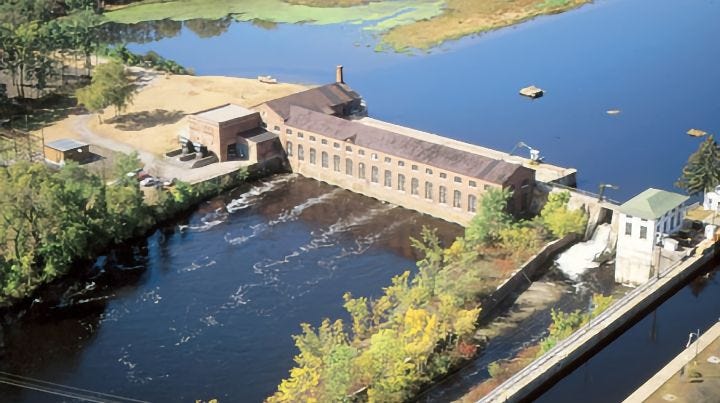

Update: New York Hydro Plant Mining:

In the July 23rd issue of this letter, Issue number 13, I reported on an upstate New York hydroelectric plant, the oldest active hydro in the nation, that had begun mining Bitcoin with the power it produced. I visited the plant and was impressed by the operation. Now, the Albany Times Union has followed up an earlier story with one about several other upstate mining facilities. It seems miners like the upstate area, for many reasons.

Coinmint, a major mining player, has set up shop in Massena, New York, near the Canadian border, mainly to access the area’s cheap and abundant hydroelectric power. Greenridge Holdings has fired up a former natural gas plant in Seneca Falls to mine crypto, and a small hydro plant in Valatie, in Columbia County, has also drawn the interest of crypto miners.

Not everyone in upstate is happy about these developments. Environmentalists, as expected, decry the use of energy to fund operations that they may find unnecessary. State Senator Anna Kelles of Ithaca has sponsored a bill to put a temporary moratorium on mining, but the bill has so far stalled in the state Assembly. Kelles acknowledges that “Upstate New York has the trifecta of what they (miners) need,” hydro power, water for cooling, and low costs.

Proponents of crypto mining in Upstate New York include the electrical workers unions, which have been hard hit by job losses in recent years. Addie Jenne, legislative counsel for the state Association of Electrical Workers, said, of crypto:

“We don’t want to see New York state chase away an emerging technology. Digital currency is not something that is going away.”

This week in Bitcoin History:

On September 1, 2017, Bitcoin’s price broke $5,000 for the first time.

As of Wednesday, the price was $48,800, which represents an increase of 875% in just four years.

Issue No. 19, September 3, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter