Strong US Dollar Means Pain for Foreign Currencies

The US dollar, relative to other world currencies, has been soaring in strength throughout this year. But why? With high inflation, negative GDP growth and mounting debt, why would the US currency hold so much value across the globe? Two reasons.

First, the Federal Reserve is actively, aggressively raising interest rates. They see it as their only tool to fight the highest inflation we’ve seen in forty years. Treasury bond yields are taking off, and those higher rates are attracting more foreign investment. When rates rise, capital flows into the US and the dollar gets stronger.

In addition, the dollar tends to strengthen during times of global crises. Investors will flock to the global reserve currency, and reserve economy, and that means the US. Europe is battling an energy crisis, a recession, and inflation, not to mention a war on Ukraine soil. Multiple crises.

So What Currencies are Tumbling?

The Japanese Yen is in total freefall, and just hit a new 24-year low last week. The Bank of Japan has refused to budge from its policy of ultra-low, near-zero interest rates. And with the US fighting inflation by hiking rates, Japanese money is fleeing their country. Not surprising. It’s also not clear how long the BoJ can continue this failing policy.

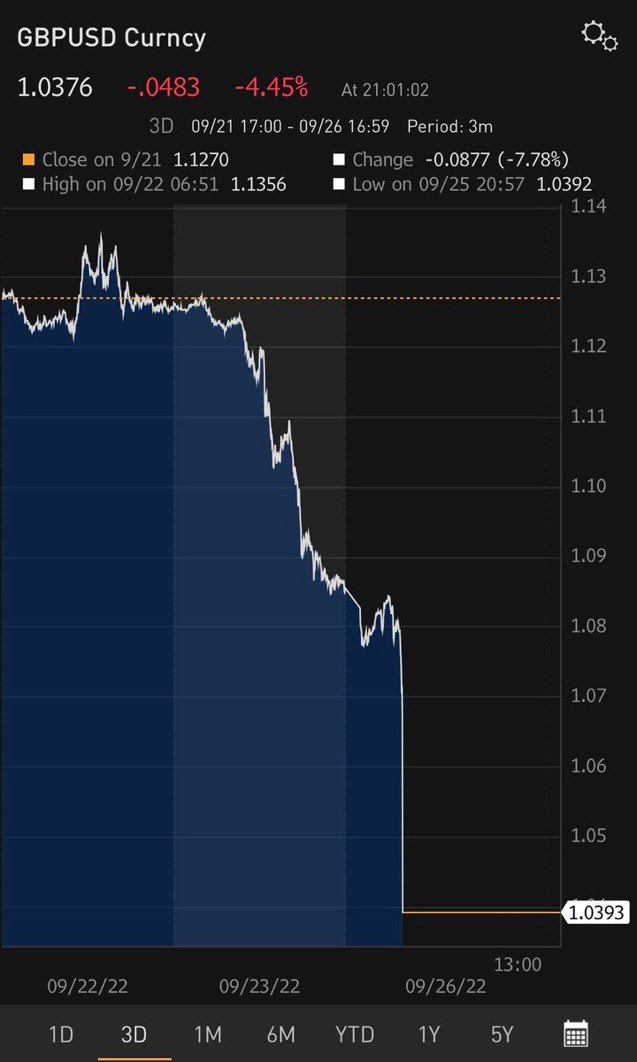

The British Pound is also in a rapid descent. It recently sank to a low level not seen since 1985, and at present is almost at parity with the US dollar. And why is that? Well, it seems the Brits are not too happy with new PM Liz Truss’ policies in the midst of a recession and record inflation.

Truss’s economic plans include large tax cuts funded by steep increases in government borrowing, some used to subsidize citizens for soaring energy prices. The tax cuts represent the largest in fifty years. The country is in a bit of a mess right now.

“Confidence in the UK economy is low right now,” Pao-Lin Tien, an assistant professor of economics at George Washington University.

The Euro has also been dropping in price, relative to the dollar, for many of the reasons mentioned above. The coin has also dropped, along with the pound, to an essential parity with the dollar.

And let’s not forget the recent currency crises, wreaking havoc with the economies of several nations in recent years, along with severely devaluing their currencies. Among them, Venezuela, Turkey, Argentina and Cyprus.

The tumbling of the British Pound this week:

But Bitcoin Has Held Up Very Well?

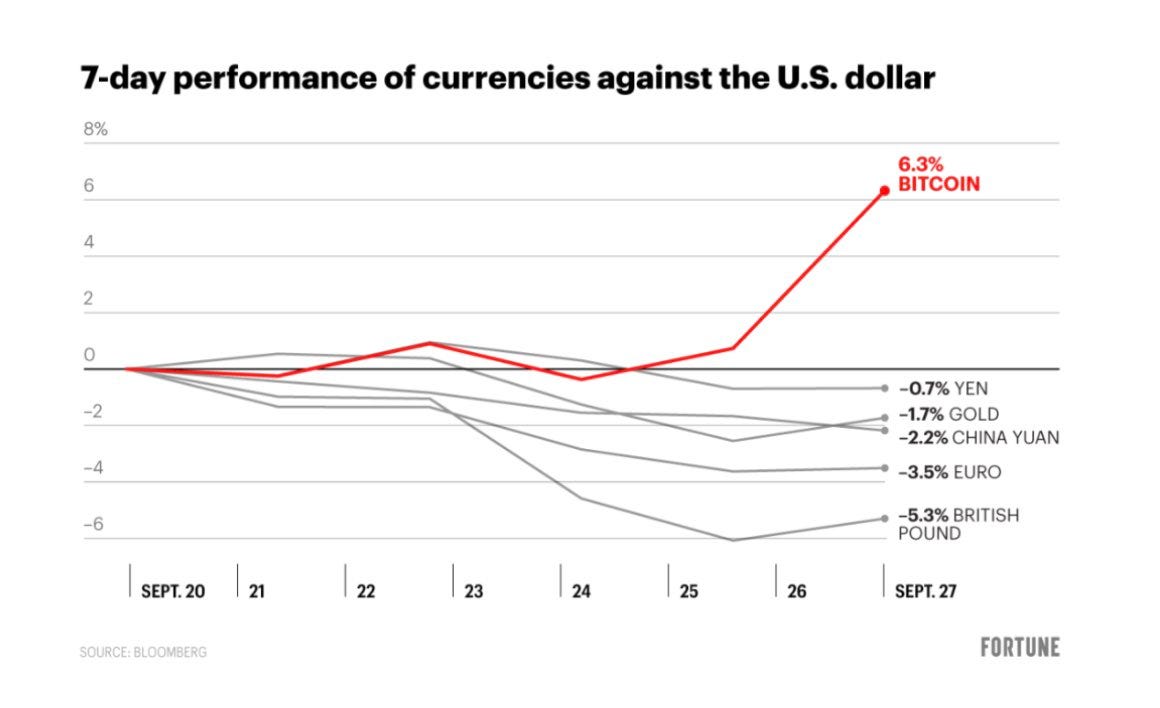

Why yes, it has. Bitcoin’s price rose 6.5% in a week, in the wake of tumbling global currencies, as shown below.

Could it be that:

Bitcoin is properly decoupling from equities and “risk assets?”

Bitcoin is finally being recognized as a (long-term) safe haven in times of crisis?

Weaknesses of fiat currency are being exposed?

Time will tell, but I firmly believe that Bitcoin’s volatility will decrease over time, as adoption continues and fiat money continues to fail. Nations simply cannot continue to pile on debt. They also can’t continue to print money to prop up weak economies. Or keep interest rates near zero. “Something’s gotta give.”

A tweet from the incomparable Dan Held:

“The world’s economy is so bad this week that Bitcoin is outperforming major currencies” - Fortune

Even The New York Times Agrees!

Thanks for reading. Please share this newsletter, on Twitter or with friends.

“Hard Money” - Excellent New YouTube & Podcast

Natalie Brunell has unveiled her new YouTube show and podcast entitled “Hard Money.” It’s a reference to Bitcoin, of course. Fifteen episodes out so far, with great guests, headline stories and more. A quick, informative look at economics, finance and of course, Bitcoin. Becoming one of my favorites.

In 2021, Natalie also launched the Coin Stories podcast, which is focused on cryptocurrency and Bitcoin. Coin Stories features one-on-one interviews with leading voices in the crypto space about their origin stories and philosophies on monetary policy, economics, and digital currencies such as Bitcoin. Coin Stories quickly ranked among the top 100 Business Podcasts according to Chartable. (Wikipedia)

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 550 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 76, September 30, 2022

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.