Twitter Enables Bitcoin Tipping

Just this Thursday, Twitter enabled third-party tipping services, utilizing companies such as Strike, giving users the ability to send payments around the world, nearly instantly. Twitter’s “Tip Jar” will utilize the Lightning network platform, making Twitter one of the world’s most efficient platforms for transmitting money across the globe.

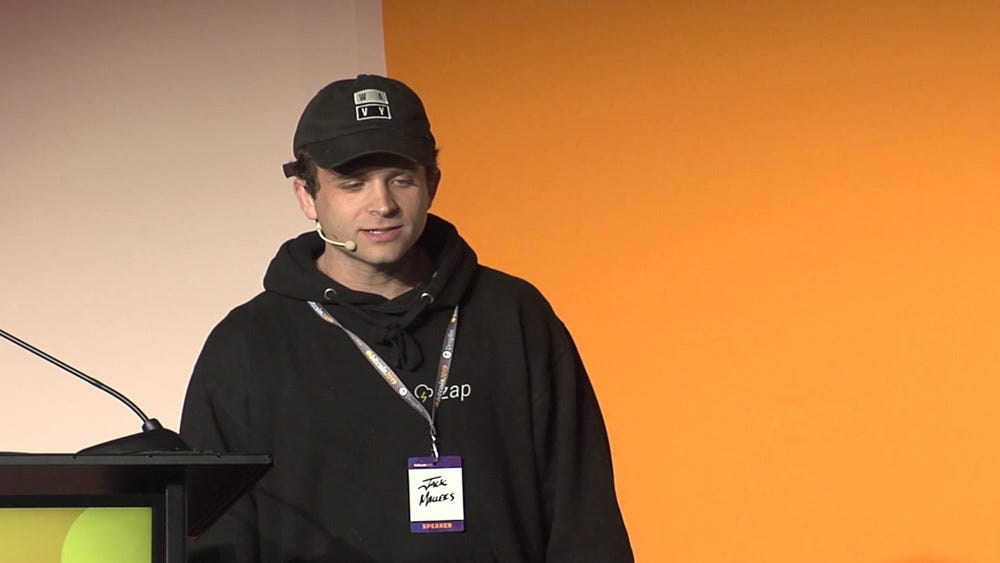

Said Strike’s 23 year-old CEO Jack Mallers, “Twitter’s integration with the Strike AOI turns Twitter into one of the best remittance experiences in the world, one of the greatest global payment experiences in the world, and allows an internet communications company to interoperate with the monetary standard for the world.”

Twitter, in a statement, said they “were not in the flow of funds,” and would not be taking any commission on the remittances. Mallers demonstrated the service with a video he released on Twitter last Thursday, showing Bitcoin being sent from Chicago to El Salvador over Twitter, instantly.

The announcement prompted speculation that, if Twitter captured a significant slice of the global remittances business, given the market cap of the major players, the value of a single Bitcoin could rise to over $300,000. (Peter Chawaga, Bitcoin Magazine, September 25.)

Coinbase Allows Paycheck Deposits

Coinbase, the cryptocurrency exchange giant with over 68 million users, announced on Monday that they will begin allowing users to deposit any percentage of their paycheck into their online Coinbase accounts. Users would then be able to immediately convert their fiat dollars directly into cryptocurrencies like Bitcoin, with no fees whatsoever.

Coinbase said it will partner with an FDIC-insured bank to deliver the direct deposit service, but did not disclose which bank. The move propels publicly-held Coinbase deeper into the world of traditional financial services, at the same time they are being scrutinized by regulatory authorities over their crypto lending platforms.

Other financial services players such as PayPal, Robinhood, and SoFi also allow users to deposit their paychecks. The move positions Coinbase as one of the major players in providing total cryptocurrency services. Said Max Branzburg, vice-president of products at Coinbase, “We’re determined to deliver the most trusted full suite of crypto-first financial services to our 68 million users.”

China Bans All Crypto Transactions

It’s deja vu all over again.

The People’s Republic of China, for the umpteenth time, has banned some or all forms of cryptocurrency activity. Recently, China banned Bitcoin mining activities in many provinces of the country, and over several years has banned various crypto activities. In 2013, the country banned banks from handling Bitcoin transactions, and in 2017 the country blocked all initial coin offerings and crypto exchanges.

This week’s announcement, banning all cryptocurrency transactions, comes amid China’s planned rollout of its own central bank digital currency. The Digital Currency Electronic Payment (DCEP) will use blockchain technology, but all data is centrally-controlled and will be retained by the government.

Many believe that China’s deliberate exit from the Bitcoin world will open up more opportunities for other countries to thrive in the Bitcoin space. US Sen. Pat Toomey (R-PA) tweeted that this will give the US more room to make developments in the crypto space. “China’s authoritarian crackdown on crypto, including Bitcoin, is a big opportunity for the US,” said Toomey. Said Ross Gerber, CEO of Gerber Kawasaki Wealth Management, “China’s decision effectively isolates them from what will be the future monetary system.” He added, “This is great news for Bitcoin. The last thing we want is China [to be] involved in a currency of the world.”

Will Congress Raise the Debt Ceiling?

In the next fiscal year, the US government plans to spend $6.8 trillion.

They will have to borrow $3 trillion of that. (Not a typo.)

Every few years, Congress must vote to raise the country’s debt ceiling, or else they can’t borrow the money needed to pay the bills. So far, Republicans in Congress have stated they will not approve an increase in the borrowing limit, protesting what they deem to be runaway spending under the Biden administration. Gridlock.

This is potentially the fourth time in the last twenty years that the ceiling will be raised, the last one coming in 2013. No one believes that the borrowing limit won’t be increased, and no one believes that a total government shutdown will take place.

But, what if? Like, really, what if? Well, in the short-term, the US GDP would decline significantly, as $3 trillion represents 15% of America’s GDP. Real money that won’t be spent during the next fiscal year. However, without the money printers humming, the $3 trillion won’t be siphined off of America’s savings in the form of inflation and reduced purchasing power. Long-term, a winner for the people.

And, what are the options for dealing with our now $29 trillion national debt? Well, there are three, two of which won’t be considered by Washington. First, the government could default, either partially or in full, on the debt. Never going to happen. You’d be talking global recession. Second, government spending could be slashed by about thirty percent for several years, thus throwing the US into a big recession. Again, not going to happen.

The only option is to actively (but not too loudly) promote inflation for the next ten years or so. You know, pay back debt later with cheaper dollars. There’s your winner, a government game of Kick the Can Down The Road.

This sets things up nicely, to say the least, for a store of value with a fixed supply. An asset class that won’t lose power during inflationary times. You guessed it. Bitcoin. Gold 2.0.

This Day in Bitcoin History:

On October 1, 2013 one Bitcoin was trading at a price of $140.

Right now, you’d have to pay about $43,000 for that coin.

300x in eight years.

Issue No. 23, October 1, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter