The Richest Bitcoiner in Babylon

Classic Laws of Money Still Relevant

On the plane headed to The Bitcoin Conference in Miami Beach, I had the opportunity to read a classic book on money, savings and financial success called “The Richest Man in Babylon." Businessman George S. Clason, in 1926, penned a series of pamphlets which were widely distributed by banks and insurance companies. Put together in book form, these parables have become an inspirational classic, selling over four million copies.

Clason sets each of his parables in ancient Babylon, over six thousand years ago. Business and trade were of course much simpler in those times, but the principles of money were the same then as they are now. Much can be learned about saving, lending, borrowing and budgeting from this book. And to my surprise, the principles laid out by Clason reminded me of many aspects of Bitcoin.

What came to mind as I read this was how many of these proven principles of money can be applied to investing in Bitcoin. And how Bitcoin reinforces sound money and discipline.

Here, in Clason’s words, are some key concepts from the book. And my take on each:

“Thou makest me to realize the reason why we have never found any measure of wealth. We never sought it.”

Two things came to mind when I read this line. Mainly, that many people never assemble any kind of wealth because the don’t proactively go after it and try to attain it. True wealth rarely falls into someone’s lap. The decision must be made to set forth on a journey to accumulate wealth.

The second thing that the line triggered in me was about our system of money itself. We have bemoaned, for decades, the fact that our dollars are devalued every year. Inflation eats away at our paychecks. More and more money is being printed, devaluing our dollars every year. Fiat money is not even tied to gold anymore. It’s not tied to anything. Fiat money has failed us. Centralized currencies have failed us.

And the reason we haven’t transitioned to a better system of money is that no one ever sought it out. Not until the 1990’s, when experiments with digital currencies began. Ever since the Nixon administration’s decision in 1971 to take the US dollar off the gold standard, the dollar has been just a promise that it would hold value. Fast forward thirty-seven years. Enter Bitcoin, a truly hard-capped and decentralized currency, which came about in response to the 2008 Great Financial Crisis. Banking was broken and our money needed a solution.

“I found the road to wealth when I decided that a part of all I earned was mine to keep. And so will you.”

This has to be a proactive decision on each person’s part, to save part of every paycheck, to “pay yourself first.” When you think about the system of money differently, you will think about money as yours to save, yours to invest. Money is not simply a channel to pay bills.

Putting money into a bank savings account on a regular basis used to be pretty common. And you could earn 3 to 5% interest on your savings. There was some incentive. Not so in this new economy, where interest rates were driven to near-zero in order to keep an otherwise struggling economy afloat. No incentive to save, every incentive to borrow. There is no cost to capital, and this is wrong. Sound financial principles turned upside down.

Bitcoin, for many, has become the new savings account. Stack on a regular basis, with long-term price appreciation potential. And earn yield on your Bitcoin. Don’t dwell on short-term price movements. Make it your savings account. Money for you to keep.

“Usurious rates of return are deceitful sirens that sing but to lure the unwary upon the rocks of loss and remorse.”

Investments offering high rates of return. Think, junk bonds in the eighties. Mortgage-backed securities. And now, cryptocurrency “altcoins,” centralized, pre-mined junk offerings that are promised to go up 100x this year. “If it sounds too good to be true…” Stay away. No, run away.

“We desire riches; yet, how often when opportunity doth appear before us, that spirit of procrastination from within doth urge various delays in our acceptance. In listening to it, we become our own worst enemies.”

Investing money into new asset classes or new technologies can make anyone hesitate and maybe be scared off. It’s natural. But with proper research, new opportunities can be uncovered which can be game changers for financial health. Bitcoin is so much like that. A new technology that has created an asset with a trillion dollar market cap. Sure, it’s over thirteen years old, but it’s not too late. Do your own research and take a plunge with assets that you won’t need too soon.

Also, this beauty from Clason:

“Good luck can be enticed by accepting opportunity.”

George Clason’s Five Laws of Gold, in simpler language:

Gold will come to a man who invests ten percent of his earnings.

Gold will multiply if put to work earning income.

Gold will cling to the cautious owner who invests safely with trusted parties.

Gold will slip away if invested in assets which a man is not familiar with.

Gold will also slip away if employed in attaining impossibly high returns.

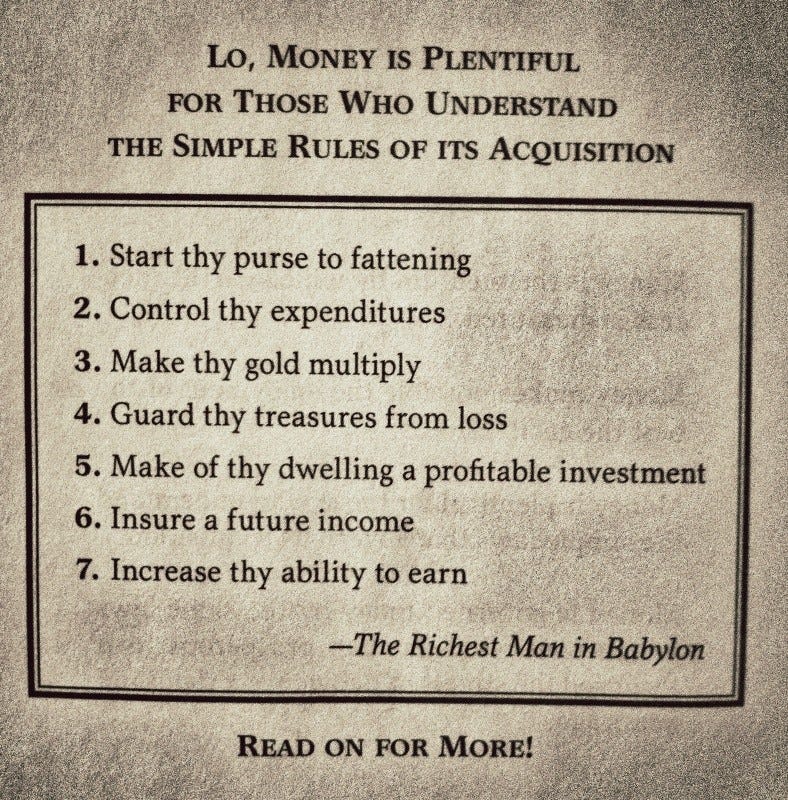

George Clason’s Seven Rules of Money:

Article of the Week: “Slave Coin or Freedom Coin: Which Way Western Man?”

Wow. Just wow. One of the most powerful articles I’ve ever read, about money, freedom, sovereignty, and much more. Written by Aleksandar Svetski for Bitcoin Magazine, this is one great argument for a decentralized form of money, free from central bankers and politicians. The title just grabs you, right? This article is well worth your time.

Link to Svetski’s article in Bitcoin Mag:

Slave Coin or Freedom Coin: Which Way Western Man?

I had the pleasure of meeting Svetski at Bitcoin Miami, along with his co-author of the book “The UnCommunist Manifesto,” Mark Moss. Got a signed book and planning to dive into it soon. Check out Svetski’s article, above, though. You won’t regret it.

Issue No. 53, April 22, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter