It happens about every four years. You might have heard about it.

Kind of like the Olympics. And presidential elections.

This year it will occur about April 20th. Next week.

Kind of like this week’s solar ecipse? Maybe not.

Wrong take: “The Bitcoin Halvening is coming. The price will be cut in half!” No, it’s not like a stock split.

What will actually happen is that the amount of Bitcoins rewarded upon mining a block of Bitcoin will be reduced. From 6.25 coins to 3.125 coins. The mining reward is cut in half every 21,000 blocks. It’s written in Satoshi’s code.

Previous halvenings have ocurred in 2012, 2016, and 2020.

Thus, the supply of new coins coming onto the market is decreasing. It’s not that the overall supply of Bitcoin is decreasing, just that new coins are becoming more scarce.

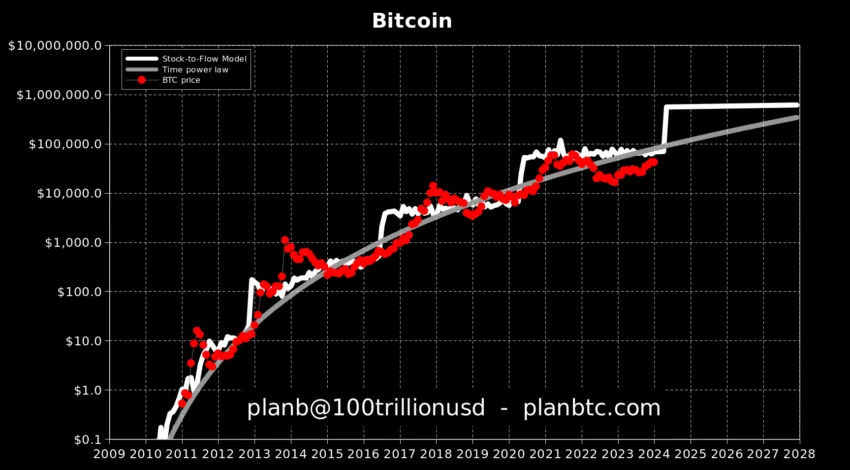

And thus, the Stock-to-Flow model becomes more relevant.

It follows the four-year cycles precisely.

What Does This Mean For the Miners?

So, what happens to the enterprises that are mining Bitcoin? Their revenue would seemingly be cut in half every four years.

While their cost of equipment remains fixed. And their cost of electricity probably rises, at least by a little bit.

Seems gloomy to me.

But, the most efficient miners will continue to make money. And, as Satoshi designed, as mining block rewards decline, Bitcoin transactions, and transaction fees, will increase for the miners.

And the miners that utilize renewable energy sources will be rewarded. (Incentivized!)

Plus, the decrease in new supply should result in a price increase for Bitcoin, which will help miners and investors alike.

But Many Have Predicted Big Price Increases with the Halvening!

Yep, that has happened.

Was it priced in?

Possibly. To a small extent.

What was more than likely priced in during early 2024 was that Bitcoin spot ETF’s would be approved by the SEC. They were, nine in all. Starting on January 10th. They’ve reaped tens of billions in assets so far. And millons in fees.

So Will This Halvening Drive Prices?

The short answer: Probably not. (My answer)

That’s my guess. An unpopular opinion among Bitcoin maxis.

Why? Because:

Supply shortages won’t incease prices for at least two quarters

The Bitcoin ETFs have been greatly funded already. Tens of billions worth.

Bitcoin just reached an all-time high of over $72,000.

Volatility has been decreasing. Thus, investor frenzy has not yet kicked in. FOMO, if you will. Retail FOMO could change the game.

I’m not recommending that you buy or sell. Do your own research.

Is This Time Different?

Many media outlets have proclaimed that this halvening is different and will not result in big price runups. Could be. Their guesses are as good as yours. Or mine.

Cointelegraph.com: “Bitcoin halving won’t see 600% return. Adjust your strategy.”

Investopedia: “Bitcoin halving: How this time is different.”

Indeed, the volatility of Bitcoin’s price has decreased, and will continue to do so. On the other hand, major investment houses are finally recommending a small allocation to Bitcoin for investors’ portfolios. We’re talking a potential of trillions of dollars.

So, demand may go up. Supply remaining fairly constant. You know what that means. Econ 101.

That’s my take on what is happening in Bitcoin this week. Demand may outpace new supply. But not right away.

HODL your Bitcoin. Keep it safe. Diversify your assets.

Interesting Note:

Some Bitcoiners have been referring to the halvening event as the “Hal-Finning,” named after the OG Bitcoin pioneer, the late Hal Finney.

https://twitter.com/halfin/status/1110302988

10 years ago this week, the first person to receive $BTC (Hal Finney) sadly died of ALS. He played a crucial role in the developement of Bitcoin.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my over 700 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 133, April 9, 2024

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.