“Bitcoin fixes this.”

We’ve all read this. Especially on Twitter. What exactly does Bitcoin fix, or what is it purported to fix? Just about everything, it would seem. Consider:

Inflation. Bitcoin, with its fixed supply, is programmed to appreciate in value, not depreciate like fiat currencies, which can be printed to infinity. The hardest money ever created.

Confiscation. Bitcoin’s private, decentralized network is not subject to anyone’s control. Not the case with fiat money or Central Bank Digital Coins.

Central point of failure. A decentralized currency like Bitcoin has no central point of control, and thus, no central point of failure. No hacking of the ledger.

Falsified ledgers. Bitcoin’s blockchain is an immutable ledger, and its proof-of-work protocol ensures the accuracy and validity of each transaction.

Portability. Bitcoin can be sent, spent and transmitted very easily. Not so with some currencies or stores of value. Think: gold.

And it even fixes the Byzantine Generals Problem. Yes. But first, a little background.

Origin of the Byzantine Generals Problem

In a 1982 research paper, Leslie Lamport, Robert Shostak and Marshall Pease, financed by NASA, wrote of the analogy of the “Byzantine Generals Problem.” Their study had to do with the field of computer networking, and in particular how to ensure the reliability of data transmitted throughout the networks. In the hypothetical example where several generals are circling the city of Byzantium, waiting to attack, they are in need of a messenger, a way to communicate. The plan of attack must be coordinated, since if they don’t all attack at once, the mission is doomed to failure.

Some generals may be traitors to the cause and not follow the consensus. Thus, messages could be interrupted or altered, foiling the plans of the majority of the generals. Without any secure communications channels, there can be no guaranty that the attack will succeed.

In any centralized system, or computer network, success of the mission depends on the trust in the central authority. However, any central authority is prone to corruption, much like a banking system. As I’ve pointed out in previous articles, any system with a central point of control also inherently has a central point of potential failure.

How Does Bitcoin Fix This?

Bitcoin is the first technology to solve the Byzantine Generals Problem. Previous attempts to create digital money, separate and apart from government, had failed. To manage the ownership of the money and prevent monies from the “double spend” problem, Bitcoin uses the blockchain ledger. Blockchains of course are public, distributed ledgers that have been proven to be immutable.

Bitcoin’s “Proof-of-Work” mechanism established clear, objective rules for any transaction added to the blockchain. Members of the network, called “nodes,” perform detailed algorithmic calculations to verify the validity and accuracy of each transaction. Any traitorous or malicious actor can be discovered by the Proof-of-Work (POW) mechanism. If these honest, hard-working nodes control the majority of the CPU power of the network, it is virtually impossible for an attacker to corrupt the system.

To quote Bitcoin journalist Scott Melker, “The more people involved in the system, the more trusted the network of transactions.” The Bitcoin blockchain currently contains more than 10,000 nodes, all working 24/7 to ensure the reliability of the network.

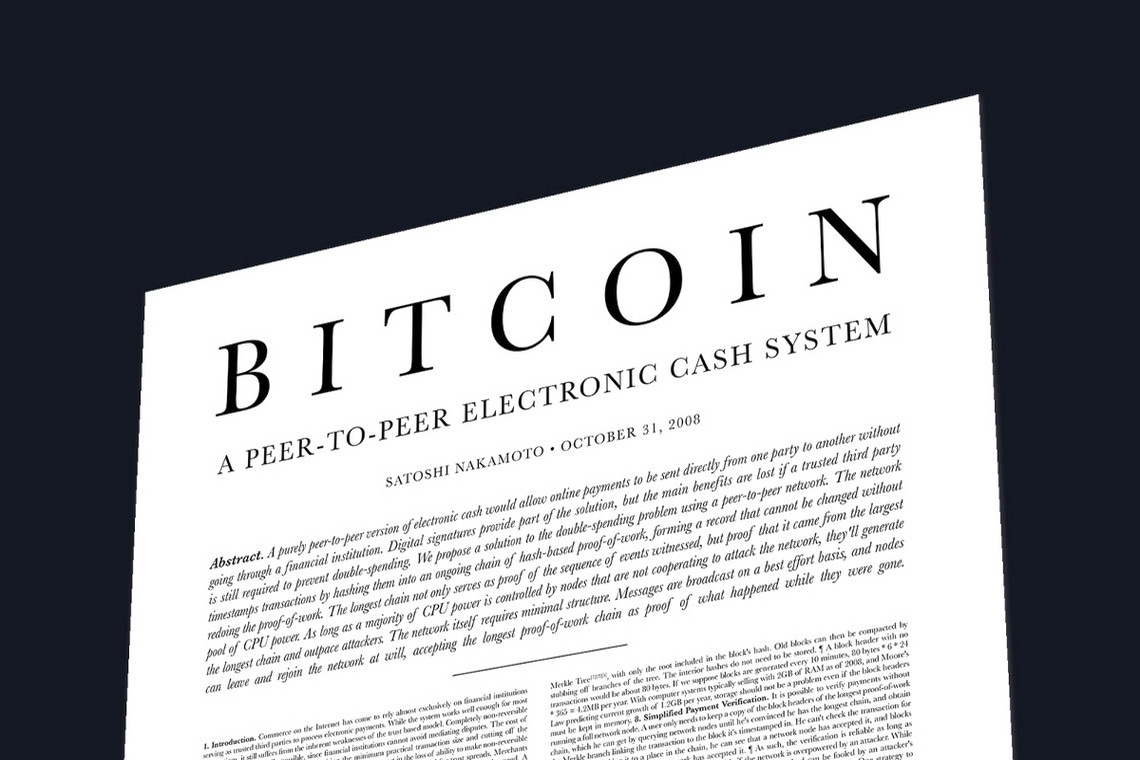

Satoshi’s Bitcoin Whitepaper

Satoshi Nakamoto’s whitepaper, published in 2008, details the proof-of-work mechanism, the solution to Bitcoin’s “double spend problem.” Without reliable verification of all transactions, it had been possible to record transactions twice, hence the “double spend problem.” Referencing the pioneering work in blockchain by the likes of Stuart Haber and Scott Stornetta, Satoshi comes up with perhaps the most significant innovation in the history of money. And a way to snuff out any traitorous generals who may want to corrupt the Bitcoin network.

Absolutely brilliant. Game changer.

(Link to my article on Haber, “That Time I Met Satoshi”)

“We proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power.” - from The Bitcoin Whitepaper.

Link to Satoshi Nakamoto’s Bitcoin whitepaper:

Bitcoin: A Peer-to-Peer Electronic Cash System

And yes, the above-mentioned Stuart Haber and Scott Stornetta are mentioned prominently in Satoshi’s Bitcoin Whitepaper. I’m honored to have met them. It was a thrill for all the Bitcoiners in the room.

“Bitcoin Fixes This” More examples:

More Bitcoin Miami ‘22 Speakers Announced

Can’t wait!

Issue No. 49, March 25, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter