I just re-watched the 2015 movie, The Big Short, an incredible film based on the best-selling book by Michael Lewis. Lewis is the undisputed master of the non-fiction business genre, with such credits as Lairs Poker, Moneyball, and The Blind Side.

To recap briefly, The Big Short details the historic bubble of the early-mid 2000’s real estate market and associated mortgage meltdown. It was pretty tough to watch, actually, and exposed the unscrupulous and greedy practices of mortgage brokers and lenders during that period. No down payments, interest-only mortgages, no income verifications, lousy credit scores. Mortgage loans given out to pretty much anyone. Multiple mortgages on the same properties. Worse yet, these garbage loans were packaged as securities and sold up and down Wall Street. And given AAA ratings by Moody’s, Standard & Poor’s, and others.

Michael Burry, of the hedge fund Scion Capital, saw it coming, and profited to the tune of billions of dollars. A few others did as well. Burry was brilliantly portrayed by Christian Bale in the flick. Another investor who played for the crash and scored big was Mark Baum, who was played by Steve Carell. Yes, they were criticized for betting against the US economy, but boy, were they spot on.

And I saw a lot of this coming. In the trenches. I should have connected the dots.

Clients refinancing their mortgages multiple times in a year. Multiple home equity loans on one property. People with nowhere near enough income were buying houses. Skyrocketing house prices.

The race was on to finance real estate, and then refinance it. Because prices could only go up. And fast. Everyone was going to get rich.

We know now how it turned out. Inside each mortgage-backed security were some bad FICO scores and a staggering number of defaults. The housing market imploded, prices plunged, the mortgage industry nearly went away in its entirety.

The contagion spread to equity markets, with prices plunging forty-five percent before eventually recovering. Many millions of jobs were lost, and millions of people lost their homes. No one was spared.

One of the biggest economic bubbles in world history had gone bust, in spectacular fashion.

Why am I dredging up these painful memories? Because I’m seeing a lot of economic indicators that are, um, not good at all, and some are at all-time record worsts. This time seems different because there is no euphoria in any one sector of the markets. Not with real estate, not with stocks, certainly not with economic growth.

But things are trending in a bad way, and they seem to be largely ignored by the media and by investors. Here are a few indicators that should make everyone take notice.

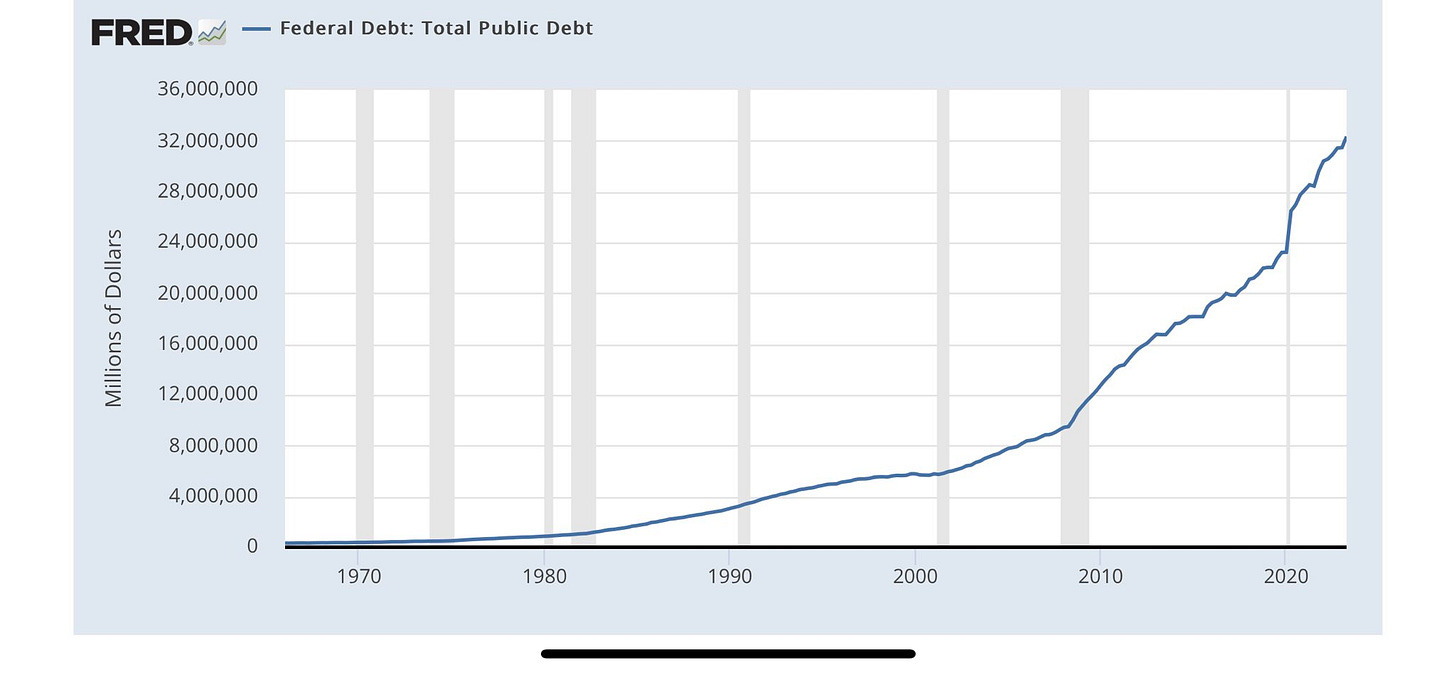

1. The National Debt. Well, this one is starting to get the peeps’ attention. Finally. $33 trillion and counting. The US borrowed over $1 trillion in the September alone. This is not sustainable. And with the additional debt comes more interest payments. And not just proportionately higher. No, the debt is growing, and interest rates are rising. It’s a perfect storm brewing.

By the end of 2023, the interest on the debt will be over $1 trillion per year. Out of a total budget of $7 trillion.

2. Mortgage Interest Rates. This has been much more publicized, as it affects many homeowners and many more potential homebuyers. Rates have more than doubled in the last two years. Thus, new homebuyers are paying twice as much in interest payments. And most of a loan’s early-year payments consist of interest.

3. Home Prices Have Skyrocketed. Inflation has hit every sector of the economy, and housing has probably been the hardest hit. Not only have the prices of existing homes soared, but new home prices have risen quite a bit as well, mainly due to higher material costs and labor shortages. And renters have not been spared. Rents in major cities have reached levels never before seen, when based on a percentage of income.

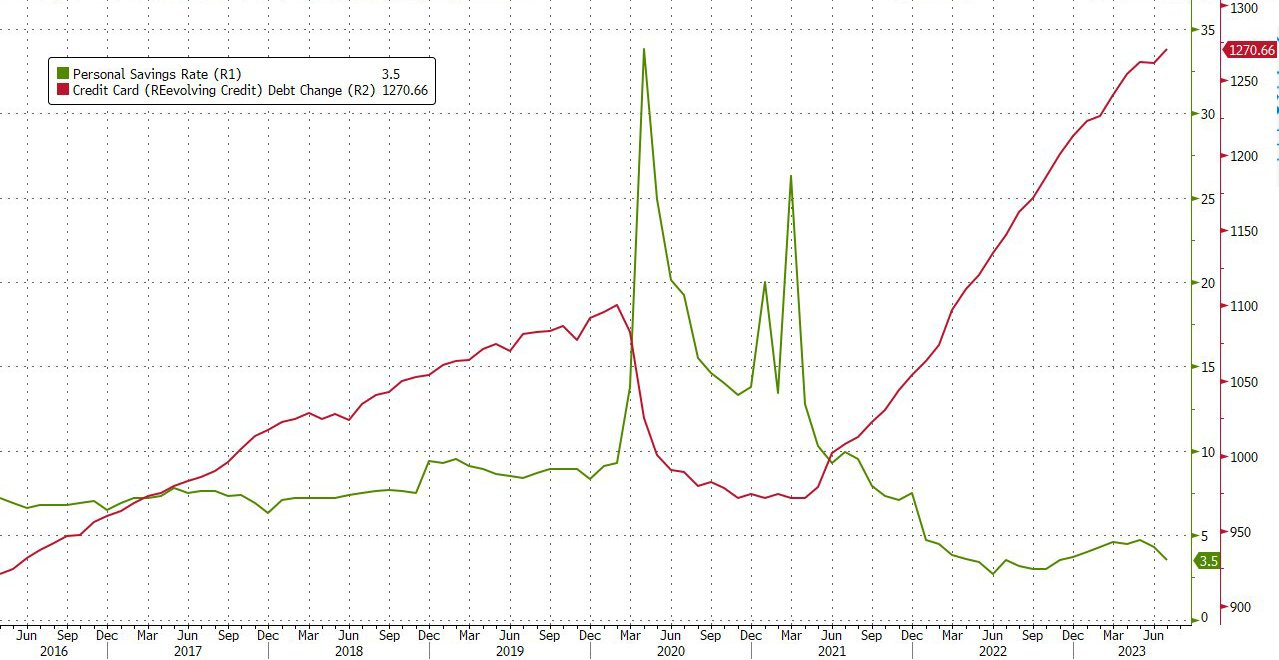

4. The Savings Rate Has Plummeted. That’s right. During the “COVID Years,” savings grew exponentially in the US. This was mainly due to stimulus payments, generous unemployment benefits and pandemic-related grants. But now, savings have fallen off a cliff.

5. Credit Card Debt is Out of Control. Inflation and higher mortgage payments are hitting everyone’s wallet. Hard. Gas prices, up fifty percent in three years. Food prices up by at least that number. Americans are continuing their world-leading lifestyles on the backs of plastic. (And interest rates on the cards are soaring.)

Savings versus credit card debt, illustrated:

6. Student Loan Payments Begin This Month. More money extracted from the paychecks of young working folks. Not that they shouldn’t be repaying their loans. It’s just that they haven’t been required to make payments for the last three and a half years. That means hundreds of dollars from each borrower’s pay that can’t be spent in the economy. (Not withstanding the possibility of massive government bailouts in this area.)

What does this all mean? And why is a Bitcoin proponent writing about all of this gloom and doom economic stuff?

Well, after watching The Big Short, I felt that more people should have been able to connect those scary dots. We have a lot of scary dots on the economic landscape right now. And they are not even masked by euphoria in any given area. They should be screaming out very loudly right now.

Stock markets have not reacted. Real estate markets have not reacted. But a recession has to be on the horizon. How could it not be?

Connect these dots: Higher mortgage payments, fuel prices, food bills. Student loan payments. Credit card debt. Inflation everywhere. National debt out of control. What does it add up to? Let me tell you like the accountant that I am:

“The balance sheets of America and Americans are turning to rubbish.”

How is the United States government to react to all of these factors? Well, they will keep interest rates somewhat high to try to tame inflation. Of course, that will hurt housing, auto sales, everything that gets financed. Including those handy plastic cards.

More money will be (literally) printed just to pay the interest on the national debt. And as more old, low-rate debt gets retired and replaced by new debt, the interest payments will soar even higher. Money printing begets even more inflation.

Look, there are only three ways that a nation can tame its debt:

A hard default on its bonds. (Never going to happen.)

A massive cut in government spending. (Never going to happen.)

Inflation, at pretty high levels, for decades. (We have a winner!)

Inflation is here for a while. It will cause a recession and will lower some people’s standard of living. It will crush consumer spending and hurt the stock market.

What Will Become of Bitcoin During These Times?

Two things can and will happen to Bitcoin. Confusing? Well, it’s the timing of these two reactions can’t be exactly determined.

1. Bitcoin will suffer with all “risk on” assets. This makes me cringe because it’s so stupid. I’ve written before how Bitcoin doesn’t have risks of earnings, recessions, etc. But somehow it keeps getting correlated to equities. It shouldn’t, but at times it will.

2. Bitcoin, with its fixed-supply, anti-inflationary qualities, will emerge as a safe haven in times of economic panic and strife. It should, but time will tell if that plays out. The fiat system, and the legacy finance system, have every reason to perpetuate the messed up system of money we have in place right now. But I am optimistic on this count. Very.

I sincerely hope that in mid-2024, I write about how the US and the rest of the world deftly avoided a serious recession. That inflation remained moderate, but not out of control. That the national debt is not continuing it parabolic trend upwards. This would be the most that we could hope for.

And as for Bitcoin, if moderate inflation is here for the long-term, then I hope I’ll be saying that the world has woken up to a fixed-supply asset class that will help them battle inflation, that Bitcoin will be the preferred savings vehicle for millions of people around the world.

Then I won’t worry so much about connecting the dots. And I won’t be shorting any markets.

Thanks for reading. And please share this with anyone who cares about the US economy.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 123, October 6, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.