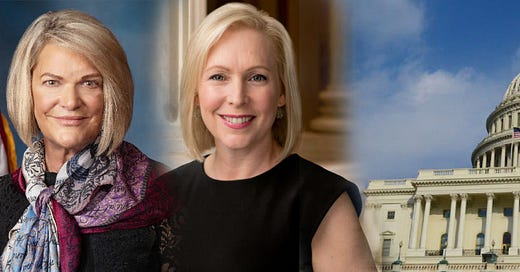

On Tuesday, US Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) unveiled their long-awaited proposed legislation involving cryptocurrency regulation. Crypto proponents generally looked at the bill favorably. The bill is dubbed “The Responsible Financial Innovation Act.” Here’s what’s included in the 69-page proposal:

1. Tax Breaks on Spending Crypto

This legislation would permit a de minimis exemption from capital gains taxes for each gain that doesn’t exceed $200. The exemption would apply to transactions where the crypto owner is using crypto to pay for goods and services, not when selling on an exchange. This would facilitate the use of Bitcoin and other cryptos as a medium of exchange. It would also greatly simplify the tax reporting of those spending crypto. The two senators had initially considered a $600 exemption, but tamped it down, feeling it had a better chance of passage at the lower threshold.

2. Other Important Tax Provisions

The bill would also change what I thought was the biggest inconsistency in the tax treatment of cryptocurrencies. While saying that crypto is generally taxed as property (gains are taxed when the coins are sold) Treasury has been taxing miners when coins are mined, i.e., immediately. Thus actually taxing them as if they produced a currency. This bill changes that provision and taxes miners when the mined coins are sold.

Link to my February article on Crypto Taxation

Miners and other participants that are not crypto exchanges would not be classified as brokers and as such would be exempted from reporting requirements. This had been a key provision in last year’s federal infrastructure bill.

Link to my 2021 article on Infrastructure Bill

The bill also requires the Internal Revenue Service to perform a study and clarify crypto events such as airdrops and forks, merchant crypto acceptance, mining and staking, and the charitable donations of cryptocurrencies.

3. Definitions for Digital Assets

The proposed legislation lays out a clear set of definitions for each type of digital asset. Most cryptocurrencies will be classified as commodities, and as such will be regulated by the Commodities Futures Trading Commission (CFTC). This would include Bitcoin and Ethereum. Smaller tokens, or altcoins would be considered “Ancillary Assets,” and are also presumed to be commodities.

Digital tokens that would be classified as securities would include cases where the token would pay interest or dividends, and where such earnings come from “entrepreneurial or managerial efforts of others.” These assets, which are not fully decentralized, would fall under the regulatory jurisdiction the the Securities and Exchange Commission (SEC).

The bill also directs the SEC and the CFTC to work together to create a proposal for a “self-regulatory” organization to work with regulators to increase efficiency and oversight.

4. Regulations Involving Stablecoins

Following the Luna-Terra meltdown and the collapse of so-called “algorithmic stablecoins,” the proposal seeks to regulate all stablecoins and ensure they are backed 100% by cash or equivalents. Reserves would be audited on a regular basis, seeking to ensure that stablecoin holders are able to redeem their coins at any time for full dollar value. Banks and credit unions would also be able to issue stablecoins, and a special charter would be created for that purpose.

Of note in this area of the bill is that Lummis-Gillibrand wouldn’t require stablecoin issuers to register as banks and be overseen by federal banking regulations. The Biden administration had recommended that treatment for stablecoin issuers.

5. Areas Designated for Future Study

Much of the bill lays out areas that have been designated for more study and analysis before issuing regulations. They include the following:

401K Plans. Bill requires the Governmental Accountability Office to analyze opportunities and risks of digital assets in retirement accounts.

Self-custody. The bill grants the right for cryptocurrency holders to keep custody of their own coins, as opposed to being held in custody on exchanges, and to continue study in this area.

Consumer Protections. The bill requires issuers and providers of digital assets to disclose full information about the products, risk of loss, and legal treatment of the assets.

Energy. The Federal Energy Regulatory Commission will be assigned to work with the CFTC and the SEC to study the power used by cryptocurrencies.

CBDCs. The bill calls for several US agencies to study China’s issuance of a Central Bank Digital Currency, or CBDC.

NOTABLE:

The bill’s co-sponsors, Sens. Lummis and Gillibrand, represent states considered to be among the most conservative and most liberal in the US. Wyoming and New York, respectively.

The bill may still be broken down into smaller pieces, thereby increasing the likelihood of passage of key elements of the bill.

Gillibrand expects the bill to pass through the banking, agriculture, intelligence and financial services committees before heading to the Senate floor. She feels the Senate will get behind the bill.

This bill will take a while to weave through all committees and get to the floor for a vote, but we’ll keep you updated. Stay tuned.

Thanks for reading, and please share this newsletter.

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 500 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 60, June 10, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter