RFK Jr: "I'll Back the Dollar With Bitcoin, and End Taxes on Bitcoin"

Plus, Miners Keep Selling Bitcoin

Among Democratic candidates for President, Robert F. Kennedy Jr. is only polling at about 9% in the early primary states. But he should garner pretty much all of the Bitcoiners’ vote.

The son of the late Robert F. Kennedy and nephew of President John F. Kennedy does have a favorability rating of 49% among Democratic voters, however.

A noted proponent of Bitcoin who spoke at this year’s Bitcoin conference in Miami Beach, Kennedy sounds like, with many of his positions, a true Libertarian. And it seems he wants to keep money sovereign from government. At the very least, he favors a harder currency, one that is backed by something. I mean, at least up until 1971, the dollar was backed by gold.

Now we can rest assured that our money is backed by “the full faith and credit” of a nation that is $32 trillion in debt. (Don’t get me going on the national debt.)

In describing his plan to begin to return US money to a hard currency, Kennedy said, “My plan would be to start very, very small, perhaps 1% of issued T-bills would be backed by hard currency, by gold, silver, platinum or Bitcoin.” So, not just Bitcoin, actually, but other hard assets as well.

Depending on how that works out, RFK said he would then increase the allocation to hard assets each year.

“Backing dollars and U.S. debt obligations with hard assets could help restore strength back to the dollar, rein in inflation and usher in a new era of American financial stability, peace and prosperity.” - Robert F. Kennedy, Jr. , July 2023.

The candidate also said he wants to stop taxing the sale of Bitcoin, something that long-term holders would really appreciate. In doing so, Bitcoin would be treated as more of a currency than as a commodity. Currently, the IRS classifies Bitcoin as property, or a commodity, and capital gains are taxed upon the sale.

Free Speech and Anti-Censorship

"The benefits include facilitating innovation and spurring investment, ensuring citizen privacy, incentivizing ventures to grow their business and tech jobs in the United States rather than in Singapore, Switzerland, Germany and Portugal. Non-taxable events are unreportable and that means it will be more difficult for governments to weaponize currency against free speech, which as many of you know, is one of my principal objectives."

Kennedy has also defended the right to keep self-custody of your Bitcoin and the right to run a full Bitcoin node at home. At the Bitcoin Conference in Miami Beach in May, Kennedy blasted the Biden administration’s proposed tax on energy used by Bitcoin miners, and indicated that Congress should support Bitcoin’s development rather than hinder it.

As to RFK Jr’s chances to gain the Democratic nomination, pollsters show he has not gained the needed support, and has positioned himself as the “outsider Democrat” in the race. Per a recent article in Bitcoin Magazine:

“His public stances on issues like vaccine mandates and climate change have contradicted those of most mainstream Democrats. As of this writing, he sits in second place, though trailing by a significant margin, to Joe Biden in national polling average.”

What should be interesting to see is how Kennedy’s views on Bitcoin affect other candidates’ positions, on both sides of the aisle. Will it be an issue, even a minor issue, in Campaign 2024?

Bitcoin Miners Have Been Selling Lately

Like any business, Bitcoin miners have expenses to pay. Electricity, payments on mining rigs, personnel, and other overhead. Thus, it’s not feasible for large-scale mining operations to HODL all of the Bitcoin that they mine. Stands to reason.

So there’s always this selling action, kind of a smoothing of price movements. Miners tend to sell more of their Bitcoin when prices trend higher, less when prices are down. This constant need to sell a portion of their rewards is one reason that Bitcoin prices don’t go parabolic very often. It’s healthy, and it reduces volatility in the market somewhat.

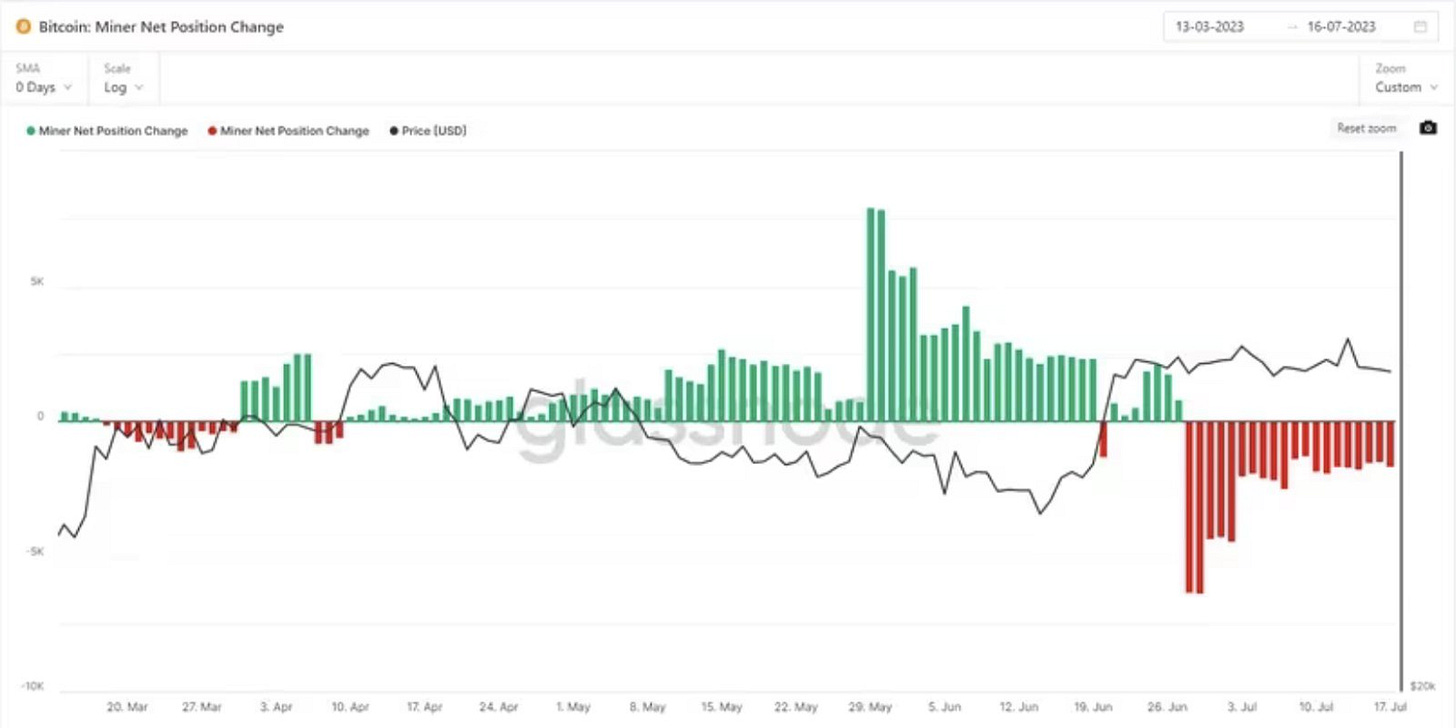

From April through June this year, the miners’ net position was trending positive, but has reversed course in July. This of course corresponds with the recent rise in price to levels north of $30,000.

Though the overall change in miner supply has been negative for 20 days, the amount of Bitcoin held by miners is virtually identical to where it was at the start of 2023.

The miners’ balances currently stand at about 1.83 million coins, versus 1.82 million on January 1, 2023, according to crypto analytics firm Glassnode. Thus, the recent activity may be just normal rebalancing and not a bearish view of the Bitcoin market.

Thanks for reading , and please share this newsletter with a future-coiner.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 118, July 21, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.