We’ve all seen that disclaimer, on investment advertisements. And it’s common sense.

But starting with 2013, November has been the best performing month for Bitcoin. Buoyed by a 449% return (no typo) in November 2013, Bitcoin has produced a mean return of 53.34% in those months. Six out of nine Novembers have been up months for Bitcoin.

November is far and away the best performing month for Bitcoin. It’s not even close.

This November, however, has started out very differently.

As of this writing on Wednesday, the Bitcoin price is down over $4,000 or 20% in just nine days. It’s sitting right around $16,000 right now. You probably knew that.

What Happened This Week?

Well, nothing happened with Bitcoin. Bitcoin, once again, was dragged into the fallout from another crypto exchange implosion. A meltdown of not just an exchange but also of the exchange’s own “crypto token.”

It was inevitable.

Cryptocurrency exchanges keep failing. And altcoin tokens keep failing. Terra, Luna, Celsius, and maybe more to come.

Crypto Exchange FTX on Tuesday announced that without a cash infusion, it would face a “liquidity crisis,” and was staring at a potential $8 billion shortfall. Its token, FTT, has dropped in price from $25 last week to just $2.38 today. Per Swan Bitcoin’s Cory Klippsten, “These tokens were about 80x overvalued.”

Here’s the problem: FTX’s affiliated company, Alameda Research, held over $3.6 billion of the tokens on its balance sheet. And these tokens, pretty much minted from thin air, were used as collateral for over $950 million in loans. Real loans, that have to be paid back. That collateral, along with much of the company’s equity, has now pretty much vanished.

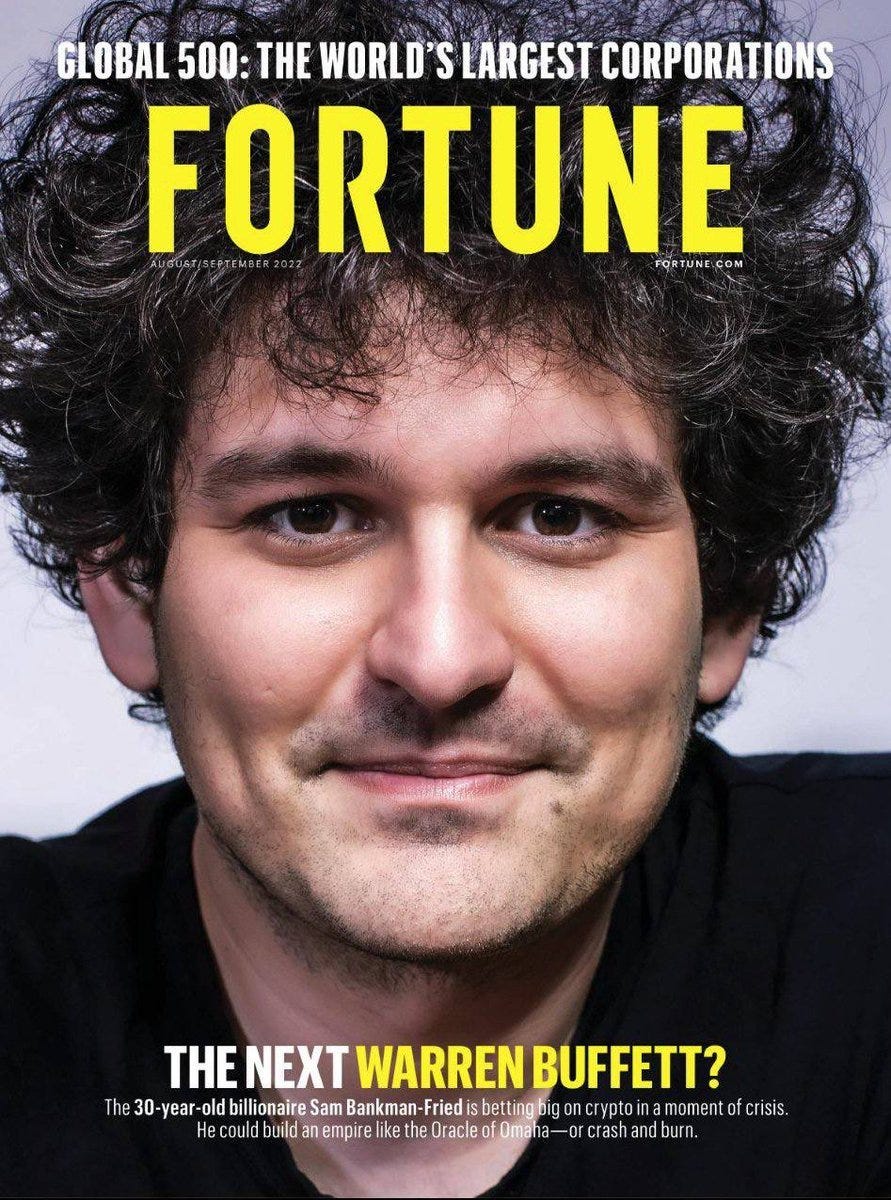

FTX was on the largest crypto exchanges in the world and at one time had a net worth of $32 billion. Its founder, Sam Bankman-Fried, boasted a personal net worth of over $26 billion. Fortune Magazine featured this cover:

Brief Glimmer of Hope

FTX allegedly reached out to Binance and its CEO, Changpeng Zhao, and asked for a lifeline. On Tuesday, it indeed looked like Binance may be the white knight to save FTX. After some very quick due diligence on Wednesday, however, Binance announced they would not be making any deal for FTX. The balance sheet of FTX must have looked pretty bad.

FTX and Bankman-Fried are both potentially staring at bankruptcy.

And the FTX Arena, home to the Miami Heat, may be looking for a new naming sponsor. FTX had acquired the naming rights for $135 million in March of 2021. Could the Crypto.com Arena in Los Angeles be next?

Guilt By Association

Bitcoin, Ethereum and most every other cryptocurrency were dragged down in price this week. It’s understandable that altcoin tokens may suffer. Investors are wary that they may be operating under the same business model as FTX, and may be highly leveraged.

Bitcoin is different. Bitcoin doesn’t exist as a company. There is no debt, no leverage. There is no management team. What happened to these exchanges cannot happen to Bitcoin.

Excellent revelation on FTX/Alameda from Swan Bitcoin’s Cory Klippsten:

“It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token.”

Great take here on "altcoins" in general from Anthony Pompliano:

"What did you expect from an industry that openly talked about “ponzinomics”? Or that named assets like they were 4 years old and had just learned to read a coloring book? Or people trying to create fake assets out of thin air?"

For an excellent, short synopsis of what happened with FTX this week, check out Natalie Brunell’s pod episode with Cory Klippsten:

The Bottom Line

People who sold Bitcoin this week just do not understand Bitcoin. Sorry. That’s the truth.

I believe that at least 90% of the altcoins have no utility, and they will implode at some time as well, just like FTX.

Bitcoin will be the only major cryptocurrency left standing. Bitcoin is different.

Thanks for reading. Please share. And thanks to all of last week’s new subscribers - big numbers!

- Rick Mulvey

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 550 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 82, November 11, 2022

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.