Ignore the Price of Bitcoin

Ten Reasons to Love Bitcoin, Not its Price

Admit it.

You’ve checked the price of Bitcoin before getting out of bed in the morning.

It’s okay, you don’t need a support group. In Bitcoin’s existence, its price has gone from pennies per coin to over $60,000. So, I get it. There has been some pretty exciting price action to watch. And when Bitcoin goes on one of its parabolic runs, it is indeed something to see.

Here’s ten reasons why you should focus less on Bitcoin’s price and more on the attributes and potential of this new technology:

Adoption matters more than price. Mass adoption of Bitcoin is taking place, every day. More institutions and more cities and nations are getting into the space. More legacy financial firms are creating onroads for their customers to buy Bitcoin. It’s happening, slowly, gradually. As they say, gradually, then suddenly.

The whales aren’t watching the price. They’re buying more Bitcoin. In fact, during price dips, the large holders are buying more. Michael Saylor and MicroStrategy continue to buy. Terra has purchased $135 million of Bitcoin to back its stablecoin. Follow the money. Even better, follow the big money.

Focus on Bitcoin’s scarcity. 19 million Bitcoins have been mined; there are only 2 million more to be mined. Bitcoin’s hard, fixed cap make it the soundest money ever created. Long-term holders continue to keep their Bitcoin in storage, creating an eventual supply squeeze. Keep accumulating what you can. Buy more, look less.

Bitcoin is not a technology stock. Bitcoin has somehow been lumped in with equities as a “risk-on” asset. In fact, Bitcoin has recently been 90% correlated to the NASDAQ index. So, stocks drop, Bitcoin drops. See through this fallacy. That correlation shows how misunderstood Bitcoin is. And just how early we are.

Believe in the technology of Bitcoin. Bitcoin is code, it’s a protocol, it’s a technology. A technology that’s enabling international remittances to be transacted at the speed of light, and very cheaply. It will totally replace the Western Unions of the world. Bitcoin is a technology that’s enabling people across the globe to come into the financial system, to finally have their own “bank” accounts.

Bitcoin is the new long-term store of value. Bitcoin is better at being gold than gold is. In every way. Think, portability and storage. Think, commissions and fees. Think, price appreciation potential. Bitcoin has the potential to replace the traditional bank savings account, and to replace gold for investors.

Think long-term and stack sats. Don’t focus on short-term price gyrations. Have a long-term focus and continue to accumulate. Monthly, weekly, or daily. Exchanges allow you to set a fixed buy at whatever intervals you want. Take advantage of a solid dollar-cost-averaging strategy. Like I said, Bitcoin is the new savings account.

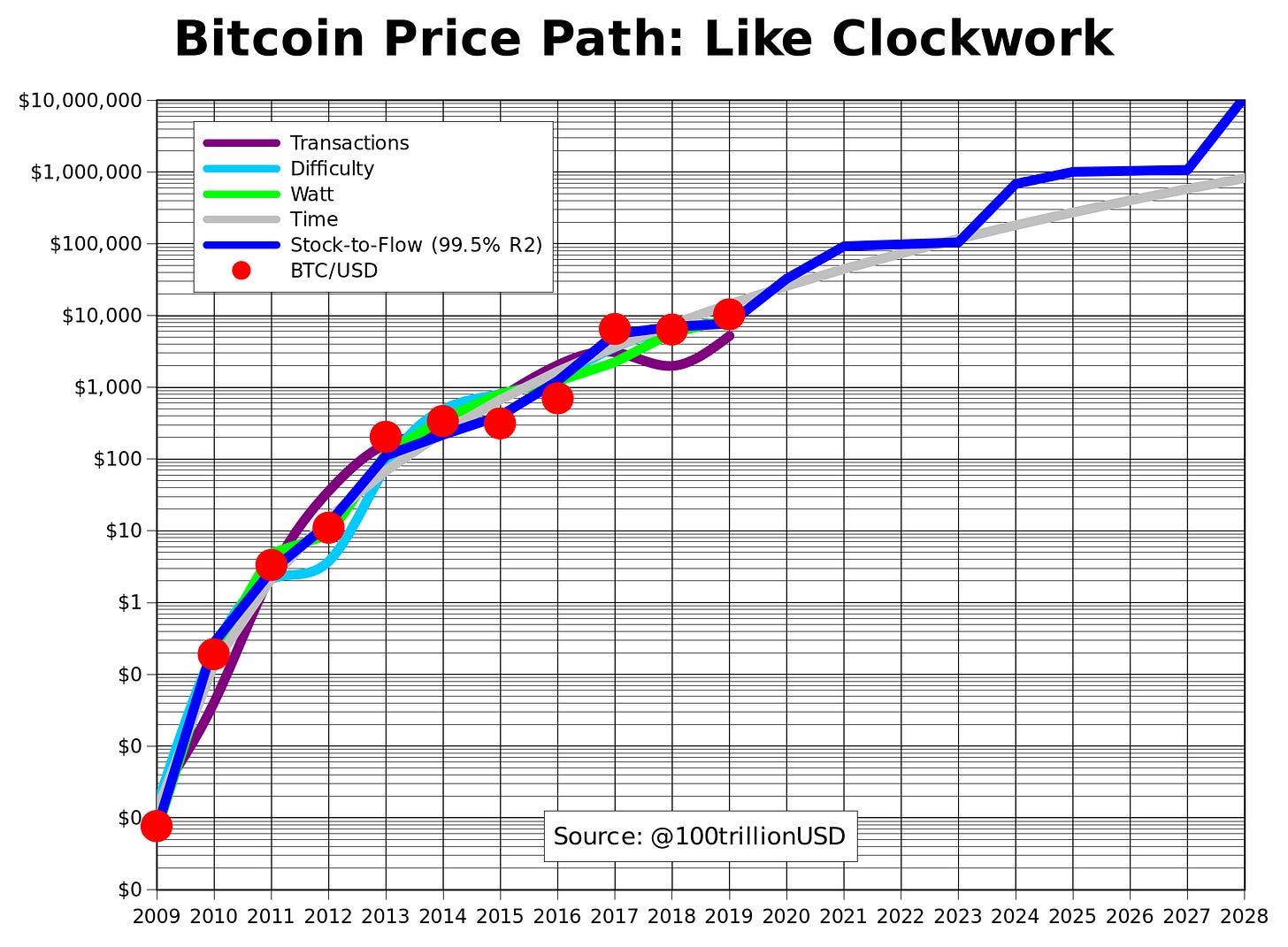

Bitcoin’s price is programmed to go up. It’s built into the code. Really. The scarcity increases as adoption is growing. The mining rewards are programmed to decrease about every four years. It’s brilliant technology. Long-term, it is programmed to go up in price. Ignore the short-term fluctuations and block out the noise.

Bitcoin is in the early adoption phase. We are so early, like second inning early. Think of the internet in, say, 1998. Adoption was increasing, but none of us could envision the ways that the internet would transform business and transform our lives in general. There were naysayers in the 1990’s, just like there are today.

When in doubt, zoom out. Investors, traders, and pundits focus too much on short-term price swings. Like I mentioned above, Bitcoin has gone from pennies per coin to over $60,000, in a thirteen-year period. Even severe drops like the pandemic-related panic in 2020 look like small blips when you zoom out and look at the bigger picture.

Short-term look:

Now, zoom out:

Perfect quote regarding Bitcoin’s price and it’s potential:

As Marc Andreessen, co-founder of Netscape, has pointed out, “the price of domain names didn't determine the usefulness of the Internet.”

Don’t be this guy:

Issue No. 52, April 15, 2022

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter