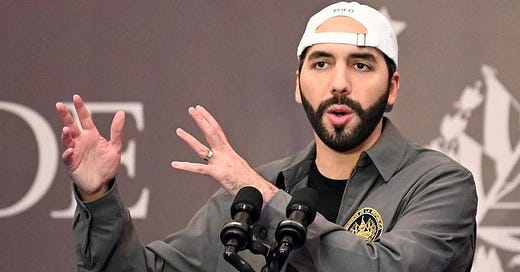

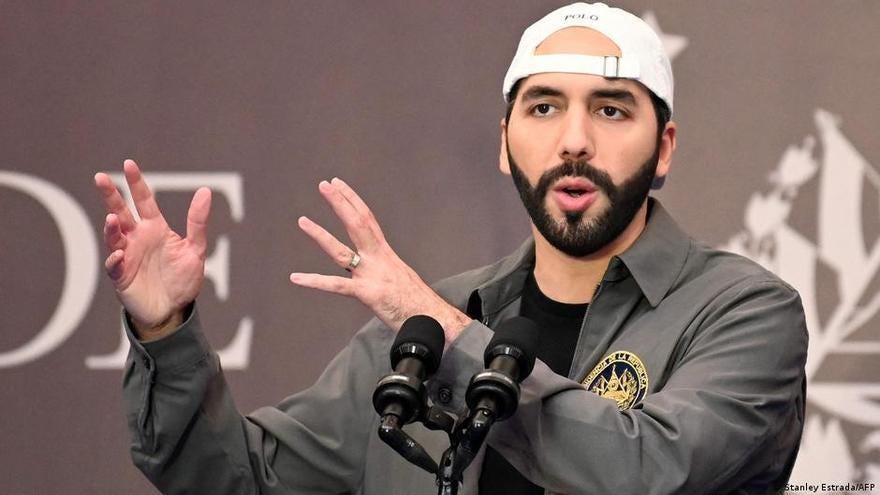

El Salvador President Nayib Bukele made big headlines when, appearing by video at the 2021 Bitcoin Conference, he announced that his country would be the first in the world to declare Bitcoin as legal tender. And that wasn’t all.

Bitcoin wallets were issued to all citizens of the country. Each citizen also received $27 worth of Bitcoin to try it out, play around with it a little bit.

Bukele declared that, with Bitcoin a currency and not a commodity, there would be no capital gains taxes upon sale or spending of Bitcoin. Huge.

Soon after, the country announced that a “Bitcoin City” would be formed, with the hopes of having all businesses and citizens inside make transactions only in Bitcoin.

If that wasn’t enough, Bukele announced plans for El Salvador to start mining Bitcoin using geothermal energy from an inert volcano.

The country also began buying up Bitcoin on the open market. Millions of dollars worth. A big gamble.

How’s That Working Out?

In trying to make El Salvador a “Bitcoin nation,” results have been mixed.

The country purchased 2,546 Bitcoins at a total cost of around $108 million, or an average cost of $42,000 per coin. So, they’re still under water on their holdings. Bukele says they’re holding (hodling?) for the long-term though, and is not worried. He’s been roundly criticized by political opponents and others.

Crime is way, way down in El Salvador. Like 99% down. There has been a huge crackdown on crime in general and on gang activity in particular. Whether this has anything to do with the Bitcoin adoption or not is open to debate. What is certain is this: In 2015 there were 6,640 murders in the tiny nation. Recently, Bukele announced the country has gone 365 days without a murder. It’s not clear which 365 days he was referring to, but it’s amazing progress nonetheless.

(Human rights groups have criticized Bukele’s crime-tackling strategies. It’s not clear why.)

Tourism is way, way up. Whether it’s a general feeling that the country is safer, or that Bukele is open for business, or that the nation is courting Bitcoiners from around the world, it doesn’t really matter. Over 1 million tourists have visited El Salvador, from just January 1st through May 12th of this year.

Well-known Bitcoin proponents Max Keiser and Stacey Herbert have relocated to El Salvador and are advising President Bukele on the adoption of Bitcoin in the country. The pair are quite prominent in the Bitcoin community, and despite Max’s wacky antics, both are respected and bring a great deal of knowledge and credibility to Bukele’s efforts.

Keiser calls El Salvador’s Bitcoin adoption efforts just the beginning of “superhyperBitcoinization” in the region. His term, not mine.

At last week’s Bitcoin Conference, Bitcoin rockstar Jack Mallers announced that his company was opening a “headquarters” in El Salvador. Mallers is the 29-year-old founder of Strike, a Bitcoin payments company. Actually, Strike’s main offices will remain in Chicago, but the company hopes that the El Salvador hub will pave the way for expansion into a planned 65 countries around the world.

Mallers made a point during his announcement in Miami Beach that his company favors the Bitcoin-friendly practices of Bukele and El Salvador over the regulatory uncertainty of the United States. Seems to be a recurring theme. Per Mallers:

“And we’re going global, headquartered out of El Salvador. It’s really f*cking awesome, it’s really a beautiful thing.”

Bitcoin rewards company Fold opened an office in El Salvador as part of its expansion into Latin America, despite a recent spike in blockchain transaction fees that has disproportionately impacted users of Bitcoin. It’s another big score for El Salvador.

Fold partnered with Visa in 2020 to offer a prepaid debit card that rewards users with up to 1% cash back paid in bitcoin.

Bukele’s Bitcoin strategy is definitely paying off in terms of attracting Bitcoin business ventures.

Not Everyone is Sold on the “Bitcoin Nation”

The "Accountability for Cryptocurrency in El Salvador Act” was introduced in the US Senate by Senators James Risch, Bob Menendez, and Bill Cassidy. The bill requires the Secretary of State to report on the adoption of Bitcoin as legal tender in El Salvador and must include an assessment of the regulatory framework in El Salvador and the impact of Bitcoin adoption on the economy and on the governance of El Salvador.

The proposed law seems to be a plan to mitigate any potential risks to the United States financial system posed by the adoption of Bitcoin as legal tender in El Salvador or any other country that uses the U.S. dollar as legal tender.

El Salvador’s proposed issuance of “Bitcoin bonds” has been delayed. The plan was to raise money from bonds that would be backed by Bitcoin holdings, a move deemed controversial by many onlookers. The plan was announced by Bukele in November of 2021, and called for issuing $1 billion in Bitcoin-backed bonds.

Citing volatile market conditions and the war in Ukraine, causing instability in the world economy, El Salvador has not yet moved forward with issuance of the bonds. In addition, a report in the Financial Times made the claim that the bonds would not be issued by the government of El Salvador, but rather by the government-owned thermal energy company La Geo.

To date, Bukele still plans to issue the bonds, sometimes referred to as “volcano bonds.” Stay tuned.

Other criticisms of El Salvador’s Bitcoin gambit:

“A year on, El Salvador's bitcoin experiment is stumbling” - Reuters article.

“El Salvador’s Lonely Bitcoin Experiment: It’s Either the Biggest Failure or the Biggest Con” - Barron’s article.

“El Salvador's Bitcoin experiment has proven to be a spectacular failure” - Firstpost.com article.

Key takeaway: If you read these three articles, and others like them, there is a common thread. The “failure” that they refer to is all in reference to Bitcoin’s market price. And this is looking at the price drop over a very short period of time. As investors often say, “Zoom out” and look at the long-term returns.

It seems journalists tend to look at short-term price gyrations, especially when they make a good story, or attention-grabbing headlines. (Well, some journalists.)

The jury is still out on El Salvador’s grand Bitcoin experiment. Zoom out, take a long-term prospective, and stay tuned. We’ll keep on eye on it.

Thanks for reading. And please share this newsletter with some future-coiners.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 110, May 26, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.