“Earn up to 25% interest lending your crypto on Kucoin.”

This shocked me, and I’ve been studying Bitcoin and crypto for several years. So, I dug into it a little bit. Kucoin is a cryptocurrency exchange based in Hong Kong, and yes, US investors are allowed to participate on the exchange. It seems that their lending operation is different from the exchanges you see in the US (see below). Kucoin doesn’t take a pool of investors’ coins and lend them to a third party. Rather, they set up a completely peer-to-peer lending arrangement. So, your coins are loaned to a specific party. The loans are collateralized, which implies that borrowers are looking to leverage their stack by borrowing from you.

The rates charged fluctuate according to the demand for loans. So, in volatile times, up or down, traders will look to ramp up their margin , or leverage, in order to boost their profits. These are very short-term traders and the leverage aspect, with potentially huge profits, explains the high interest rates.

Though Kucoin’s loans are collateralized, and considered relatively safe, the exchange itself has a less than stellar record of security. The exchange was hacked in 2020 for $284 million of coins, though much of it was recovered. Still, that’s enough for me to run the other way. Indeed, a Mozilla study gave Kucoin a D+ score for security.

So, let move on to some more realistic lending platforms, from some more trusted crypto exchanges, and explore the different types of crypto earning possibilities.

Types of Lending: Some crypto exchanges offer Fixed lending arrangements, with a locked-in interest rate and term. Terms are usually 7 to 90 days, and thus pay higher rates than a day-to-day account. Fixed loans are very similar to bank certificates of deposit. Flexible accounts function more like bank savings accounts, where funds can be deposited and withdrawn at any time. They generally pay lower rates than fixed loans. Keep in mind, though, that neither type of crypto lending is insured like a bank account. There is no FDIC insurance on crypto exchange accounts. Maybe someday?

Rates: Stablecoins, those that just mirror the US dollar, offer the highest rates, between 5% and 25%. Obviously, these coins are not volatile in price, so they offer a stable asset base for lending. When crypto markets turn bullish, there is a strong demand for stablecoins, as crypto investors park their funds on exchanges, getting ready to pounce on the next hot crypto coin.

Rates for the more popular cryptocurrencies, like Bitcoin and Ethereum, are generally lower. Most exchanges pay around 1% to 3% for these coins, which can be more volatile than most assets. Understatement, yes.

How Do the Biggest Exchanges Stack Up?

The biggest crypto exchanges each offer interest on certain coins, and each are good at certain aspects of this function. An articles by Jeremy Wagner (www.apyguy.com) last week ranked the top 11 crypto “savings accounts” by various categories. Here are three of the largest and how Jeremy (and I) evaluated each.

Blockfi: Wagner’s article ranks Blockfi “Best Overall” as a savings mechanism for your crypto. They pay excellent interest rates, up to 5% on Bitcoin and a whopping 8.6% on stablecoins. Compare that to a bank. Interestingly, however, Blockfi pays lower rates of interest on higher balances, kind of a reverse tiered system.

Blockfi is a solid company, has been in the business for a while, and was recently funded at a $3 billion valuation. So, for interest rates, safety, security and ease of use, it deserves a Best Overall ranking.

Coinbase: The largest US crypto exchange, Coinbase has $233 billion in assets under management and the company trades on the NASDAQ at a $60 billion market cap. So, for safety, you can’t do any better. Here’s the drawback: Coinbase only pays interest on US Dollar coins. Stablecoins, that is. No interest is paid on Bitcoin, Ethereum or any other crypto. That’s a big deal. Now, Coinbase does not lend out your coins to borrowers, rather the company itself just pays you interest, kind of like a bank. Another drawback, they pay, at this time, only 1.25% per year.

Coinbase gets Wagner’s rating as “Best for Newbies,” holding US Dollar coins, that is. The easy setup and mobile app rate high, but it’s just not a true crypto lender.

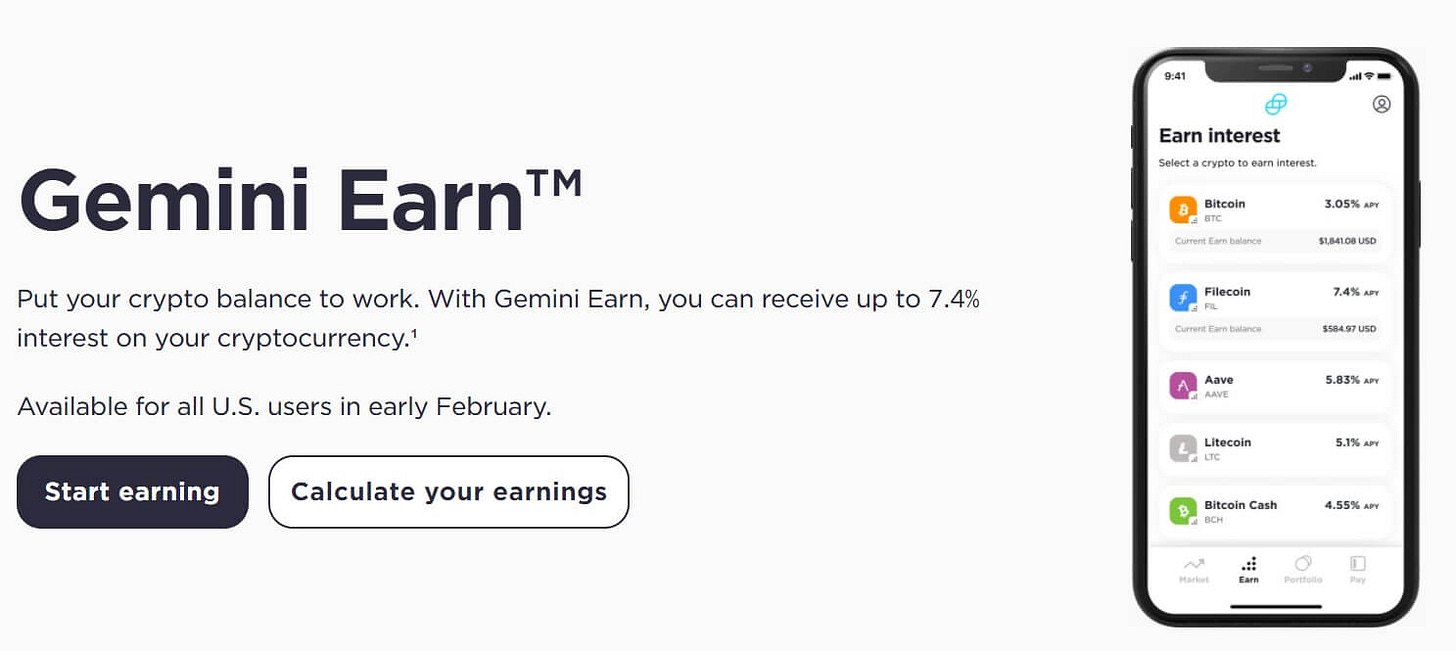

Gemini: The Gemini Exchange, founded by Cameron and Tyler Winklevoss (see Issue No. 2!), was late to the crypto savings game. They now offer interest on over thirty coins, including pretty competitive rates. Current yields are 2.05% on Bitcoin, 3.05% on Ethereum, and 7.4% on stablecoins like Filecoin and Dai. So, for rates, they stack up well. For security, they can’t be beaten. They get Wagner’s “Best in Security” rating.

I concur with Wagner when he says “Gemini has been focused on security since day one.” With Gemini, the majority of your crypto is held in Gemini’s “offline, air-gapped cold storage system” which helps prevent theft by hackers and/or malware. Only a small portion of your deposited crypto will be held in their ”hot wallet” and it is insured.

For lending, Gemini partners with their accredited third-party borrower, Genesis Capital. Gemini periodically conducts analyses of each partner’s cash flows, balance sheets and financial condition. They pay your interest earnings in crypto, ever day, at 4:00PM.

Notable: Gemini is the only exchange to offer interest earnings on crypto in New York State.

Tax Reporting For Crypto Interest:

From the research I have done, it seems that each cryptocurrency exchange will issue a Form 1099-MISC for interest earnings on crypto. Forms will be issued for any account earning in excess of $600 in a year, which is consistent with all uses of the 1099-MISC form. Note that bank accounts will issue Form 1099-INT for interest earnings, but since crypto exchanges are rewarding you with crypto, and not US dollars, the 1099-MISC is used.

Conclusion: Consider the risks. Your crypto is not insured like with bank FDIC insurance. I would liken the interest-earning arrangement to buying a corporate bond. You may get a good rate of return, you may be dealing with a big, solid company, but there is no guarantee you will get your principal back. Still, some of the biggest and most experienced Bitcoin pros, like Dan Held, are earning interest in crypto. I earn interest on my Bitcoin on Gemini and have great faith in the company. To this date, I have never heard of anyone losing coins on an interest-earning platform.

Book Review: Crypto Revolution, Your Guide to the Future of Money, Publ. 2020, 290 pages, Boardwalk Flock, LLC.

Bryce Paul and Aaron Malone (aka, “Pizza Mind”) host the popular podcast Crypto 101: The Average Consumer’s Guide to Cryptocurrency. To date they’ve hosted 375 episodes, so they’re not noobs when it comes to Bitcoin. Paul is a crypto and blockchain expert who has spoken at conferences around the world and has worked as a biz dev professional in the crypto space for several years.

Pizza Mind co-founded A-B Engineering and actually builds crypto mining rigs. He’s an experienced crypto advisor and researcher, and together, Paul and Malone complement each other nicely to educate on crypto. The podcast is enjoyable and informative, but they also wrote a book. A book that is outstanding for any crypto novices out there.

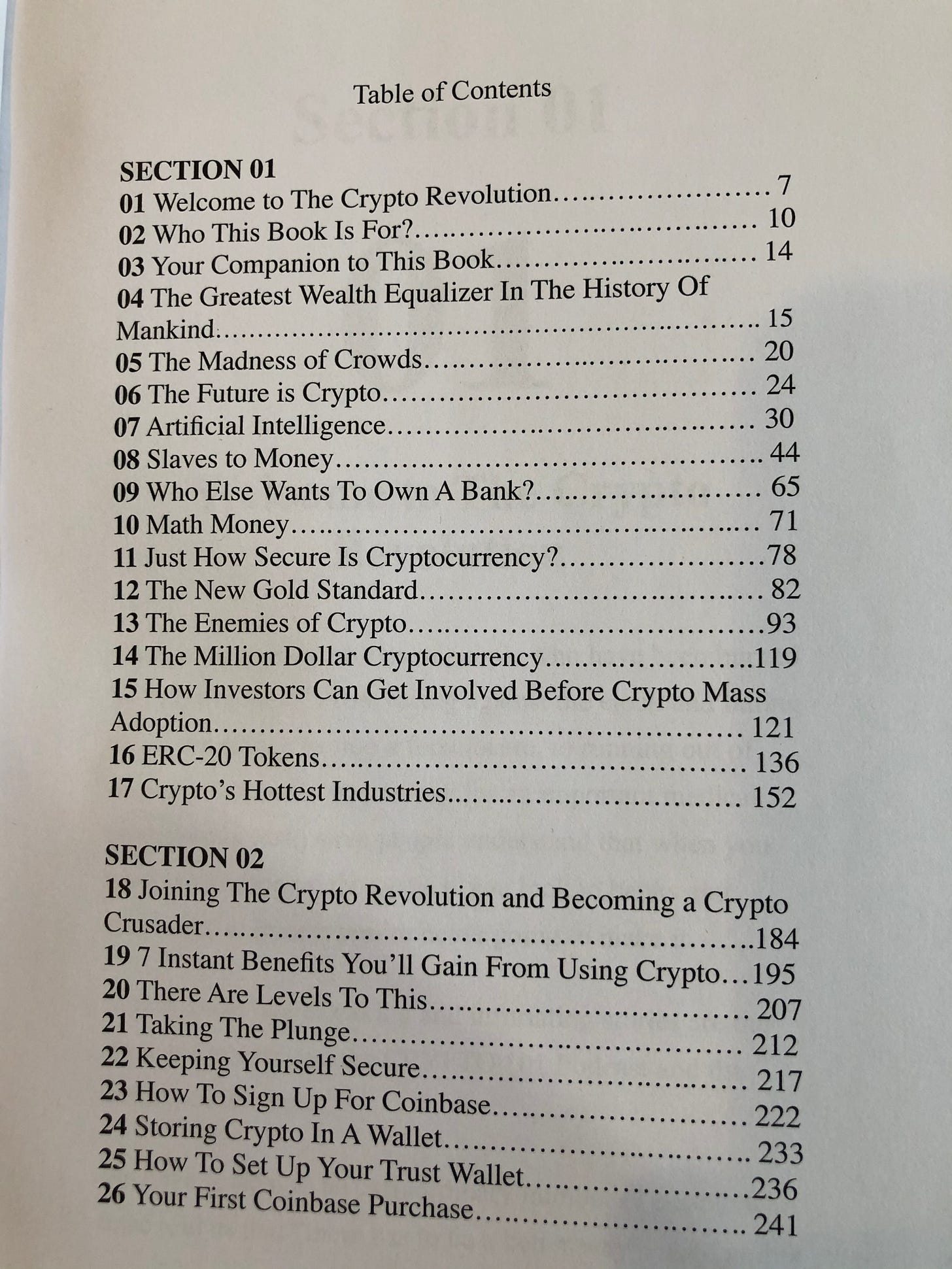

For anyone out there who’s new to Bitcoin, or just wants to learn more about cryptocurrencies, this book is a great place to start. Twenty-six topics, from a primer on the history of money all the way to buying your first crypto, they walk you through all of the basics and make it enjoyable. They deftly link the history of money to their vision of the future of money, and then they tell you how to get involved.

Great read for anyone at all interested in crypto. Best of all, you just pay shipping.

Link:

Bitcoin’s Market Cap

With Bitcoin’s price standing at around $38,000 mid-week, its total market capitalization was approximately $710 billion. The second-highest market cap still belongs to Ethereum, at around $300 billion.

The total market cap of the over 10,000 crypto coins out there stands at over $1.6 trillion. Bitcoin swallows up almost half of the total. Bitcoin is, of course, down from its high point earlier this year. Its market cap was over $1 trillion. By comparison, the cap of gold stands at just over $10 trillion.

This month in Bitcoin History:

In May 2011, Bitcoin was selling at $3.03 per full Bitcoin. Not a typo.

Tweet of the Week, from the awesome Scott Melker:

Big news, now anyone can buy and sell Bitcoin through PayPal, and also move their coins off the PayPal platform. Great way to get started. Click in to read:

Author’s Note - Upcoming event, the biggest Bitcoin conference in the world comes to Miami, Bitcoin 2021 Miami. Next Friday and Saturday, June 4 and 5. I’ll be reporting on some of the sessions (watching streaming on Bitcoin Magazine’s web page). An amazing lineup of speakers - Jack Dorsey, Pomp, Michael Saylor, Sen. Cynthia Lummis, Ron Paul, Floyd Mayweather, Sean Culkin, many more.

Issue No. 4 May 28, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, runs marathons, yells at the Yankees and Giants, and tries to make homemade wine.

Follow on Twitter! The Bitcoin Files Newsletter