“It’s over. Wormer dropped the big one” -

Daniel Simpson Day, Animal House, 1978.

Gary Gensler, SEC Chair, dropped some big ones this week. The Number One and Number Two cryptocurrency exchanges in the world, Binance and Coinbase, respectively, were sued by the SEC for offering unregistered securities to the public, among other things.

Binance, headquartered in China, is accused of evading U.S. laws and regulations by implementing tactics to avoid registration requirements. The SEC accuses Coinbase of operating as an unregistered securities exchange, broker and clearing agency.

Is it over? For cryptocurrencies?

It doesn’t look good for “crypto” projects. They have all been, effectively, classified as securities by the SEC. Most, have, Bitcoin being the biggest exception. Gensler has said that Bitcoin is a commodity, and the IRS has agreed, since 2014. What Gensler hasn’t opined on is Ethereum, which is strange.

Ethereum possesses all of the same characterizations as the lesser-known crypto projects, and as such it seems like a security. The properties of Ethereum include:

The tokens are sold to the public with the intention of making a profit for the founders.

The Ethereum tokens are centrally controlled by a management team, as opposed to Bitcoin.

The amount of Ethereum tokens that can be minted is effectively unlimited, again, differing from Bitcoin.

To Gary Gensler’s credit, he hasn’t lumped Bitcoin in with the other crypto coins.

Many of the “crypto projects” deserved to be regulated, and probably shut down. A lot of them serve no legitimate function, except to line their founders’ pockets.

Coinbase’s Response:

Brian Armstrong, the Coinbase CEO, commenting on Twitter:

1. “The SEC reviewed our business and allowed us to become a public company in 2021.

2. There is no path to "come in and register" - we tried, repeatedly - so we don't list securities. We reject the vast majority of assets we review.

3. The SEC and CFTC have made conflicting statements, and don't even agree on what is a security and what is a commodity.”

And, from Coinbase’s chief legal officer:

“The SEC’s reliance on an ‘enforcement-only’ approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance,” Coinbase chief legal officer Paul Grewal told CNBC in a statement.

“Enforcement-only regulation.” Perfect description.

Coinbase feels confident that a solution will be worked out without decimating their core business.

So, What’s the SEC’s Motivation?

The Securities and Exchange Commission is supposedly all about protecting investors. They have regulations in place for registering securities for sale. They would, apparently, like all crypto projects to register for sale with the SEC as securities. Fine. There’s only one problem with that.

The SEC hasn’t told any crypto project how to register.

And that casts doubt on Gensler’s motivation. Further, Gensler has shown his hand. He is more interested in protecting fiat currency, i.e., the US Dollar, than he is in protecting investors. It’s evidenced by this quote:

And there you have it.

The SEC is interested in protecting the US dollar, which can be printed into infinity, and can be controlled and manipulated by unelected Federal Reserve bankers. Currency that can be inflated to cover persistent, ever-growing budget deficits.

And so, the SEC cracks down on digital currency projects.

Does Bitcoin Care About This?

Nope.

That’s because, as I’ve said many times before, Bitcoin is totally decentralized and not controlled by a group of founders.

Does Gensler like Bitcoin? I don’t think so.

Does he want to reduce the number of onramps to Bitcoin? Probably.

Can he shut down the Bitcoin network? No, absolutely not.

Bitcoin’s price initially dropped by $1,700 on Monday and Tuesday, following the SEC’s Coinbase announcement. But it rebounded completely by late afternoon Tuesday. It is a network independent of founders, and truly doesn’t care. It has proven, time and time again, to be a resilient, decentralized asset.

“Regulation by Enforcement”

Gary Gensler and the SEC want them all to register as securities. The exchanges say, “you haven’t told us how to register.” In other words, the “regulations” are ambiguous, or not clear.

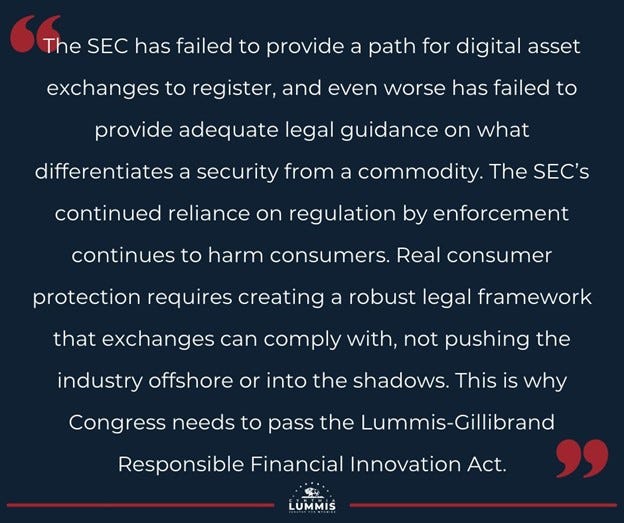

Here’s what US Senator Cynthia Lummis (R-WY) had to say:

As for the crypto investors, who willingly bought the tokens on the free market, what exactly is Gensler trying to protect them from? It’s not clear.

The SEC didn’t protect the public from Bernie Madoff, who executed a fraud of tens of billions of dollars. But digital currencies represent a threat to the status quo. The fiat banking system, the US dollar.

How will this all shake out?

It is my bet, or at least my hope, that the SEC will take these actions in regard to crypto projects:

Come up with a clear set of regulations. Who is required to register, and how to do it.

Levy some fines on the existing exchanges as a warning, and allow them to stay in business.

Be diligent in monitoring crypto “projects” that are misleading or outright scams.

Allow Bitcoin to operate as is, and allow safe onramps to invest in Bitcoin.

Finally approve a safe, regulated spot Bitcoin ETF to allow investors of all size to get exposure to Bitcoin.

The SEC has now sued most of the major cryptocurrency brokerages that operate in the United States. Though crypto investors may hope for a quick resolution to the various cases, don’t bet on it. The litigation, including potential appeals, could drag out for years.

And the Bitcoin network will continue to run, flawlessly.

Thanks for reading. And please share this newsletter with some future-coiners.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 112, June 9, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.