Did any of us think we would see the price of Bitcoin hit $77,000? This year? Any time?

When the price was at $16,000 less than two years ago?

Bitcoin’s price has more than doubled in the last year. Is there one, dominating factor that has spurred the orange coin to record highs? I don’t think so. I think there are several.

ETF Growth has been dramatic

Bitcoin investing went mainstream earlier this year, in a big way. With the biggest players in the investment world. BlackRock, the world’s biggest asset manager with over $10 trillion in assets under management, now boasts the largest Bitcoin ETF (exchange traded fund).

Its fund (IBIT) now holds over 400,000 coins, worth around $33 billion. Its assets grew by over 20%, just in the third quarter. Bitcoin ETFs, in total now hold over $60 billion in assets. Bitcoin funds have been the largest growing ETFs in US history.

And consider this: The Bitcoin ETFs saw $2 billion in inflows in just three days after presidential election.

With the biggest asset managers in the world, like BlackRock and Fidelity, advising their clients to allocate a portion of their portfolios to Bitcoin, it would seem that prices are likely to keep rising. Simple supply and demand.

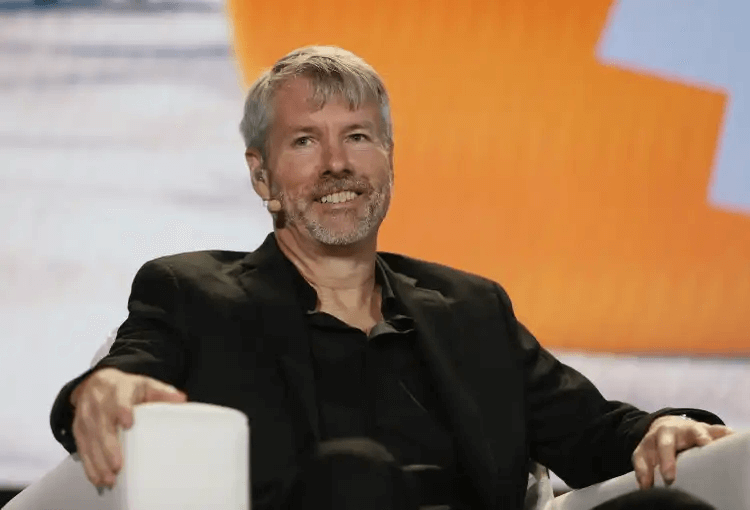

The “Saylor Factor”

Yep, that man. One definition of the term “conviction” is the quality of showing that one is firmly convinced of what one believes or says. A firmly held belief or opinion. When it comes to the future of Bitcoin, the potential of Bitcoin, no one has more conviction than Michael Saylor. Saylor is the CEO of publicly-held MicroStrategy Corp.

MicroStrategy has purchased 252,220 Bitcoins, which are now worth approximately $19.3 billion. With a B. They have, by far, the largest amount of Bitcoin of any company in the world.

Their cost basis is only $39,000 per coin.

(Imagine if the really big companies get involved. Think: Alphabet, Meta, Microsoft.)

Bigger news: Saylor has announced that over the next four years, MicroStrategy will be investing a total of $42 billion in Bitcoin, through a combination of debt and equity capital raises.

That’s conviction.

And other investors have been listening.

One big catalyst for the recent price escalation.

The US Presidential Election

Though hard to quantify, the results of the US Presidential election probably had some influence on Bitcoin investors. And may have been responsible for some of the price jump.

From Election Day, November 5th, until Friday November 10th, the price of Bitcoin popped from $67,000 up to $77,000.

Can’t be coincidence.

Donald Trump was previously sour on Bitcoin and other crypto, calling the whole space a “scam.” It’s understandible. He made his fortune in the fiat world, in real estate, measured in US dollars. Without doing much research into Bitcoin (undoubtedly) of course he would dismiss it.

But in 2024, Trump changed his tune. He even appereared at the Bitcoin Conference in Nashville in July. Several of Trump’s new buddies, including Tulsi Gabbard, Robert F. Kennedy Jr. and Vivek Ramaswammy, have previously appeared at Bitcoin conferences. They are all big proponents.

Trump now supports the development of Bitcoin technology and businesses in the space, stating that if Bitcoin is to flourish, the United States must be the leader in its development.

Additionally, several prominent Democrats have seemingly been in favor of regulating Bitcoin out of existence, as if that were even possible. Think, Senator Elizabeth Warren, for one. Warren and some of her colleagues seem to believe that Bitcoin, with its fixed, limited supply, may threaten the US dollar.

So, several factors have been affecting Bitcoin’s price in 2024. And two things are certain: the supply of Bitcoin will never exceed 21 million, and demand is rising.

Simple economics.

Thanks for reading.

Check out my latest book, House of Cards: The Rise and Spectacular Collapse of the FTX Crypto Empire, available on Amazon.com.

Twitter (X) - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my over 700 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 139, November 9, 2024

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.