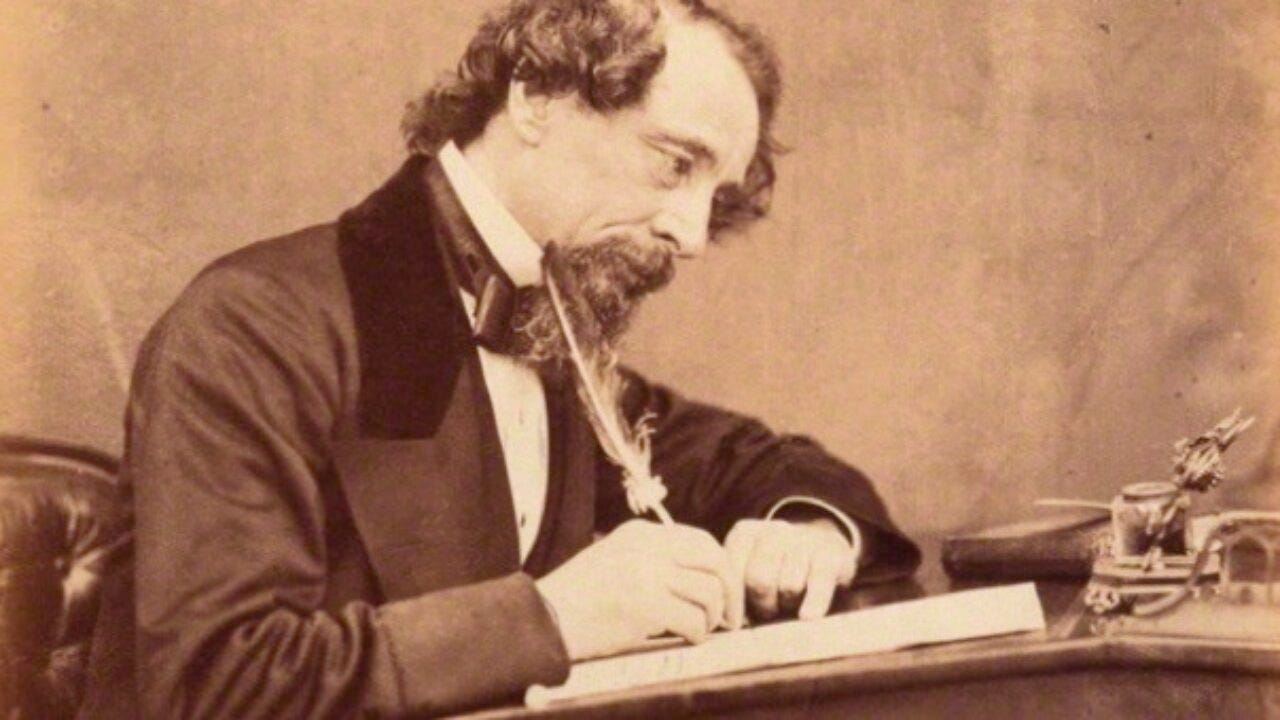

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…”

Charles Dickens could have been speaking in current times, describing the contrasting belief systems that exist regarding the innovative technology that we know as Bitcoin. This week, I happened to read two newspaper columns that discussed Bitcoin, and they couldn’t have been more different, in many ways. The columns appeared in the New York Times and the New York Post, two publications that don’t share the same world view about much of anything.

“Bitcoin Cosplay is Getting Real”

Binyamin Applebaum, in his Times piece, used expressions such as “mostly useless,” “doesn’t work,” and “unnecessary” in describing Bitcoin. Applebaum is the lead writer on business and economics for the Times editorial board, so his views will certainly be heard across the world. He also describes the Bitcoin movement using the newly popular term “cosplay.” I had to look that one up. Cosplay, definition is - the activity or practice of dressing up as a character from a work of fiction (thanks, Miriam Webster). Hmmm.

In “Bitcoin Cosplay is Getting Real,” Applebaum opines that Bitcoin, while designed to safeguard against inflation, big government and financial intermediaries, “doesn’t work.” He does acknowledge that Bitcoin has increased dramatically in value since 2009, so that actually seems like a great hedge against inflation. And, as far as avoiding the “depredations” of government and finance companies, it seems to be performing perfectly. A decentralized asset will do that. Thus, I don’t understand his “doesn’t work” declaration.

Applebaum laments the “rigidity of Bitcoin’s design” as being “dangerously impractical.” The fixed supply written into the Bitcoin code is, I’m afraid to tell Mr. Applebaum, a feature of Bitcoin, not a flaw. Apparently, the Times writer prefers a currency or store of value that can be printed out of thin air, at government bureaucrats’ whims. As everyone knows, such practices (think $30 trillion in US debt) result in a gradual erosion of the value of a currency. Yes, Bitcoin is rigidly designed to prevent this.

Applebaum also states that Bitcoin is difficult and expensive to use as a currency. I’ll give him partial credit on that one. Bitcoin is proving to be a great store of value, a great means of sending international remittances, and only a fair, at this point, spendable currency. That doesn’t mean it won’t get better. (Think dial-up internet.)

Actually, now that I’ve reviewed Applebaum’s column, I think he has made a great case for the existence of Bitcoin in the world’s financial system.

Maybe it’s just me, but I don’t think his column ever really explains his “cosplay” description. I’ll reach out and see if we can debate a bit.

“Nurturing Crypto”

Charles Gasparino, in his New York Post column “Nurturing Crypto,” presents a more optimistic and hopeful narrative surrounding Bitcoin. Consider his sub-title: Still-young $2.2T industry could grow stronger - if SEC allows it to thrive.

Gasparino, rather than dwelling on imperfections that can be improved upon, sees the “reality that we are on the verge of something revolutionary.” His opinion, with which I concur, is that crypto and blockchain technology “could usher in the next Internet revolution.” Quite a contrast to the NY Times piece.

Focusing on the SEC’s approach so far with cryptocurrencies, an approach Gasparino calls “asinine,” he compares the regulatory steps to that taken with the internet in the 1990’s. Indeed the same potential pitfalls existed with the internet that are present in the crypto world. Some of the “FUD” (fears, uncertainties, doubts) about Bitcoin were prevalent in the early days of the internet.

Crime: Unsavory characters used the internet for illicit purposes. They still do. Same with Bitcoin. But crime committed with crypto pales in comparison to that committed with cash and the traditional banking system. Hype: There is a hype about Bitcoin that resembles that surrounding the internet in 1995. Obviously, the internet has thrived despite the big hype, and Bitcoin can do the same. Hype is not necessarily a bad thing. Bubble: There is much talk about Bitcoin being a tulip bulb-like bubble that is going to burst and burst in an ugly fashion. That talk was around during early internet days, too. Bitcoin, after surviving and improving for twelve years, is really wearing down that bubble accusation.

Gasparino’s opinion is that the 1990’s SEC, led by Arthur Levitt, took a common-sense approach to regulating the internet, a framework that allowed innovation to flourish. Contrast that to today’s regulatory climate surrounding Bitcoin. The SEC claims that it is trying, above all, to protect investors. However, it has practiced selective, somewhat random enforcement which is stifling innovation. Agencies are waging a turf battle, led by the SEC, Congress, and the Department of Justice. Unfortunately, at least with Congress, there are not a lot of informed participants in this game.

Cryptocurrency businesses are extremely nimble. They will relocate to friendlier environs if the US seems to not want their business. The US can regulate the industry to death, or adopt of more measured and better thought out approach. Gasparino cites the proposal being floated by SEC Commissioner Hester Pierce. Pierce, known as “Crypto Mom” in Washington, has proposed a three-year moratorium on “random” enforcement actions so the crypto industry can continue to innovate and adapt.

US regulators could adopt this, in Gasparino’s words, more “holistic approach,” before forcing innovators to pack up for other lands.

Dickens, were he around today, could no doubt recognize today’s best of times, age of wisdom, epoch of belief, and spring of hope, and that we “had everything before us.” We could use some of that optimism.

Links to both columns below:

CHARLES GASPARINO

Still-young crypto industry could grow stronger — if SEC allows it to thrive

September 18, 2021 9:35pm Updated

BINYAMIN APPELBAUM

Bitcoin Cosplay Is Getting Real

Sept. 14, 2021

Issue No. 22, September 24, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter