Fewer Bitcoin in Circulation

Scarcity. It’s one of the great things about Bitcoin. 21 million coins, and there can never be any more. It’s written into the code.

It’s nothing like a fiat currency.

And every time some coins are lost, the scarcity of Bitcoin gets even greater. Out of the nearly 20 million coins that have been mined, it’s estimated that as many as 2 million have been “lost.” As in, the owners forgot or lost their private keys, and will never recover the Bitcoin.

In a much publicized recent loss of Bitcoin, the crypto exchange Prime Trust announced that it had, back in 2021, lost access to thousands of Bitcoins. The coins were stored in what is called “legacy wallets.” Over 20,000 Bitcoins.

And then it got worse. From December 2021 until March 2022, in order to satisfy the withdrawal requests of its customers, Prime Trust used customer fiat money to purchase additional digital currency. Talk about compounding the problem.

At this time, Prime owes customers $85,670,000 in fiat currency, but has only $2,904,000 left in its coffers.

Speculation abounds, especially on Bitcoin Twitter, that the coins weren’t actually “lost,” but may have been stolen. We don’t know yet. But if they are lost, the supply of available Bitcoin just got smaller.

MicroStrategy Continues to Buy Bitcoin

Michael Saylor is the definition of conviction. The CEO of publicly-held MicroStrategy Corp. has orchestrated yet another huge purchase of Bitcoin. The company recently bought another 12,333 coins, bringing its total accumulation to 152,333 Bitcoins.

They are worth, as of Thursday, approximately $4.65 billion. Billion, with a B.

MicroStrategy’s average cost is $29,668 per Bitcoin. The price of Bitcoin currently sits at around $30,500.

Now that’s what I call “all in.”

Governments Getting in the Bitcoin Game

Do you live in North Carolina? Your state, the Tar Heel State, is bullish on Bitcoin.

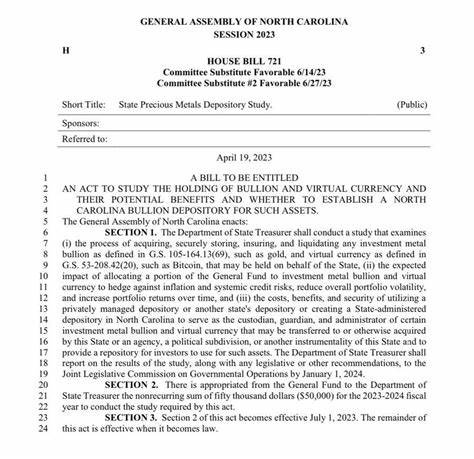

The General Assembly of North Carolina has introduced a bill, House Bill 721, to “Study the holding of Bullion and Virtual Currency and Their Potential Benefits.”

The bill covers gold, and any virtual currency, “such as Bitcoin.”

The bill would appropriate $50,000 to such a study. Not a huge amount. But certainly a bullish development for Bitcoin.

Bitcoin is being taken seriously.

This Month in Bitcoin History

June, 2011. The year 2011 started out with Bitcoin, being very thinly-traded at the time, priced at $0.30 per coin. Yep. No typo. It rallied bigly in June, hitting a high of $31.50 on June 8th. But by the end of the month, it had fallen to $11.00. Talk about buying the dip. Woulda, shoulda, coulda.

June, 2021. In June of 2021, the Legislative Assembly of El Salvador passed legislation to make Bitcoin legal tender in El Salvador, along with the US dollar. The law took effect on September 7th. This was the first nation to do so, but a few more have since followed suit.

Gradually, then suddenly.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 115, June 30, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.