Google “Is Bitcoin dead?”

I got 156,000,000 results in .51 seconds.

Seems people think it is dead.

Bitcoin’s price declined to under $18,000 last weekend, down from its all-time high of over $69,000. That’s a 74% decline. That’s severe. Not dead, but pretty severe. Ethereum and every other cryptocurrency followed suit.

I’ve written quite a few times about Bitcoin’s inexplicable correlation to stocks, and about its correlation to other crypto, the “altcoins.” Neither make sense, but here we are.

Are stocks, as a whole, dead? Of course not. Are altcoins dead? Maybe, we’ll see. I liken this to the bursting of the dot com bubble. The successful projects endured, the others crashed in spectacular fashion. I believe this will happen in the digital assets space. The better, more proven platforms will prevail. I think Bitcoin will survive and thrive. Let’s take a look at Bitcoin’s history, and why I believe in its future.

Many Successful Companies have Endured Multiple Declines

Bitcoin has had eight corrections, or declines, of over 50%. That’s some volatility. But some think that stocks haven’t endured such corrections. In reality, they have, and some of the biggest, most successful companies have been through it. Amazon, one of the most valuable companies in the world, suffered four declines of over 80%. Just this year, such tech bellwethers like Netflix, Nvidia, Meta and Google have experienced declines of 35 to 80%.

No one has pronounced any of these large companies as “dead.”

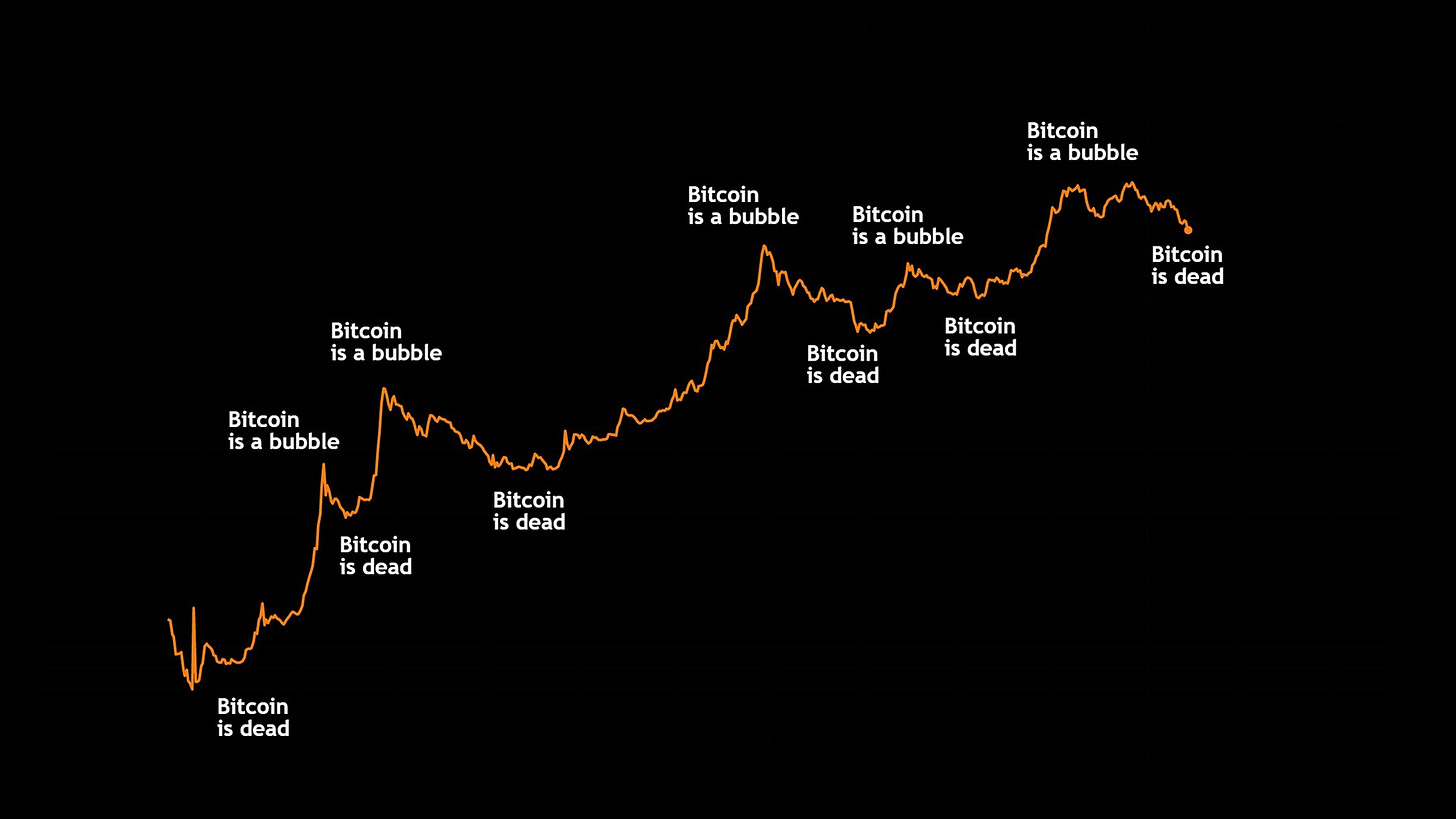

What the Media Would Have You Believe:

When Bitcoin soars, it has to be a “bubble.” You know, which has to burst at some point. And just go away.

When Bitcoin tanks, well, stick a fork in it. It’s done.

Maybe the old stock adage applies: “The markets climb a wall of worry.”

Bitcoin has been pronounced dead, many times, by journalists. They’ve been wrong, for the better part of thirteen years. And remember the Lindy Effect.

In fact, there have been over 400 instances of journalists predicting the demise of Bitcoin. Here’s an excellent compilation of several of those dire predictions, and some of the recent headlines:

371February 17, 2022 Bitcoin's Candle Will Soon Blow Out Twitter Peter Schiff

Bitcoin Won't Be Around A Decade From Now Twitter Peter Schiff Economist373 March 8, 2022

Crypto Is Dead The Spectator Ross Clark Writer / Columnist377May 18, 2022

Things to Look For in the Future:

Yearly lows. Look at the yearly lows in Bitcoin prices, the times of despair. They are getting higher, pretty much every year. Higher lows beget higher highs.

Stock correlation. This should decrease as adoption and understanding increase. I always say on Twitter, “Bitcoin is so misunderstood, and we are so early.” Bitcoin should decouple from stocks, eventually.

Volatility will decrease. As Bitcoin becomes a more mainstream store of value, and speculators are driven out, its volatility should decrease. Leveraged traders, causing much of the volatility, should decrease as well.

Crypto Will Have Its “Dot Com” Meltdown. So far, good crypto projects have been punished along with the worthless ones and the outright scams. The weakest will go the way of the worthless dot com companies, and the strongest will survive. Many altcoins and weak “stablecoins” will be gone, soon.

The next time you read that “Bitcoin is dead,” look more closely. See if the author is referring to crypto, altcoins, stablecoins, NFT’s, or actual Bitcoin. Know the difference.

Oh, and here’s a beauty from 2018, by professor and noted Bitcoin critic Nouriel Roubini:

Bitcoin “Short” ETF Approved by SEC

Gary Gensler’s SEC so far won’t approve a spot Bitcoin ETF.

But they have approved both a futures ETF and now a short ETF. It seems odd, since both futures and shorts are considered much more risky than a long position.

ProShares, which launched the Bitcoin futures ETF, will now open the ProShares Short Bitcoin Strategy ETF. The fund will help Bitcoin investors to hedge their long positions.

Could a spot Bitcoin ETF be in the offing soon? Several other countries have approved them, Canada, Australia, Germany included. Stay tuned.

Mr. Wonderful is Buying the Dip

Shark Tank’s Kevin O’Leary recently disclosed that he holds 32 positions in the digital assets space, including Bitcoin, Ethereum, Solana and Polygon. He also backed the crypto trading firm WonderFi, featured on the Toronto Stock Exchange.

O’Leary foresees many crypto projects being regulated out of existence and sees that as a good thing for the space. In the past, he has stated his view that sensible regulations will bring trillions of institutional dollars into the crypto space.

“Mr. Wonderful” believe he’s “betting on the best intellectual capital in the world.”

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 500 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 62, June 24, 2022

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.