Bitcoin and marathons. Two things I probably spend way too much time thinking about.

A quick Google search of “Bitcoin is a marathon, not a sprint” produced 482,000 results in a half a second. Popular topic.

Seriously, Bitcoin’s journey has been and will be a marathon, not a quick sprint. The OG cryptocurrency just turned fourteen years old. It’s estimated that 300 million people use or hold Bitcoin. That’s a lot of people, but still only 4% of the world’s population. The potential for growth is huge. Consider this:

Over 1.7 billion people on the planet don’t have access to a bank account. Of these people, 1.1 billion, however, have a mobile phone. Opportunity to “bank the unbanked.”

So Bitcoin is a Teenager. How’s That Compare With the Internet?

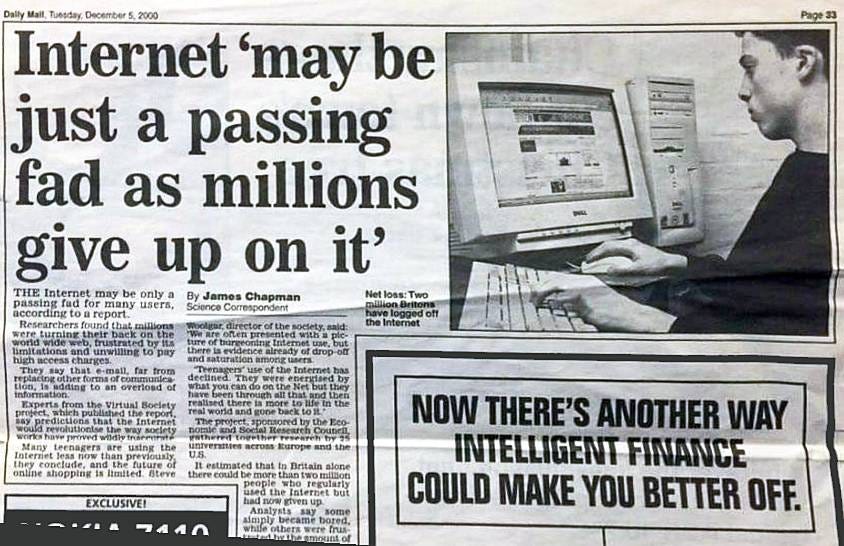

It’s entirely fair to compare the adoption rate of Bitcoin to that of the internet. The internet is perhaps the greatest technological advance in the history of the world. The revolution of digital money may be of similar magnitude in importance. So how do they compare so far?

The internet was generally introduced for mass usage around 1983. That means the net was fourteen in 1997. In 1997, only about 2% of the world’s population used the internet. However, by 2000, global internet usage had climbed to 5% of the world population. And in 2022, two-thirds of the world uses it, about 5 billion people. So in other words, gradually, then suddenly.

At the age of fourteen, the internet had been growing at a rate of about 63% per year. Bitcoin, by contrast has been growing by over 110% per year. That’s a huge difference. Clearly, Bitcoin adoption is growing at a faster pace than that of the internet. But why hasn’t Bitcoin exploded even faster? Here’s a theory from Bitcoin on-chain analyst Willy Woo:

“Human nature is one that looks at things in a linear stance. So we’re not very good at looking at exponential growth, which is obviously what Bitcoin is doing.” - Willy Woo.

People aren’t yet seeing the full potential.

Bitcoin has its many critics. The internet had its critics, too. It wasn’t easy to see the potential of such a groundbreaking new technology. Even noted economist Paul Krugman stated, “By 2005, it will become clear that the Internet's effect on the economy is no greater than the fax machine's.” Krugman is now a Bitcoin hater as well.

(See my 2021 issue about The Bitcoin Haters.)

Bitcoin Goes Through Adoption Cycles

So why has Bitcoin’s price retreated so much and has now remained stagnant for almost five months? The key is the four-year halvings cycles. Bitcoin is just repeating what it’s done in the past. These phases of accumulation by long-term Bitcoiners occur during parts of every cycle.

Following a massive, retail-led FOMO runup, Bitcoin’s price started retreating, and the traders, the short-term “tourists” as I call them, ran for the hills. The HODLers are still plugging away, accumulating.

The percentage of Bitcoin that hasn’t moved for over a year is at an all-time high. Two-thirds of Bitcoin hasn’t moved in a year. Or, as one prominent investor said, “Here’s an asset where 85% of the holders are religious zealots.”

Bitcoin’s hash rate is at an all-time high. Hash rate is a measure of the computational power per second used when mining the cryptocurrency. When China banned mining, it took only a few months for the large miners to pick up and move to friendlier areas. The network didn’t miss a beat.

Key Takeaways:

The Bitcoin network is as healthy as ever.

Long-term, serious Bitcoiners are holding and buying.

The tourists have been flushed out.

Bitcoin adoption is growing faster than the internet did.

The potential for even greater exponential growth is there.

The looming supply squeeze could cause an explosion in price.

Internet adoption wasn’t a sprint. Nor is Bitcoin’s.

Thanks for reading!

Fun Fact:

Another Fun Fact:

(Try this with your bank)

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 550 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 81, November 4, 2022

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.