Yes, Bitcoin has been around a while. If Bitcoin were a person, it would have passed through puberty and would be looking forward to that driver’s permit. It might have acne; it might still be socially awkward. Well, Bitcoin still is, I guess.

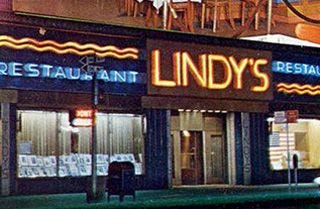

Bitcoin still going strong in its fifteenth year reminds me of the Lindy Effect. If you read my previous newsletters, you would know that Lindy’s was a famous delicatessen in Manhattan where standup comics would hang out and talk about other comics. During these sessions, the comics theorized that the longer a particular comedian hung around, the more likely he or she was to stay in the biz permanently. The theory being, of course, that the longer one performed, the more new material they were coming up with, i.e., they were no “flash in the pan.”

So over these fifteen Augusts, what has happened, of any significance, with Bitcoin?

First, the domain name bitcoin.org was registered on August 18, 2008. And just two months later, a link to a paper authored by Satoshi Nakamoto titled “Bitcoin: A Peer-to-Peer Electronic Cash System” was posted to a cryptography mailing list. Nakamoto implemented the bitcoin software as open-source code and released it in January of 2009.

I bet he/she had no trouble getting that domain name.

Lightning Network Appears

Fast forward nine years to August of 2017. In the previous month, July 2017, the controversial SegWit software upgrade was approved. Segwit was intended to support the Bitcoin Lightning Network, as well as improve scalability. SegWit was subsequently activated on the network on August 24, 2017 (six years to the day prior to me writing this). The bitcoin price rose almost 50% in the week following SegWit's approval. That’s certainly a major event in Bitcoin’s histroy.

The Lightning Network is a “Layer Two Protocol,” and has enabled Bitcoin transactions to be processed in milliseconds and for extremely cheap fees. That’s thousandths of a second. That’s what I would call a technological breakthrough.

And Then Corporations Invested in Bitcoin

In August 2020, publicly held MicroStrategy Corp. invested $250 million in bitcoin as a treasury reserve asset. It was the beginning of a series of Bitcoin purchases. It was what MicroStrategy CEO Michael Saylor terms, the date that “MicroStrategy adopted the Bitcoin strategy.”

The company has gone on to purchase Bitcoin several times, going, as they say, “all in.” Some of the purchases were even financed by debt and equity offerings. Saylor has certainly staked his entire career on the future of Bitcoin.

As of August 2023, MicroStrategy has accumulated a total of 152,800 Bitcoins. The total purchase price for the bitcoins was $4.53 billion USD, making an average price of around $29,672 USD per bitcoin.

Talk about all in.

Bitcoin August Prices, Through the Years

August 28, 2016 $608.

August 27, 2017 $4,853.

August 26, 2018 $7,272.

August 25, 2019 $9,757.

August 27,2020 $11,711.

August 22, 2021 $44,829.

August 28, 2022 $19,986.

August 24, 2023 $26,100.

Aside from a brief, crypto-frenzied, bubble-like period in 2021, Bitcoin has been on a stready ride up. For fifteen years.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 121, August 25, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.