Bitcoin ETF's Are Approved! Started Trading on Thursday

Big names launch Bitcoin funds, but others shun the asset class.

The big day finally arrived.

Thursday, January 10, 2024.

The Securities and Exchange Commission (SEC) finally approved the launch of several spot Bitcoin Exchange-Traded Funds (ETF’s).

The approval was highly anticiapted in the Bitcoin community. A total of eleven ETF’s were approved. The importance of this stamp of approval by the SEC cannot be understated. Bitcoin ETF’s open up millions of retirement accounts and other institutional investment accounts to some Bitcoin exposure. Already, investment advisors are scrambling to get at least a 1 or 2 percent allocation of their clients’ accounts to Bitcoin.

(Over the past fifiteen years, it has been proven that just a 1% allocation to Bitcoin would have greatly increased overall portfolio returns. With very little downside risk.)

Was the Approval Priced into the Bitcoin Price?

Yep.

In the weeks leading up to the SEC deadline for approval of January 10th, the price of Bitcoin rose over 80%, in just four months.

On the day that the ETF’s started trading, Bitcoin spiked from $46,000 to $48,000. But it would retreat, by the end of the trading day, to around $46,000.

Still, over the past twelve months, Bitcoin’s price rose from around $20,000 to $46,000. Not a bad return.

What Should We Expect From an ETF Launch?

Well, very simply, based on the launches of Gold and Silver ETF’s, we can expect a significant runup in price.

What did Gold do in the eight years following the 2004 ETF launch? Take a look:

Yes, we can expect that, in this writer’s opinion.

Billions of dollars are expected to flow into Bitcoin ETF’s, which can only contribute to “number go up.”

Several Bitcoin spot ETF’s did five million dollars in volume on Thursday, in the first five minutes of trading.

Wow, on an Unbelievable Anniversary

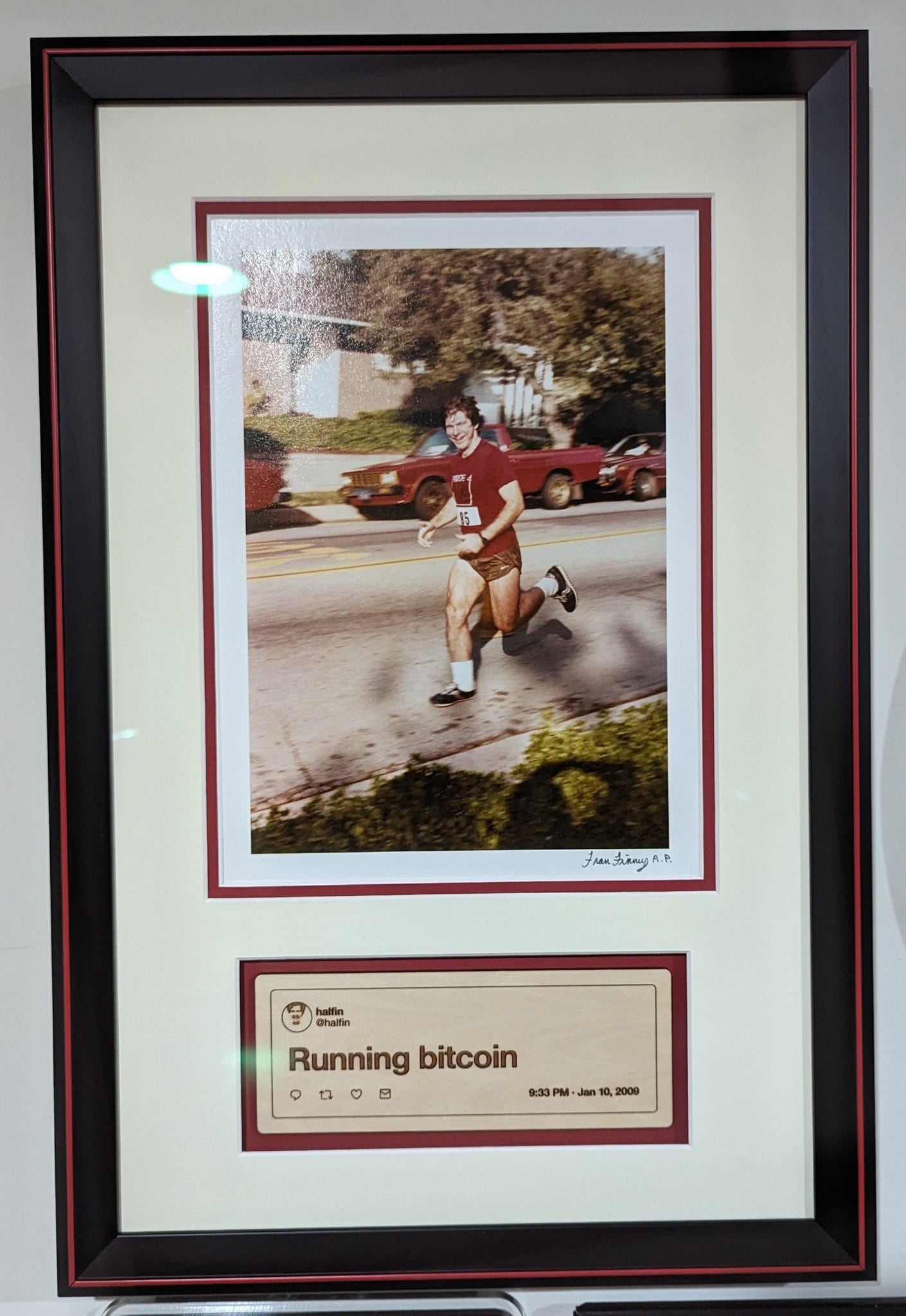

It was fifteen years ago, to the exact day, that super coder and Bitcoin pioneer Hal Finney tweeted, “Running Bitcoin.”

Many have speculated that Finney was actually Satoshi Nakamoto. His widow, Fran Finney, says, no. Hal died of ALS in 2014. We may never know.

(The tweet, and the iconic photo below, link his tweet “running Bitcoin,” with his love of long distance running.)

Not All Financial Service Firms Were Onboard

Most of the major players in the investment world launched their own Bitcoin funds.

BlackRock. $9 trillion in assets under management, number 1 in the world.

Fidelity. $4 trillion in assets under management, number 3 in the world.

ARK, Van Eck, Val Kyrie, Invesco, Grayscale. Some heavy hitters. All eager to offer their clients some exposure to Bitcoin. That asset with the fixed supply. That asset that has out performed all others over the past dozen years. That asset that ranks Number Ten on the list of the highest asset market caps.

Higher than Berkshire Hathaway. Whoa.

But how could other asset managers shun this asset, this new technology?

Well, Vanguard, number two on the list of largest asset managers, has forbidden their clients from buying a Bitcoin ETF. Seems it doesn’t fit with their “investment philosophy.”

Ditto Merrill Lynch. Citibank. UBS. Edward Jones. Hmmm.

Time will tell if their position on Bitcoin is prescient. Or short sighted.

Right side of economic history? Or not?

Meanwhile, the infux of capital into Bitcoin ETF’s should be very interesting. Let’s see how much money flows in. And how the price reacts.

Increased demand. Limited supply.

Thanks for reading. Only invest in Bitcoin what you can afford to lose. Do your own research. Bitcoin is risky and volatile. This is not investment advice.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my over 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 129, January 12, 2024

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.