It is widely expected that the Securities & Exchange Commission wil start approving spot Bitcoin ETF’s (exchange traded funds) as early as January 10th, less than a week from now. This is big news, in case you’ve been living under a rock.

And has probably been fueling Bitcoin’s recent price runup, to over $45,000.

Spot ETF’s will open up Bitcoin exposure to tens of thousands of retirement accounts and will also provide safe, easy access to Bitcoin exposure for institutional accounts. Seems a Gary Gensler stamp of approval means a lot to the big players.

During the past few months, the SEC has been going back and forth with the big investment players. Names like BlackRock, Fidelity, and Van Eck certainly carry some weight with the SEC. The big boys have been submitting revisions to their applications, in rapid acton.

At issue is the SEC’s desire that the SEC allow cash withdrawals from the funds, as opposed to just in-kind withdrawals, whereby investors can only withdraw the actual Bitcoin. So far, the big investment players seem to be playing along, and revising their proposals accordingly.

So, will there be a rash of approvals on Wednesday, January 10th? Possibly.

This writer thinks there is a possibilty that they all will be postponed. And maybe approved later this year, with some revisions. Stay tuned.

Ads are Playing, Anyway

Television and social media have been inundated with ads for Bitcoin ETF’s.

Van Eck has aired a dramatic, slow motion ad entitled “Born To Bitcoin.”

“Understanding Disruptive Innovation Takes Time. Bitcoin’s Time Has Arrived.” This, from Hashdex.

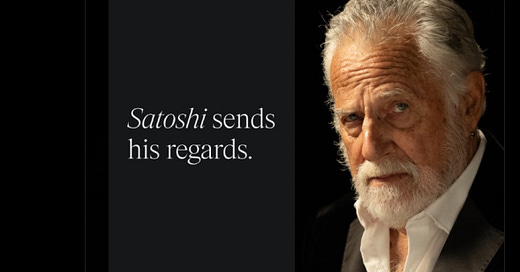

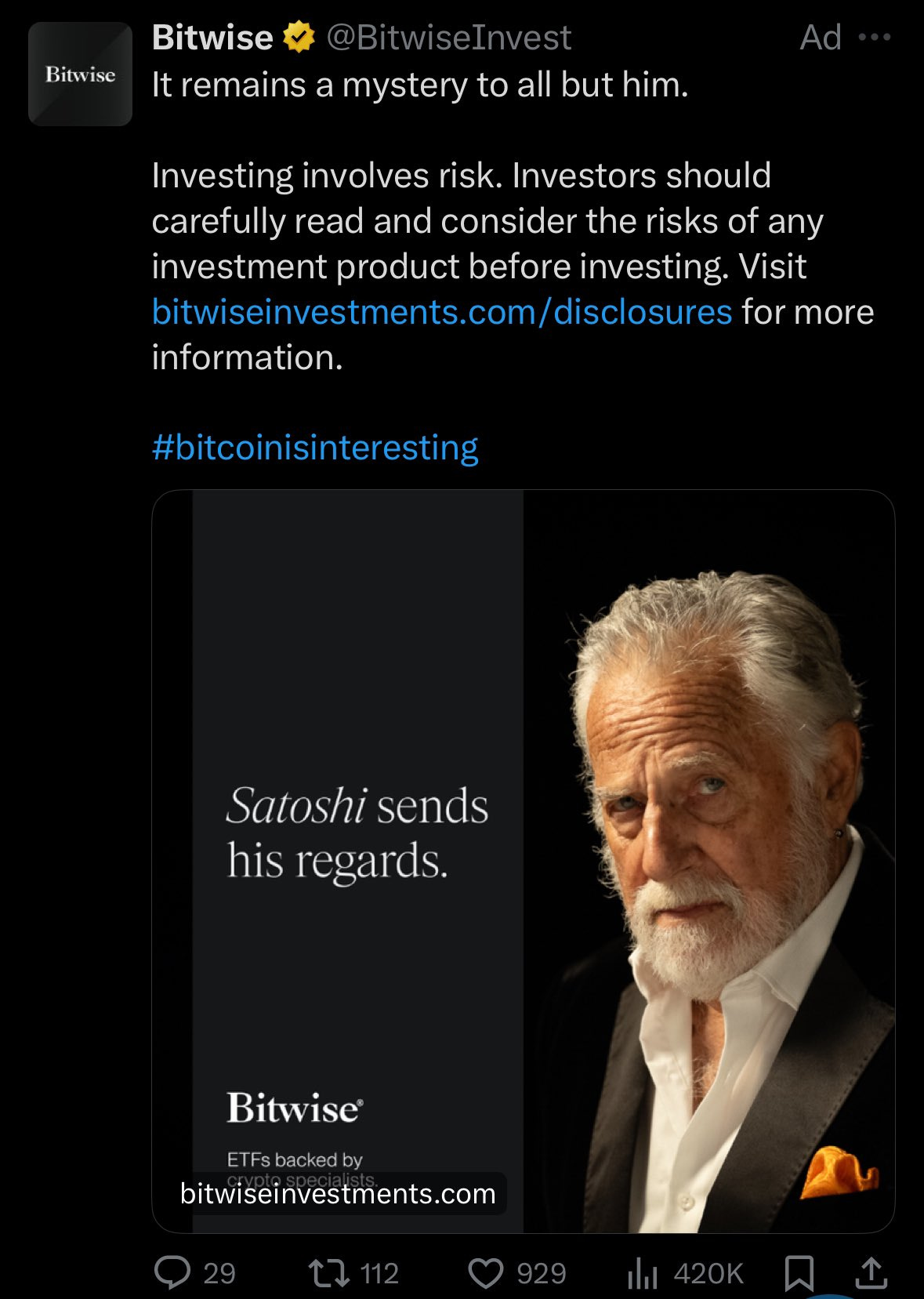

And this, from Bitwise:

If the big players are already advertising, it seems that a spot ETF is all but done. We’ll see, around January 10th, when the deadline for most appovals arrives.

And More Participants Get into the Game

ETF applicants Galaxy & Invesco have also released new videos commemorating Bitcoin's fifteenth birthday. They seem to be betting pretty heavily on a spot ETF approval.

And with Super Bowl XVII approaching in February, who knows what ads wil air?

It wasn’t long ago, after all, that crypto companies like Coinbase and FTX placed huge bets on Super Bowl ads.

What Will a Spot ETF Approval Mean?

Well, if institutional players, money managers, and investment advisors have assurance that investing in Bitcoin can be safe, a tremendous influx of money could flood into Bitcoin. For example, an allocation of just one percent of retirement accounts into Bitcoin, which seems more than reasonable, could mean tens of billions of dollars added to Bitcoin’s market cap. And as such, a huge increase in Bitcoin’s price. Number Go Up.

Here is the opinion of one keen Bitcoin observor:

“Why the #Bitcoin #ETF approval is very likely now:

- Blackrock has a 575/576 hit rate on ETF filings

- Every applicant has kept updating their S-1 filings after talks with the SEC = constructive

- All ETF comment windows to end this/next week

- ETF ads already running in US”

These are pretty astute observatons, and who beleives BlackRock will be denied?

Pay attention to the advertisements that investment and crypto firms air during the NFL games during the coming weeks. As some people say, “follow the money.” As I say, “follow the big money.”

With Bitcoin’s block reward being cut in half during spring, 2024, and the great possibility of the ETF approvals, things are looking pretty bullish for Bitcoin.

And remember, Bitcoin’s supply is strictly capped. Unlike any fiat currency.

Happy Anniversary!

Fifteen years ago this week, Bitcoin’s “Genisis Block” was mined.

Think about that. Bitcoin has been around for fifteen years. And it’s selling for around $45,000 per coin. There might just be something to this.

Lindy Effect?

Before you invest in Bitcoin, do your own research. Only invest what you can afford to lose; Bitcoin is volatile.

But pay attention. Bitcoin is going mainstream.

Thanks for reading.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my over 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 128, January 5, 2024

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.