Bitcoin Difficulty Adjustment....

Biggest drop ever....positive in so many ways!

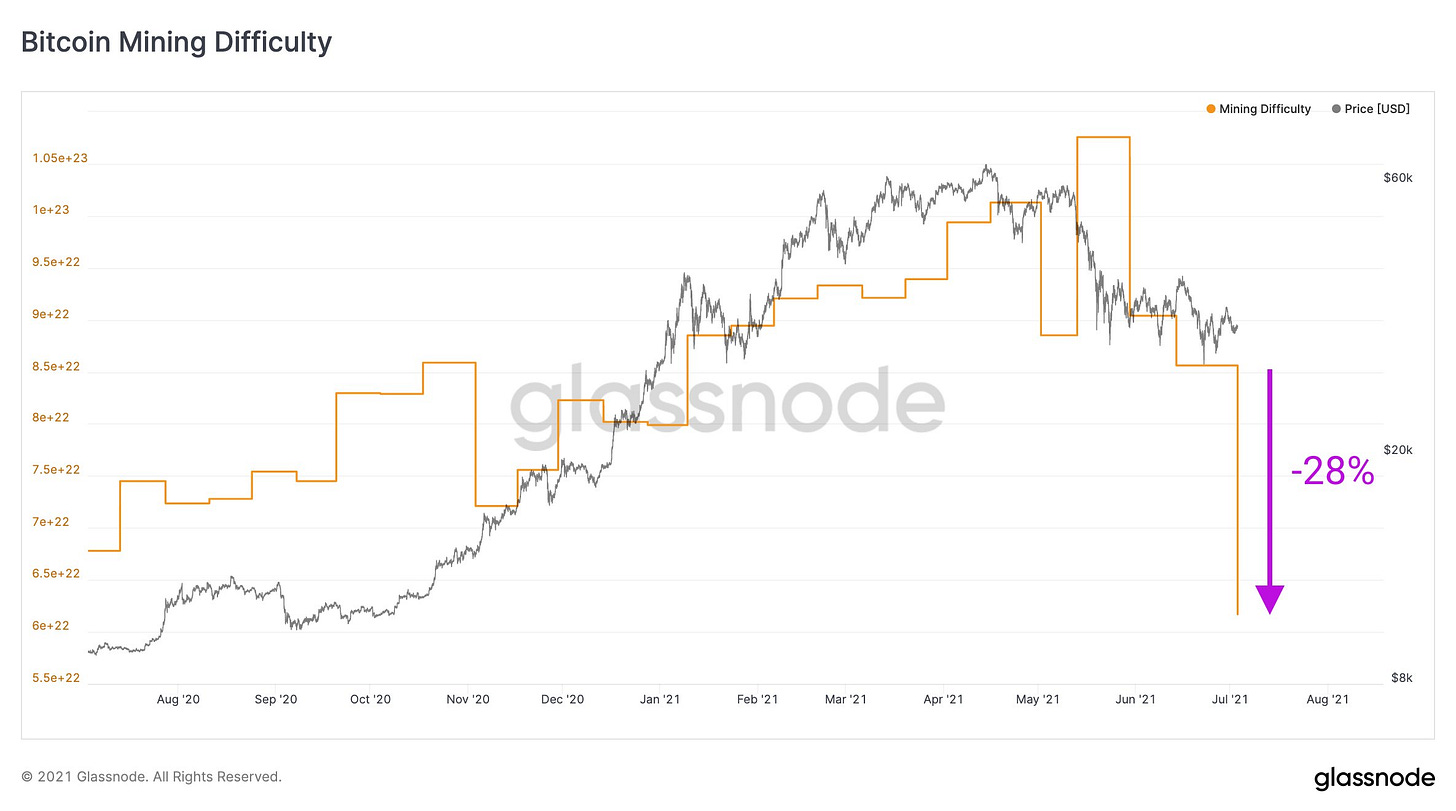

What happened on Saturday:

Early Saturday morning, the Bitcoin blockchain underwent its biggest-ever drop in mining difficulty, plunging nearly 28%. As a result of China’s strict crackdown on Bitcoin mining in the country, the vast majority of mining operations were shut off from the power grid. (See Issue No. 9.) With the loss of this much power from mining on the network, the time needed to mine one block increased from the standard target time of ten minutes to almost 23 minutes. Keep in mind that mining operations in China had accounted for around 65% of all mining on the Bitcoin network. But, let’s back up a bit.

What is this Bitcoin Mining Difficulty?

The Bitcoin mining difficulty factor is an internal score that Satoshi created as part of his Bitcoin code. Satoshi programmed the network to increase or decrease the difficulty depending on how many miners are competing on the network. When more miners are competing to earn the reward of a block of Bitcoin, using more powerful computers, the blocks tend to get solved more quickly. Conversely, when miners drop off the network, the block times can slow down.

Satoshi’s target time to solve a block of transactions was ten minutes. In order to maintain this standard, Satoshi designed the Bitcoin algorithm to automatically adjust the difficulty level every 2,016 blocks. This is one of the less discussed aspects of Satoshi’s creation, but a truly brilliant, self-regulating stabilizing mechanism. The 2,016th block hit on Saturday, and with the massive drop in mining power from the network, the difficulty adjustment was forced down by 28%, the largest such drop in the Orange Coin’s history. This move was widely anticipated in the Bitcoin community.

Positive Implications!

Greater Decentralization of the Bitcoin network and mining operations. Around 65% of mining was done in China, and that will no longer be the case. That factor had been the greatest reservation that US officials held about Bitcoin, in their words. That excuse no longer holds any water.

Mining Profitability. For the time being, existing mining operations will become quite a bit more profitable. Companies like Riot Blockchain, Marathon Digital and Bitfarms could emerge as big winners. Miners are already reporting a significant uptick in revenue.

Bitcoin-friendly areas will accept more of the mining operations, many with sources of renewable energy. El Salvador, Kazakhstan, Texas and Florida, especially Miami, are all eager to support Bitcoin mining operations.

Blockchain Efficiency. Saturday’s downward difficulty adjustment will make it easier for all remaining Bitcoin miners to solve blocks in closer to Satoshi’s ten-minute target. Satoshi’s brilliant, self-regulating mechanism.

Subscribe now for free!

Did You Know?

In March 2020, at the beginning of the pandemic, Bitcoin’s price dropped by 50% to $5,350. Since then, it has grown almost seven-fold. Strong hands are rewarded.

Tweet of the Week:

Issue No. 11, July 9, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, runs marathons, yells at the Yankees and Giants, and is getting better at making homemade wine.

Follow on Twitter! The Bitcoin Files Newsletter