Bitcoin $250K in January, then $1 Million when?

Crypto $3T; Rapper's $1M in BTC; Politicos: Pay Me in Bitcoin!

Analyst Calls For $250,000 Bitcoin in January

With Bitcoin hitting new all-time highs this week and its price approaching $70,000 per coin, analysts are out with some lofty predictions. Matthew Hyland, the young crypto technical analyst (@Parabolic_Matt) predicted on Tuesday that he believes Bitcoin will hit $250,000 in January. Like, this coming January, 2022.

Hyland’s analysis says Bitcoin will hit $100,000 in November or December, and from there, large investors will be the key in Bitcoin springing up quickly to $250,000. With the large players investing, they will engage in a sort of publicity campaign, luring in retail investors. He believes this will take place as soon as $100,000 hits. We’ve seen this action before, during the run-up of each cycle. Retail FOMO kicks in and pretty soon your Uber driver is advising you on buying crypto coins.

In addition, Hyland feels the Stock-To-Flow model, by “Plan B,” will be validated at the $100,000 level and many investors will believe that the similar stock-to-flow cross asset model will be proven correct. That model (S2FX) calls for $288,000 during this cycle. He feels it may fall a little short of that target. Don’t be disappointed, however, as Hyland feels the price will indeed go to $250K in January. After that, “the S2F model will remain intact which predicts Bitcoin will reach $1 million by 2025.”

Bobby Lee, former CEO of the exchange BTCC and the creator of Bitcoin wallet called Ballet, feels that in the longer-term, Bitcoin will certainly hit $1 million. Per Lee:

“In 10 years, by end of 2031, Bitcoin will go through another three block reward halvings. It’ll be very scarce. Hang on and HODL!”

Rapper all-in on Crypto, Takes $1 Million Advance in Bitcoin

The music industry is being transformed by advent of blockchain technology and NFTs, so it was only natural that Bitcoin would infiltrate the space as well. Many athletes have requested to be paid in Bitcoin, and now the first major recording artist has followed suit. Rapper Money Man has received a $1 million advance from Empire, the independent music label. It’s Empire’s first cryptocurrency artist payment.

Money Man has been all-in on crypto, and in 2018 bought himself out of his existing recording contract with earnings from his early investments in Bitcoin.

Money Man’s new album drops this week, and the album and the lead single are both called, naturally, Blockchain. All-in.

Cryptocurrencies’ Market Cap Tops $3 Trillion!

With Bitcoin, Ethereum and Solana all reaching record high prices on Wednesday, the market cap for all cryptocurrencies topped $3 trillion for the first time. Bitcoin, the OG, the first and oldest crypto coin, has a market cap of $1.28 trillion, making it the largest in the space.

Ethereum ranks second at $566 billion, while Binance, Cardano, Tether and Solana rank third through sixth. Tether is a US dollar stablecoin.

The total market cap is a pretty stunning figure, and it makes you wonder. How can crypto, especially Bitcoin and Ethereum, still be called a “bubble” or a “fad” by the naysayers? A thirteen-year history, a $3 trillion market cap, and $115 billion of transactions every day, and the Bitcoin haters like to compare this technology to “tulip bulb mania.” We are so early.

Mayors: Pay Me in Bitcoin!

It’s trending.

After Miami Mayor Francis Suarez tweeted last week, “I’m going to take my next paycheck in Bitcoin,” other political figures have followed suit.

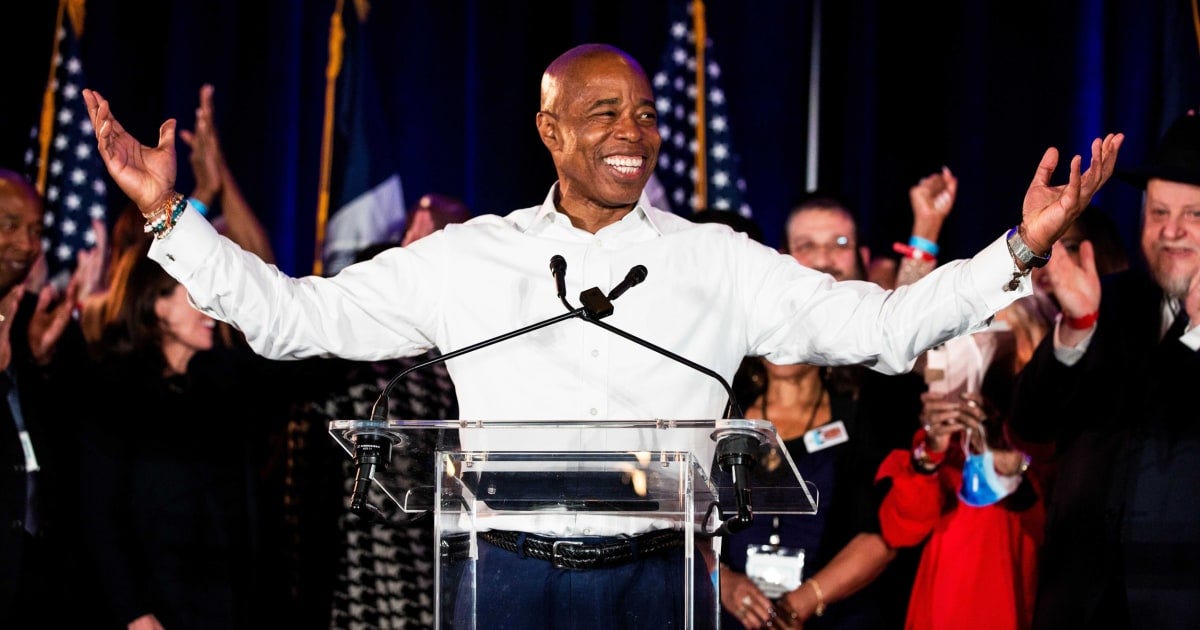

Not to be outdone by Suarez, New York City’s Mayor-elect Eric Adams declared that he is going to take his first three paychecks in Bitcoin. Adams also added: “NYC is going to be the center of the cryptocurrency industry and other fast-growing, innovative industries! Just wait!” Other mayors, including Scott Conger of Jackson, Tennessee, have explored allowing their workers to be paid in Bitcoin, something Suarez is championing as well.

As I wrote about this summer, several cities want to be the Bitcoin capital of America, including Austin, Miami, New York and San Francisco. For the attention it will garner their cities, for the jobs it may create, and for just plain-old voter appeal, embracing this new technology seems to be smart politics. Says Leah Wald, CEO of Valkyrie Funds:

“Adams is a savvy politician, and using an opportunity to promote a part of his agenda that has a rabid global following not only positions New York well for the future, it also instantly elevates his own profile.”

Issue No. 29, November 12, 2021

Rick Mulvey is a CPA, forensic accountant and crypto consultant. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

Follow on Twitter! The Bitcoin Files Newsletter