Cathie Wood is a major Bitcoin bull. And she does the analysis to back up her position.

The head of ARK Investments is all-in on technology in general and also on Bitcoin. Her ARK Innovation ETF soared in 2021 to a market cap of over $20 billion, but has fallen by two-thirds since. Some her major holdings are Tesla, Zoom, Roku, Block, Shopify and Coinbase.

After a dismal year in 2022, the fund is up 36% this year. Still, it’s a bold portfolio, not for the faint of heart. This is a fund that conservative investors might do better to shy away from.

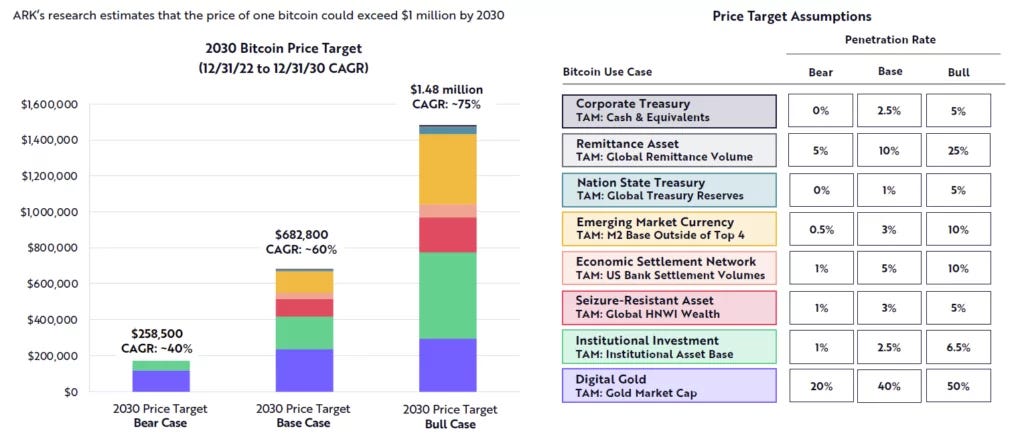

As for Bitcoin, ARK prepared an analysis of where the price could go, given certain assumptions. These assumptions have to do with how much penetration Bitcoin can make in terms of replacing various asset classes. Take gold, for instance.

Penetrating Gold’s Market

Gold, for centuries, has been looked at as a store of value. Not as a currency anymore, and not a stock or security. Just something that should hold onto its value over time. The quantity of gold, above the ground and below, is fixed. No one knows what that quantity is, but it’s technically fixed. Bitcoin’s quantity is of course, fixed at 21 million.

Where gold looks a little bit different, though, is that as its price rises, more gold is mined. So, in the short run, it’s not fixed at all. Totally different from Bitcoin. Here are some other ways that Bitcoin improves upon gold. Bitcoin can be sent, or paid, over the internet in a matter of seconds. Sending your gold overseas, say, is not at all practicable. Ditto for spending gold in a store. You wouldn’t carry gold bars around, and who could make change with them?

Wood’s analysis posits that if Bitcoin can gain just a 20% penetration into gold’s market, the Bitcoin price can grow substantially. That’s Wood’s “bear case.” Her “base case” and “bull case” would have Bitcoin claiming 40% and 50% of gold’s market, respectively.

Along with the gold market, Wood and ARK make assumptions that Bitcoin could claim tiny percentages of the markets of other asset classes. As shown in the ARK table, only 1% penetration into certain assets would propel Bitcoin much higher.

Wood’s price targets for the year 2030, based on market penetration into various asset classes, are as follows:

Bear Case $258,500

Base Case $682,000

Bull Case $1,480,000

Here are the charts and scenarios that Wood and her team came up with to arrive at those figures:

Bitcoin Bullish Factors

There are a host of other reasons that Wood cites in touting the potential for a runup in Bitcoin’s price, as follows:

Bitcoin’s Market Cap has grown, since the end of 2017, from $58 billion to $524 billion, almost a ten-fold increase.

Bitcoin has outperformed all other asset classes since its inception, and the results are not even close.

Institutions are showing more commitment to Bitcoin, with the largest money managers in the world getting involved. (BlackRock, Fidelity, BNY Mellon)

Bitcoin’s users are increasingly holding (hodling?) their coins for the long-term. Long-term holders account for over two-thirds of the Bitcoin supply.

Grain of Salt Time

Now, this is obviously all speculation on the part of Cathie Wood and ARK Investments. The scenario that they lay out is pretty much unprecedented, as most asset classes have been around for a long time. And, she has a vested interest in promoting Bitcoin and other breaking technologies. So, take it all with a grain of salt.

(Wood made the same predictions in early 2022, so the “crypto winter” of last year hasn’t dampened her enthusiasm for Bitcoin.)

Makes you think, though, right? About how a new technology could possibly make inroads into the market shares of other assets?

Do your own research. Invest for the long term. Only buy Bitcoin with money that you don’t need any time soon. It’s volatile. Did I mention that?

Thanks for reading, and for sharing this article.

Bitcoin Tools, Platforms, Podcasts:

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 600 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 113, June 16, 2023

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.