A US Strategic Bitcoin Reserve?

US Senate "Bitcoin Act of 2024" introduced, just as Bitcoin tops $93,000 (not a typo)

Folks, thanks for reading. Big things are happening, all at once, with Bitcoin.

As the saying goes, “Gradually, then suddenly.”

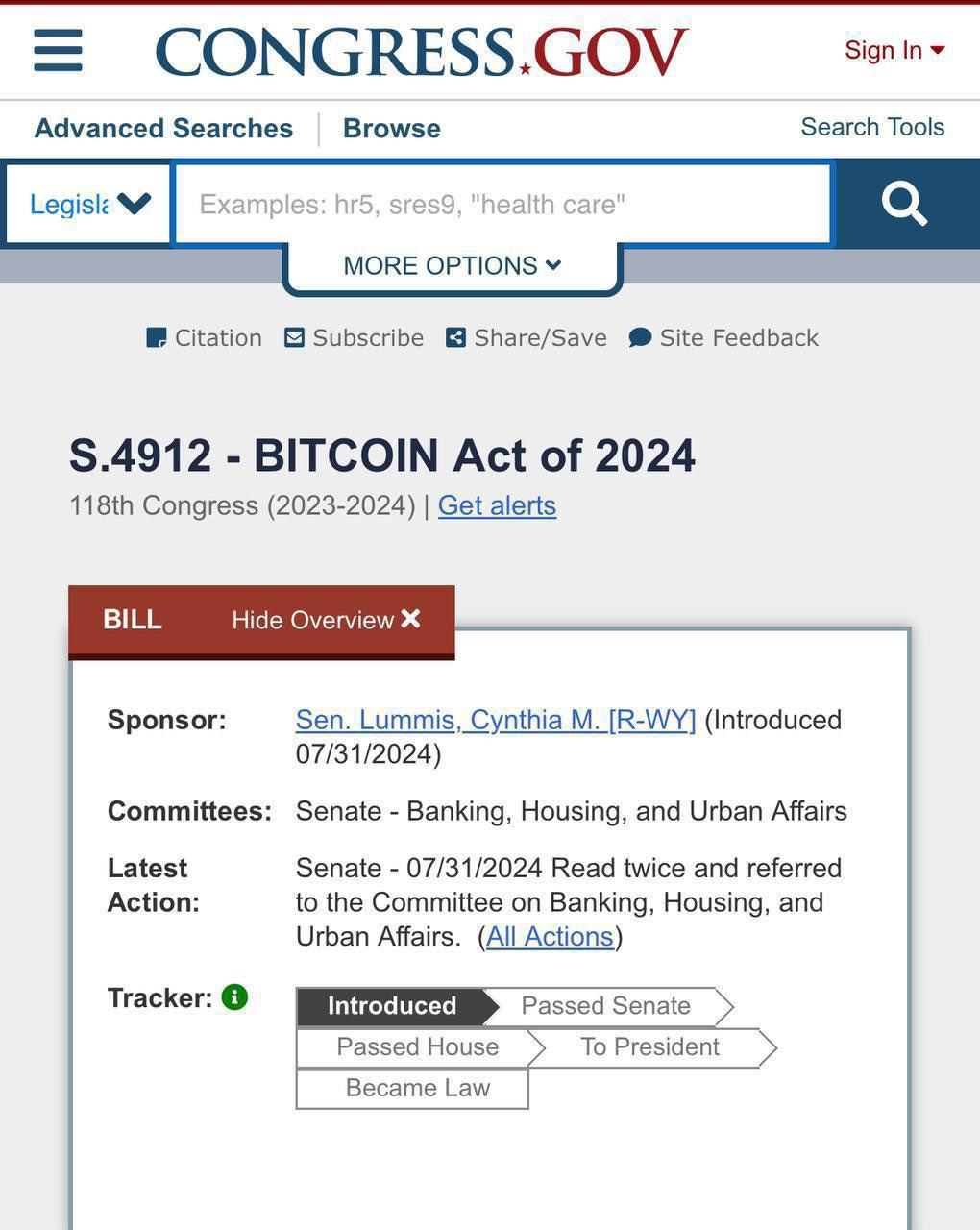

S.4912: “Bitcoin Act of 2024”

US Senator Cynthia Lummis (R-WY) has introduced a bill in the US Senate to establish a “Strategic Bitcoin Reserve,” to essentially acquire and stockpile Bitcoin. Just the same way the nation has held a strategic reserve of gold for hundreds of years. Lummis cites the bill as “boosting innovation, technology and competitiveness through optimized investment nationwide.” That sounds very positive indeed.

The intro to the bill highlights the reasons for this measure, and the Senator makes very good points here, things most Bitcoiners already know, like:

The significant role digital assets are playing in the world economy.

Bitcoin’s resilience, mass adoption and medium of exchange.

Bitcoin’s capability to enhance national security, much like gold.

Acquiring a store of Bitcoin can provide a hedge against economic uncertainty.

Bitcoin’s decentraized nature and scarcity complement our existing reserves.

Diversification of national assets can enhance the financial resilience of the US.

Here’s the Really Good Part:

The Secretary shall establish a Bitcoin Purchase Program which shall—

(A) purchase not more than 200,000 Bitcoins per year over a 5-year period, for a total acquisition of 1,000,000 Bitcoins;

(B) conduct purchases in a transparent and strategic manner to minimize market disruption; and

(C) hold Bitcoin acquired under this section in trust for the United States, as provided in this section.

One million Bitcoins. That would represent about 5% of the available supply of Bitcoin. That would be more than is owned by MicroStrategy Corp. The US would be the second largest holder of Bitcoin, trailing only the entity known as Satoshi Nakamoto.

The purchases would cost the US at least $90 billion, and probably much, much more, as the buys would drive up prices tremendously.

But just think of this possibility: If the scarcity of Bitcoin continues to drive up the price, the US could someday make a significant dent in the massive national debt. $36 trillion and growing every day.

Bitcoin Price Topped $93,000 This Week

It was only a week ago when I cheerfully wrote: “Bitcoin Tops $77,000 !!!”

Another 20% rise, really quickly, and we were all talking about buying Lamborghini’s. That was Wednesday, November 13. The price has retreated a bit, but still showing support between $89,000 and $91,000. Bitcoin is up 140% in the past year.

As I wrote about last week, there were a few major drivers of the Bitcoin price last week. The election of a more crypto-friendly president and Congress, the continued growth of Bitcoin ETFs, and the astonishing plan by MicroStrategy to purchase another $42 billion worth of Bitcoin.

This bill in the US Senate is just one more reason, and a major one, to be bullish on Bitcoin.

Link to the full text of the Senate bill:

https://www.congress.gov/bill/118th-congress/senate-bill/4912/text

El Salvador, the United States, and then, Pennsylvania?

The nation of El Salvador, behind its president, Nayib Bukele, established Bitcoin as a national currency in 2021, and has also accumulated a national reserve of over $531 million worth of Bitcoin. They are currently up $263,000,000 on their holdings. They were the first nation to adopt a “Bitcoin strategy,” and have been mining Bitcoin using energy from an inert volcano.

Of course, if the United States adopts its own Bitcoin strategy, and establishes a national reserve, it would make far bigger news. In addition, the states may also follow suit.

The House of Representatives in the Commonwealth of Pennsylvania have introduced a bill to allow the state to invest up to 10% of its liquid reserves in Bitcoin, to offer a hedge against inflation. As of this week, the state had over $16 billion in its general fund and reserve funds, so a 10% allocation to Bitcoin would be significant.

At this time, it is unclear whether the bill has enough votes to pass the legislature. Stay tuned. But, a positive development, in a week full of bullish happenings.

Check out my latest book, House of Cards: The Rise and Spectacular Collapse of the FTX Crypto Empire, available on Amazon.com.

Twitter (X) - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my over 700 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 140, November 15, 2024

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.