14th Anniversary of Bitcoin Whitepaper

Satoshi Dropped a Halloween Treat on the World. Plus, A Theory on Satoshi's Identity?

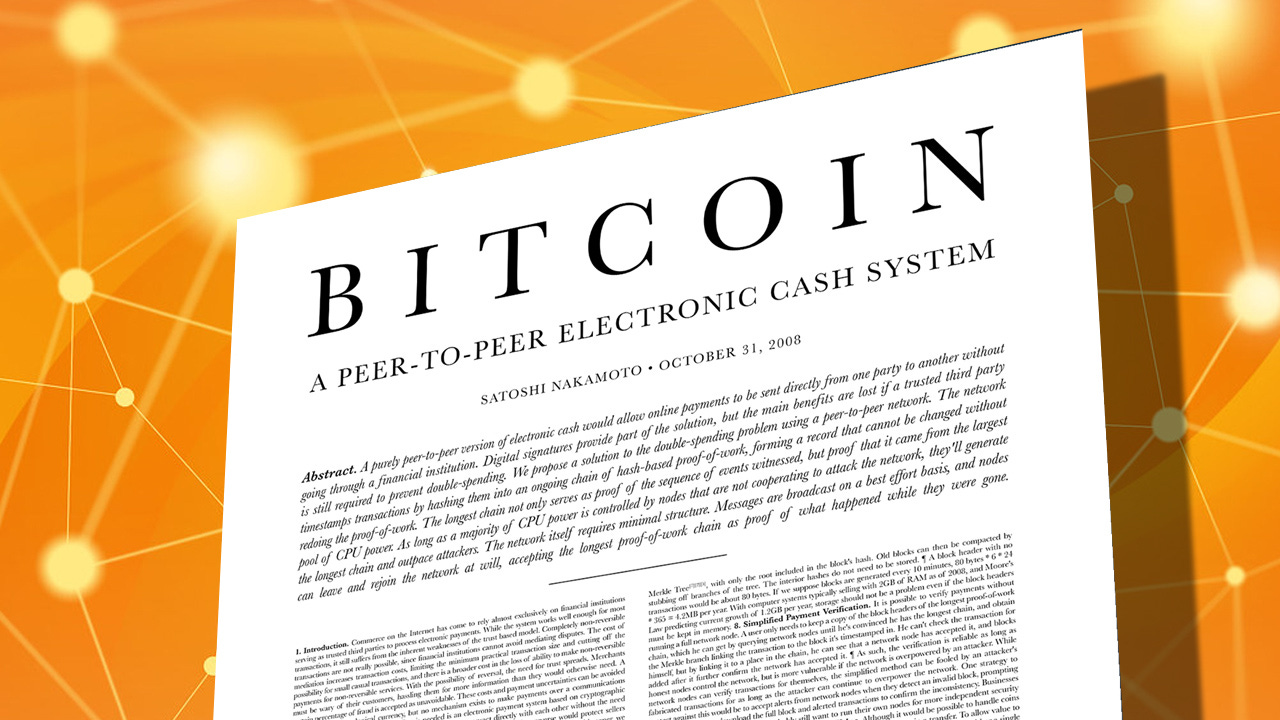

Have you read Satoshi Nakamoto’s Bitcoin whitepaper?

You should. You’ll gain some solid, common-sense insights into why Bitcoin was created. You’ll appreciate Satoshi’s brilliance even more. And it’s only eight pages long.

October 31, 2008

The world was in the midst of the Great Recession, a financial crisis not seen in decades. Stock markets were several months into complete meltdown. It was almost as if the world was ready for a new financial system, a great reset, if you will. (See my newsletter story from two weeks ago.)

And Satoshi Nakamoto, the pseudonymous coder, handed out a Halloween treat to the world.

The Abstract

If you read nothing more than the abstract of the article, you gain new understanding of what Satoshi was trying to achieve. In short, an electronic cash system, operating on a peer-to-peer network, without the need to go through a financial institution. Sounds like groundbreaking stuff.

To prevent funds from being spent more than once (the “double spend” problem) a trusted third-party was required to verify all transactions. In order to eliminate this need for the third-party, Satoshi proposed the timestamping of all network transactions, which would then be added to a growing, immutable chain. And thus, the blockchain ledger was born.

Where Was the Whitepaper Published and Where Can I Find It?

Satoshi had been a part of a cryptography mailing list called Metzdowd.com. He had been conversing about an electronic form of payments with Hal Finney and others, and released his whitepaper to this group. The whitepaper was posted at bitcoin.org and it’s still there. Or you can just Google it.

Here’s the actual post to the mailing list:

I've been working on a new electronic cash system that's fully

peer-to-peer, with no trusted third party.

The paper is available at:

http://www.bitcoin.org/bitcoin.pdf

The main properties:

Double-spending is prevented with a peer-to-peer network.

No mint or other trusted parties.

Participants can be anonymous.

New coins are made from Hashcash style proof-of-work.

The proof-of-work for new coin generation also powers the

network to prevent double-spending.

Bitcoin: A Peer-to-Peer Electronic Cash System

Full paper at:

http://www.bitcoin.org/bitcoin.pdf

Satoshi Nakamoto

Link to Satoshi’s eight-page (plus references) whitepaper.

A Different Theory on Satoshi’s Identity

A lot of theories have been debated about who Satoshi Nakamoto actually is. Or was. Was it Hal Finney? Finney denied it before his death. Was it Craig Wright? Wright claims to be, but a court of law said otherwise. Was Satoshi a single person, or a team of people? A theory that’s been tossed about since 2014 makes the case that Satoshi could be James A. Donald.

Donald was a member of the cryptology mailing list at Metzdowd.com and was the first to respond to Satoshi’s post and whitepaper release. He responded almost immediately to the post, and presented a potentially major problem with the Bitcoin proposal, a scalability problem.

Here’s the main argument that Donald could be Satoshi. You be the judge:

“If you look at the timing, Donald comments like minutes after the Bitcoin White Paper is put up and asks such a specific question to Satoshi — How could you read the White Paper, analyze it, and come up with this amazing scaling question in like three minutes? It’s almost impossible.” - Gerald Votta, Quantum Economics’ director of GameFi.

The Problems With Money and Satoshi’s Solutions

The problems with executing financial transactions, prior to this breakthrough, were numerous. Satoshi outlined all of these, and his solutions, in the whitepaper.

Commerce on the internet still had to rely almost exclusively on financial institutions.

Financial institutions, and their people, had to be trusted.

Fees to transfer money can be excessive.

Fraud runs rampant in financial institutions.

Records and ledgers can be altered.

How “Bitcoin Fixes This”

Satoshi devised a system built on proof instead of trust.

Transactions on the blockchain would be published publicly.

Transactions would be peer-to-peer, no third-parties.

Blockchain records are immutable.

No central point of authority, or central point of failure.

Impractical for an attacker to change the network.

Much lower transaction fees.

The Timestamping Technology Makes it Possible

Satoshi referenced the work of two cryptographers in his whitepaper, three times actually. Stuart Haber and Scott Stornetta, both of whom I’ve had the pleasure of meeting, had done groundbreaking work in the timestamping of digital documents. They are generally thought of as two of the “pioneers of the blockchain.”

Link to my previous article: “That Time I Met Satoshi”

The two had published an article for the Journal of Cryptology entitled “How to Time-stamp a Digital Document.” This was written in 1991, and gives you an idea of how long researchers had been exploring these issues.

Satoshi’s Great Line in the Whitepaper

In his conclusion, Satoshi summarizes the many solutions that Bitcoin offers to the problems with the current financial system. Be sure to read the conclusion, along with the abstract, but here’s his best line:

“The network is robust in its unstructured simplicity” - Satoshi Nakamoto, 2008.

Want to see the Bitcoin Blockchain ledger transactions happening in real-time? Check this out:

Thanks for reading. Eighty issues, wow! Please share this newsletter, and remember, subscriptions are always free.

Recommended Bitcoin Tools, Platforms, Podcasts:

Gemini - My choice for buying and HODLing Bitcoin, rated tops for safety and security. User-friendly platform and phone app. Earn Bitcoin rewards as well with the Gemini Credit Card.

Arculus - The crypto hardware wallet from Arculus is one of the best products on the market for storing your coins. Very easy to set up and to use, and very affordable.

Lolli - The Lolli shopping app lets you earn great Bitcoin rewards on practically everything you buy, whether you’re shopping on your phone, computer, or in-person.

Twitter - Follow The Bitcoin Files on Twitter at @BitcoinNewslet1 for all of my articles, commentary and links to my contributions to Bitcoin Magazine.

Medium - Check out my writings on Medium, including articles not featured in the newsletter. Join my 550 other followers who read and write about crypto. medium.com/@rickmulvey

Podcasts - To hear the top names in Bitcoin, and learn more than you could imagine, check out The Pomp Podcast with Anthony Pompliano, What Bitcoin Did with Peter McCormack, and The Wolf of All Streets Podcast with Scott Melker.

Issue No. 80, October 28, 2022

Rick Mulvey is a CPA, crypto consultant, and frequent contributor to Bitcoin Magazine. He writes about all things Bitcoin, and yells at the Yankees and Giants. He also runs marathons and makes wine, neither professionally.

The actual demand will start when we focus on Satoshi as an investment. For $420, you can buy a million satoshi's. Not many people have a million of anything. That general public demand could drive a 20X satoshi price increase from just under a half-cent per satoshi to 10 cents per satoshi. The cost of a Bitcoin will subsequently rise to one million dollars. Now, that's leverage.